Search results with tag "File form"

Quick Guide: File payroll tax forms

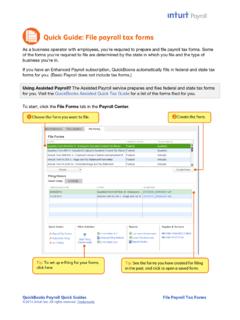

http-download.intuit.comforms for you. (Basic Payroll does not include tax forms.) Using Assisted Payroll? The Assisted Payroll service prepares and files federal and state tax forms for you. Visit the QuickBooks Assisted Quick Tax Guide for a list of the forms filed for you. To start, click the File Forms tab in the Payroll Center. Tip: Choose the form you want to file.

Premium Online federal forms - H&R Block

www.hrblock.comForm 4868 Automatic Extension of Time to File Form 4952 Investment Interest Expense Form 4972 Tax on Lump-Sum Distributions Form 5329 Return for IRA and Retirement Plan Tax Form 5405 Repayment of First-Time Homebuyer Credit Form 5498-SA Health Savings Account Form 5695 Residential Energy Credits Form 6251 Alternative Minimum Tax

Automatic 6-Month Extension of Time.

www.irs.govfile Form 1041-A or Form 5227 must use Form 8868 to request an extension of time to file those returns. These instructions apply to such trusts unless the context clearly requires otherwise. Use this form to apply for an automatic 6-month extension of time to file an organization’s return, and submit the original form to the IRS (no copies

2021 Nebraska

revenue.nebraska.govA six-month extension to file Form 1040N may only be obtained by: 1.Attaching a copy of a timely-filed Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, Federal Form 4868, to the Nebraska return when filed;

Instructions for Form N-565, Application for Department of ...

www.nmd.uscourts.govWhat Is the Purpose of This Form? Who May File Form N-565? General Instructions. Step 1. Fill Out the Form N-565. 2. If extra space is needed to complete any item, attach a continuation sheet, write your name and Alien Registration Number (A-Number) (if any), at the top of each sheet of paper, indicate the Part and item number to which your

Quick Guide: Tips for new employers

http-download.intuit.comForms > I-9. Finally, you must report new hires to the state within 7 to 20 days of hire, depending on the state. You can complete and print the new hire reporting form for many states from QuickBooks (requires the Enhanced Payroll service) ; just choose it from the list of forms on the File Forms tab.

Quick Guide: Pay taxes and other liabilities

http-download.intuit.comJan 15, 2014 · QuickBooks Payroll Quick Guides Pay Taxes and Other Liabilities Quick Guide: Pay taxes and other liabilities ... File Forms . METHOD Check Check Check Check Check PERIOD Dec 2013 Dec 2013 042013 042013 042013 . AMOUNT ... b Deposit a Tax Refund . Payment History -paymento— . STATUS Check To Print Ch eck To Print Check To Print Check

Form MO-1040 Book - Individual Income Tax Long Form

dor.mo.govthe top of the Form MO-1040 indicating you have an approved federal extension and attach a copy of your Application for Automatic Extension of Time To File U.S. Individual Income Tax Return (Federal Form 4868) with your Missouri income tax return when you file. If you expect to owe Missouri income tax, file Form MO-60 with

Form 8809 Application for Extension of Time To File ...

www.irs.govFile Form 8809 as soon as you know an extension of time to file is necessary, but not before January 1 of the filing year. Form 8809 must be filed by the due date of the returns.

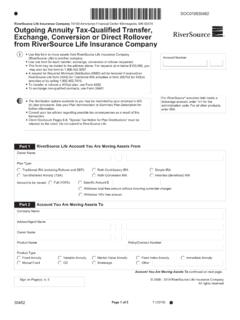

Form 30482 - Request for IRA/Roth ANNUITY Transfer or ...

www.ameriprise.comRiverSource Life form 33442 for Traditional IRA annuities or form 200702 for 403(b) annuities or by calling 1.800.862.7919. To transfer or rollover a 401(a) plan, use Form 4292. To exchange non-qualified contracts, use Form 30481. Page 1 of 5 i! Sign on Page(s) 4, 5 Policy/Contract Number Account Number For RiverSource® annuities held inside a