Search results with tag "New jersey sales"

S&U-4 - New Jersey Sales Tax Guide

www.state.nj.usNew Jersey Sales Tax Guide 2 Rev. 03/22 . Retail sales of medical cannabis are taxable. The tax rate of medical cannabis is currently set at 2%, and is being phased out. Medical cannabis is exempt from Sales Tax effective July 1, 2022. Sales Tax Law The New Jersey Sales and Use Tax Act imposes a tax on the receipts from every retail sale of

auto repair shops - New Jersey

www.state.nj.usRev. 10/17 About New Jersey Taxes Auto Repair Shops & New Jersey Sales Tax Publication ANJ-6 Introduction The New Jersey Sales and Use Tax Act provides that sales of …

Out-of-State Sales & New Jersey Sales Tax

www.state.nj.usAbout New Jersey Taxes Out-of-State Sales & New Jersey Sales Tax Publication ANJ-10 Introduction In general, Sales Tax is due to the state where the purchaser takes possession or delivery of the item(s)

Air Conditioning, Heating, Refrigeration and New …

www.state.nj.usRev. 5/17 About New Jersey Taxes Air Conditioning, Heating, Refrigeration & New Jersey Sales Tax Publication ANJ-8 Introduction This bulletin explains the New Jersey Sales and Use Tax rules for air conditioning, heating, and

S&U-4 - New Jersey Sales Tax Guide

www.state.nj.usNew Jersey Sales Tax Guide Rev. 4/18 . Sales of disposable paper products, such as towels, napkins, toilet tissue, paper plates, and paper cups, are exempt from Sales Tax when purchased “for household use.”

Contractors and New Jersey Taxes - State

www.state.nj.usSales Tax Rate Change The New Jersey Sales and Use Tax rate becomes 6.625% on January 1, 2018, as a result of legislation that reduced the rate in two phases. The rate was 6.875% between January 1, 2017, and December 31, 2017, in accordance with P.L. 2016, c.57. The Sales Tax rate was 7% in 2016.

Sales Tax Exemption Administration - New Jersey

www.state.nj.usSince New Jersey became a streamlined member state a s of October 1, 2005, amnesty for New Jersey Sales and Use Tax ended on September 30, 2006.

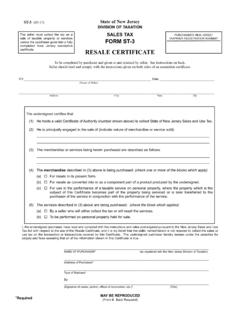

SALES TAX FORM ST-3 - New Jersey

www.state.nj.usI, the undersigned purchaser, have read and complied with the instructions and rules promulgated pursuant to the New Jersey Sales and Use Tax Act with respect to the use of the Resale Certificate, and it is my belief that the seller named herein is not required to collect the sales or

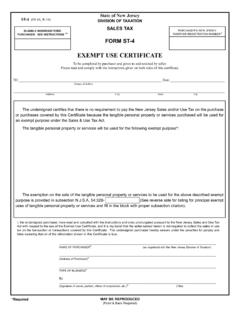

SALES TAX ELIGIBLE NONREGISTERED TAXPAYER …

www.state.nj.usI, the undersigned purchaser, have read and complied with the instructions and rules promulgated pursuant to the New Jersey Sales and Use Tax