Search results with tag "Form 4506 t"

COVID Disaster IRS Form 4506T Instructions

www.sba.govIRS Form 4506T Instructions . 1.ave a copy of your 2019 Federal Tax Return available for reference when completing the H 4506T. 2. Confirm you are using the March 2019 version available on the SBA.gov website: Form 4506-T (Rev. 3-2019) (sba.gov) 3.he 4506T should be completed using your name and social security number T (SSN) if you

Income-Based Repayment Application/Request

www.ocap.org2. Either (a) or (b) as required by your loan holder, unless you check the box in #3 below: (a) A completed IRS Form 4506-T or 4506T-EZ providing your consent for the IRS to disclose your AGI and other federal income tax return information to your loan holder.

Note: Form 4506-T begins on page 3.

www.irs.govForm 4506-T (Rev. September 2015) Department of the Treasury Internal Revenue Service

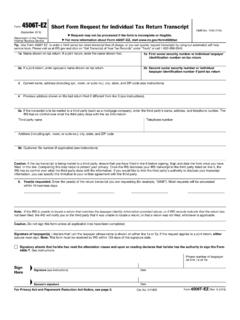

Form 4506-T-EZ (Rev. 11-2021) - IRS tax forms

www.irs.govreturn. Form 4506T-EZ cannot be used by taxpayers who file Form 1040 based on a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Taxpayers using a fiscal tax year must file Form 4506-T, Request for Transcript of Tax Return, to request a return transcript. Use Form 4506-T to request tax return

Form 4506-T (Rev. 11-2021) - IRS tax forms

www.irs.govIf you need a copy of Form W-2 or Form 1099, you should first contact the payer. To get a copy of the Form W-2 or Form 1099 filed with your return, you must use Form 4506 and request a copy of your return, which includes all attachments. 9 Year or period requested. Enter the ending date of the year or period, using the mm/dd/yyyy format.

Form 4506-T (Rev. 3-2019) - Small Business Administration

www.sba.govThere is a fee to get a copy of your return. 1a . Name shown on tax return. If a joint return, enter the name shown first. 1b First social security number on tax return, individual taxpayer identification number, or employer identification number (see instructions) 2a . If a joint return, enter spouse’s name shown on tax return.

4506-T Request for Transcript of Tax Return

www.irstaxrecords.comForm 4506-T (Rev. 9-2015) Page 2 Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about Form 4506-T and its

Form 4506-T Request for Transcript of Tax Return …

www.steverumberg.comForm 4506-T (Rev. January 2010) Department of the Treasury Internal Revenue Service . Request for Transcript of Tax Return ' Request may be rejected if the form is incomplete or illegible.

Similar queries

Form 4506T, 4506T, Form 4506-T, Note: Form 4506-T begins on, Form 4506-T Rev. September 2015, Internal Revenue Service, Form 4506-T-EZ, IRS tax forms, Form 4506T-EZ, Form, Small Business Administration, Return, Tax return, 4506-T Request for Transcript of Tax Return, Form 4506-T Request for Transcript of Tax Return, Request for Transcript of Tax Return