Search results with tag "Tax form"

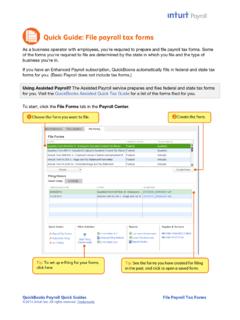

Quick Guide: File payroll tax forms

http-download.intuit.comforms for you. (Basic Payroll does not include tax forms.) Using Assisted Payroll? The Assisted Payroll service prepares and files federal and state tax forms for you. Visit the QuickBooks Assisted Quick Tax Guide for a list of the forms filed for you. To start, click the File Forms tab in the Payroll Center. Tip: Choose the form you want to file.

Publication 4011 (Rev. 8-2021) - IRS tax forms

www.irs.govTax Form Changes ITINS • ITINs not used in the last three consecutive tax years: If an ITIN was not included on a U.S. federal tax return at least once for tax years 2017, 2018, or 2019, the ITIN will expire on December 31, 2020. Affected taxpayers need to take actionto renew if it will be included on a U.S. federal tax return.

Hawaii State Tax Office Information

files.hawaii.govObtain tax forms and information all day, every day! tax.hawaii.gov Resources and services available on the website include: • State Tax Forms and Instructions

Corporate Income Tax Booklet - North Dakota …

www.nd.govRyan Rauschenberger Tax Commissioner North Dakota Corporate Income Tax 2016 Form 40 Instructions Go to www.nd.gov/tax for tax forms, guidelines, FAQs and more.

Tennessee Inheritance Tax Guide

www.tn.govother inheritance tax forms. (5) Complete the inheritance tax computation on page 4. (6) Enter the tax calculated on page 4 on line 1, page 1. (7) Complete remaining lines on page 1. (6) Complete General Information on page 2. General Instructions When completed, the return must be permanently fastened together with all sheets in proper order.

2017 Form 8922 - Internal Revenue Service

www.irs.govThe IRS accepts quality substitute tax forms that are consistent with the official forms and have no adverse impact on our processing. The official Form 8922 is the standard for substitute forms.

2016 N-11 Forms 2016 N-11 and Instructions - hawaii.gov

files.hawaii.gov2016 N-11 Forms 2016 N-11 and Instructions STATE OF HAWAII — DEPARTMENT OF TAXATION Hawaii Resident Income Tax Forms and Instructions Caution: Part-Year Residents Must Use Form N-15

BUSINESS PERSONAL PROPERTY RENDITION Tax Form …

www.personalpropertypro.comFor assistance, please refer to the instructions for this form. BUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIAL JANUARY 1, 2018 *0000000* Account Tax Year *2018* Tax Form *NEWPP130* Return to:

Oregon 2016 Corporation Excise Tax Form OR-20 Instructions

www.oregon.gov150-102-020-1 (Rev. 10-16) 1 Form OR-20 Instructions Oregon 2016 Corporation Excise Tax Form OR-20 Instructions Go electronic! Fast • Accurate • Secure File corporate tax returns through the Federal/State e-filing program.

78, Sales, Use and Withholding Tax Forms & Instructions

www.michigan.gov3 the items you sell are not taxable. If your gross sales during the year are less than $5,000, you do not need to collect or pay sales tax. However, if you collect sales tax, you must remit it even if

78 (Rev. 10-13) Sales, Use, and Withholding Tax Forms and ...

www.michigan.govSales, Use, and Withholding Tax Forms and Instructions Each business must file an Annual Return (Form 165). Annual Return Filing Deadline: February 28.

Section - Eligibility

www.chfa.orgRev. 11-2017 Page 6 b. In addition, the Participating Lender must obtain an executed Request for Copy or Transcript of Tax Form (IRS Form 4506) or a Tax Information Authorization

2017 Oklahoma Individual Income Tax Forms and …

www.ok.gov• Includes Form 511NR (Nonresident and Part-Year Resident Return) This packet contains: • Instructions for completing the 511NR income tax form

26 CFR 601.602: Tax forms and instructions. (Also …

www.irs.gov26 CFR 601.602: Tax forms and instructions. (Also Part 1, §§ 1, 223.) Rev. Proc. 2017-37 . SECTION 1. PURPOSE This revenue procedure provides the 2018 inflation adjusted amounts for Health

IMPORTANT MUNICIPAL INCOME TAX RETURN

www.newphilaoh.comIMPORTANT MUNICIPAL INCOME TAX RETURN AVOID PENALTIES – FILE $1' 3$< BY APRIL 17, 2018 THIS ENVELOPE CONTAINS TAX FORMS WHICH YOU ARE REQUIRED TO FILE Who Must File: All residents of the City of New Philadelphia, 18 years of age or older with an earned income, also any non-resident who receives salaries, wages, commissions and other income …

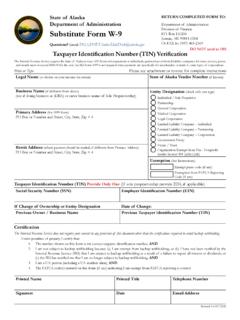

Division of Finance Substitute Form W-9 - Alaska

doa.alaska.govSubstitute Form W-9 DO NOT send to IRS Social Security Number (SSN) Employer Identification Number (EIN) ... Address where 1099 tax form should be mailed. Remit Address Address where payment should be mailed. Complete only if ... you are not required to sign the certification, but you must provide your correct TIN.

Caution: DRAFT—NOT FOR FILING

www.irs.govCaution: DRAFT—NOT FOR FILING This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information as a courtesy.

Request for Social Security Number Correction

www.ecsi.netRequest for Social Security Number Correction . To correct your Social Security Number ("SSN") on your tax form, you must fill out Form W-9S. Please

26 CFR 601.602: Tax forms and instructions. (Also …

www.irs.govOrganizations .30 Insubstantial Benefit Limitations for Contributions Associated 513(h) With Charitable Fund-Raising Campaigns .31 Tax …

26 CFR 601.602: Tax forms and instructions. (Also Part I ...

www.irs.gov- 6 - or ending in Alaska or Hawaii. These excise taxes applied to transportation that began during the period ending March 31, 2016. Section 202 of the Airport and Airway

LMA LMB LMC L1096 - Tax Form Finder

www.taxformfinder.comL1096 MANUFACTURED ON OCR LASER BOND PAPER USING HEAT RESISTANT INKS 6969 L1096 41-0852411 5100 Return this entire page to …

RESIDENT INCOME 2016 FORM TAX RETURN 502 - …

forms.marylandtaxes.gov2016 $ Dates of Maryland Residence (MM DD YYYY) FROM TO Other state of residence: If you began or ended legal residence in Maryland in 2016 place a P in the box. ..... MILITARY: If you or your spouse has non-Maryland military income, place an M in the box. ..... Enter Military Income amount here: PART-YEAR

MARYLAND

forms.marylandtaxes.govmaryland 2017 state & local tax forms & instructions)ru¿olqjshuvrqdovwdwhdqgorfdolqfrphwd[hviruixoorusduw \hdu0du\odqguhvlghqwv 3hwhu)udqfkrw &rpswuroohu scan to ...

RESIDENT INCOME 2018 FORM TAX RETURN 502

forms.marylandtaxes.gov2018 $ Dates of Maryland Residence (MM DD YYYY) FROM TO Other state of residence: If you began or ended legal residence in Maryland in 2018 place a P in the box. ..... MILITARY: If you or your spouse has non-Maryland military income, place an M in the box. .....

26 CFR 601.602: Tax forms and instructions. (Also Part I ...

www.irs.gov.33 Treatment of Dues Paid to Agricultural or Horticultural 512(d) ... Salary, or Other Income 6334(d) - 4 - ... This revenue procedure sets forth inflation-adjusted items for 2022 for various provisions of the Internal Revenue Code of 1986 (Code), as amended, as of November

MOTOR VEHICLE EXCISE ABATEMENT APPLICATION

www.mass.govState Tax Form 126-MVE The Commonwealth of Massachusetts Assessors’ Use only Revised 12/2004 Date Received Application No. Name of City or Town MOTOR VEHICLE EXCISE ABATEMENT APPLICATION General Laws Chapter 60A Return to: Board of Assessors

Form 4506-T (Rev. 3-2019), SVOG Request for Transcript of ...

www.sba.govEnter the tax form number here (1040, 1065, 1120, etc.) and check the appropriate box below. Enter only one tax form number per request. . a Return Transcript, which i. ncludes most of the line items of a . tax return as filed with the IRS. A tax return transcript does not reflect changes made to the account after the return is processed.

Similar queries

Quick Guide: File payroll tax forms, Forms, Payroll, Tax forms, Quick Tax Guide, File Forms, File, IRS tax forms, Tax form, Tax Office Information, Corporate Income Tax Booklet, North Dakota, Income Tax, Tennessee, Form 8922, Internal Revenue Service, 2016, Forms 2016 N-11 and Instructions, BUSINESS PERSONAL PROPERTY RENDITION Tax Form, Form, BUSINESS PERSONAL PROPERTY RENDITION, Sales, Instructions, Sales tax, Tax Forms and Instructions, Tax Information Authorization, Oklahoma, 511NR, 2017-37, Inflation adjusted, IMPORTANT MUNICIPAL INCOME TAX RETURN, Income, Substitute Form W, Alaska, Certification, Request for Social Security Number Correction, FORM TAX, Maryland, Treatment, Salary, Various, MOTOR VEHICLE EXCISE ABATEMENT APPLICATION, Return, Tax return