Wyoming Sales Tax Exemption Certificate Exemption

Found 3 free book(s)Exemption Certificate - dor.sd.gov

dor.sd.gova copy of this exemption certificate, to member states of the Streamlined Sales and Use Tax Agreement. The seller is relieved of the responsibility for collecting and remitting sales tax on the sale or sales for which the purchaser provided an exemption certificate if ALL of the following conditions are met: 1.

Form W-9 (Rev. October 2018) - IRS tax forms

www.irs.gov4. The type and amount of income that qualifies for the exemption from tax. 5. Sufficient facts to justify the exemption from tax under the terms of the treaty article. Example. Article 20 of the U.S.-China income tax treaty allows an exemption from tax for scholarship income received by a Chinese student temporarily present in the United States.

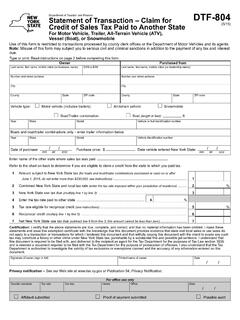

Statement of Transaction – Claim for Credit of Sales Tax ...

www.tax.ny.gova credit for sales tax paid to another state. A New York State resident who purchases a qualifying vehicle or vessel outside the state becomes liable for New York State and local sales and use tax if the qualifying vehicle or vessel is brought into the state. However, a credit against the New York tax due may be available if all of the following