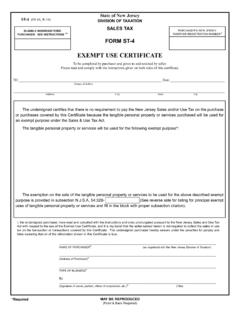

Sales Tax Exemption Administration

Found 8 free book(s)Sales Tax Exemption Administration - New Jersey

www.state.nj.usSales Tax Exemption Administration Rev. 8/07 2. items of food and drink (except when sold in or by restaurants or similar establishments), and prescription drugs.

Wyoming Sales Tax Exemption Certificate Exemption ...

www.ingrammicro.comWyoming Sales Tax Exemption Certificate (see back of this form for instructions) State of Wyoming Issued to (Seller): Date Issued: Street Address City State Zip Code

Customer Exemption Management - Tax and Accounting …

www.cch.comVisit SalesTax.com Customer Exemption Management Successful customer exemption management is critical to a business that has exempt customers …

Aircraft and the Texas Sales and Use Tax (From the Texas ...

www.lonestarauctioneers.comAircraft and the Texas Sales and Use Tax (From the Texas Comptroller of Public Accounts Website.) March 2006 Sales Tax Sales of aircraft within Texas are subject to state and local sales …

GT-800013 R. 01/18 Florida Sales and Use Tax

floridarevenue.comFlorida Department of Revenue, Sales and Use Tax, Page 1 . R. 01/18. Florida Sales and Use Tax. Sales Tax Each sale, admission, purchase, storage, or …

SALES TAX ELIGIBLE NONREGISTERED TAXPAYER …

www.state.nj.us1. Registered sellers who accept fully completed exemption certificates within 90 days subsequent to the date of sale are relieved of liability for the collection and payment of sales tax on the transactions covered by the exemption certificate.

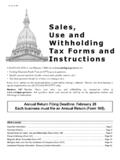

78, Sales, Use and Withholding Tax Forms & Instructions

www.michigan.gov3 the items you sell are not taxable. If your gross sales during the year are less than $5,000, you do not need to collect or pay sales tax. However, if you collect sales tax, you must remit it even if

Sales and Use Tax on Rental of - Florida Dept. of Revenue

floridarevenue.comFlorida Department of Revenue, Sales and Use Tax on Rental of Living or Sleeping Accommodations, Page 2 . exemption requirement has been met and the transient rental charges at the park or camp are exempt

Similar queries

Sales Tax Exemption Administration, New Jersey, Wyoming Sales Tax Exemption Certificate Exemption, Wyoming Sales Tax Exemption Certificate, Customer exemption management, Aircraft and the Texas Sales, Comptroller of Public Accounts Website, Sales Tax Sales, Sales, 18 Florida Sales and Use Tax, 18. Florida Sales and Use Tax, Sales tax, Exemption, Florida Department of Revenue