Search results with tag "4506t"

COVID Disaster IRS Form 4506T Instructions

www.sba.govIRS Form 4506T Instructions . 1.ave a copy of your 2019 Federal Tax Return available for reference when completing the H 4506T. 2. Confirm you are using the March 2019 version available on the SBA.gov website: Form 4506-T (Rev. 3-2019) (sba.gov) 3.he 4506T should be completed using your name and social security number T (SSN) if you

Shuttered Venue Operators Grant

www.sba.govOct 20, 2021 · 2. 4506T: The IRS could not process your 4506T for various reasons. - You will receive an email advising you of the Action Item - After logging in to the portal, you will see a new 4506T checklist. You may make corrections, i f ... o For applicants who filed Form 990 or 990 -EZ, call 877-829-5500, from 8 a.m. to 5 p.m. local time.

IRS Tax Transcript Online Request

www.mcckc.eduThe tax filer (or spouse if requesting information from a joint tax return) must sign and date the form and enter their telephone number. Only one signature is required to request a transcript for a joint return. Mail or fax the completed IRS Form 4506T-EZ to the appropriate address (or FAX number) provided on page 2 of Form 4506T-EZ.

Form 4506T-EZ (Rev. 3-2019) - IRS tax forms

www.irs.govForm 4506T-EZ cannot be used by taxpayers who file Form 1040 based on a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Taxpayers using a fiscal tax year must file Form 4506-T, Request for Transcript of Tax Return, to request a return transcript.

Amended and Prior Year Returns - IRS tax forms

apps.irs.govIRS2Go phone app or completing Form 4506T or Form 4506T-EZ, Request for Transcript of Tax Return. To get a copy of the original return, complete and mail Form 4506, Request for a Copy of Tax Return, to the appropriate IRS office listed on the form. There is a charge to receive a copy of the original return.

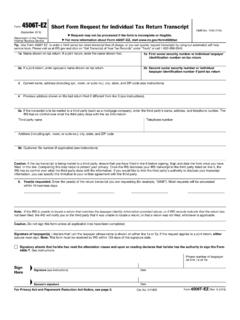

Form 4506T-EZ (Rev. 7-2017) - fayservicing.com

www.fayservicing.comForm 4506T-EZ (July 2017) Department of the Treasury Internal Revenue Service . Short Form Request for Individual Tax Return Transcript Request may not be processed if the form is incomplete or illegible.

Income-Based Repayment Application/Request

www.ocap.org2. Either (a) or (b) as required by your loan holder, unless you check the box in #3 below: (a) A completed IRS Form 4506-T or 4506T-EZ providing your consent for the IRS to disclose your AGI and other federal income tax return information to your loan holder.

IRS Tax Return Transcript and IRS Record of Account ...

www.ccc.edu• The tax filers must sign and date the form and enter their telephone number. Transcripts of jointly filed tax returns maybe requested by either spouse. Only one signature is required. Sign the IRS Form 4506T-EZ exactly as your name appeared on the original tax return. If you changed your name prior to submitting

SBA Guaranteed Loan Application Forms

www.sba.govIRS Form 4506T: Request for Transcript of Tax Return USCIS Form G-845: Document Verification Request Form 912: Statement of Personal History plus required explanations on Addendum B (page 10) from SBA Eligibility Questionnaire for Standard 7(a) Common Closing Forms Form 147: Note Form 148: Unconditional, unlimited guarantee

Gaming and Non-Gaming Application Instructions

gamingcontrolboard.pa.gov4506T-EZ. This form allows the PGCB to verify the applicant has filed federal taxes for tax year 2010. Applicants who filed taxes for 2010 jointly with a spouse will be required to enter the spouse’s name and Social Security number on the form, but the spouse will not be …

Mortgage Assistance - Carrington Mortgage

www.carringtonmortgage.comMost recent complete and signed business tax return including all schedules OR Most recent complete and signed individual federal tax return or completed including all schedules and signed 4506T (attached) if tax returns not available Unemployment benefit income Most recent benefit/award letter or statement

Form 4506-T-EZ (Rev. 11-2021) - IRS tax forms

www.irs.govreturn. Form 4506T-EZ cannot be used by taxpayers who file Form 1040 based on a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Taxpayers using a fiscal tax year must file Form 4506-T, Request for Transcript of Tax Return, to request a return transcript. Use Form 4506-T to request tax return

Section 4: Underwriting Guidelines - esnmc.com

www.esnmc.comSection 3.4: Income SNMC Page | 2 February 22, 2011 3.4-A General (cont’d) 2010 Tax Returns and Self Employed Borrowers All self-employed borrowers will be reviewed on a case by case basis until 2010 4506T transcripts can be