Search results with tag "Payroll"

Processing Payroll - ADP

otcdc1.adp.comADP ezLaborManager 3 Processing Payroll and Calling In Your Payroll Data Quick Reference Processing payroll involves four basic procedures, which are outlined briefly below. If you need more detailed information on a procedure, see the corresponding ch apter later in this guide. (Clicking the section heading below will take you directly to the ...

myCalPERS Payroll Reporting

www.calpers.ca.govThis guide is a resource to assist you with earned period payroll reporting. As a business partner with a retirement contract with CalPERS, you must provide and manage payroll information on a regular basis. Payroll reports contain your employees’ records that are uploaded or added

WEEKLY PAYROLL Bureau of Public Work

online.ogs.ny.govDepartment of Labor WEEKLY PAYROLL Bureau of Public Work For Contractor's Optional Use. The use of this form meets payroll notification requirements; as stated on the Payroll Records Notification. NAME OF CONTRACTOR SUBCONTRACTOR ADDRESS FEIN FOR WEEK ENDING PROJECT AND LOCATION PROJECT OR CONTRACTOR NO. 4) DAY AND DATE (a)

Summary of Monthly Payroll Report

www.tmrs.comSummary of Monthly Payroll Report Regular Supplemental City Information City Number City Name (required) Report for the Month/Year (required) / City Certification I certify this to be a true and complete report of the payroll information required by the Texas Municipal Retirement System for the above named city.

STATE OF NEW JERSEY 2022 PAYROLL CALENDAR

www.state.nj.usSTATE OF NEW JERSEY 2022 PAYROLL CALENDAR January February March April ... 9/3/2021 Produced by OMB-Centralized Payroll. Author: …

Understanding ADP Payroll Reports 2019 - United Church of ...

united-church.caUnderstanding ADP Payroll Reports . The United Church of Canada 2 L’Église Unie du Canada . Payroll Register 1. Earnings Column includes income, employer paid benefits (CORE BEN, EMP INDM, RCP), & employer paid pension (EMPR PEN) 2. Deductions Column includes employee paid benefits (OPT H/D, LIFE MEM/SPOUSE, AD&D, LTD) & employee paid pension (R CO …

VACANCY REFERENCE NR : VAC01662/22 JOB LEVEL : C5 …

www.sita.co.zaREFERENCE NR : VAC01662/22 JOB TITLE : Payroll Specialist ... To provide payroll services to the business and take accountability for correct, timeous, and legally compliant maintenance of employee data. To ensure that employees’ salaries are paid accurately and timeously. Key Responsibility Areas • Payroll Administration function.

Manage Your Direct Deposits in Employee Access® - ADP

support.adp.comNotify your company’s payroll contact immediately. Q Can I Stop Direct Deposit for One Paycheck? Ask your payroll contact to stop your direct deposit when processing the payroll. Q Can I change my direct deposit accounts using the ADP Mobile Solutions app? Yes, you sure can! Select Pay, then select Direct Deposit under Additional Benefits. Q

Off-payroll working rules (IR35) flowchart for contractors

assets.publishing.service.gov.ukThe off-payroll working rules are changing. Your client will become responsible for determining whether the rules apply (what your employment status for tax purposes should be). Contract is inside the off-payroll working rules (IR35) You will be employed for tax purposes for that contract The party paying your limited company or other

NO EMPLOYEE IS PERMITTED TO WORK UNTIL ALL …

selfservice.ascentis.com• Pay Card or Direct Deposit information ... Payroll Deduction Form (Send to ACCTG) O:\PeterPiperPizza\New Hire Paperwork\New Hire Hourly Packet 2021.docx . ... EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION FORM …

BRIDGE FUND

dmped.dc.govPayroll or Roster of Employees Current Payroll Roster (dated within 30 days of application) listing all full-time employees, part-time employees, and 1099 independent contractors. Roster must include state of residency for each employee/contractor. Landlord Affidavit (listing back rent)

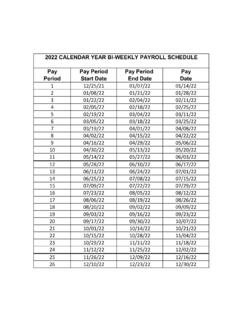

2022 CALENDAR YEAR BI-WEEKLY PAYROLL SCHEDULE Pay …

www.skidmore.edu2022 CALENDAR YEAR BI-WEEKLY PAYROLL SCHEDULE: Author: Joan Rivers Created Date: 1/13/2022 11:08:42 AM ...

Policy and Procedures Manual Personnel Payroll

www.naahq.orgHUMAN RESOURCES / PAYROLL Page 1 ATTENDANCE AND PUNCTUALITY POLICY It is the policy of the Company to require employees to report for work punctually and to work all scheduled hours and any required overtime. Excessive tardiness and poor ... Only management personnel in the Company’s Corporate Office in

2022 Payroll Calendar

payroll.uconn.edu2022 Payroll Calendar.xls Author: sgj05001 Created Date: 12/1/2021 2:33:38 PM ...

STATE OF NEW JERSEY 2021 PAYROLL CALENDAR

www.nj.govstate of new jersey 2021 payroll calendar january february march april sun mon tue wed thu fri sat sun mon tue wed thu fri sat sun mon tue wed thu fri sat sun mon tue ...

CENTRAL PAYROLL 2022 CALENDAR - Wisconsin

dpm.wi.govcentral payroll 2022 calendar department of administration sun mon tue wed thu fri sat sun mon tue wed thu fri sat sun mon tue wed thu fri sat jan 1* 1a may 1 2 3 4 5 ...

BI-WEEKLY PAYROLL SCHEDULE - 2021

tru.ca202110 May 13 May 20 202111 May 27 June 03 202112 June 10 June 17 202113 June 24 **June 30** 202114 July 08 July 15 202115 July 22 July 29 ... BI-WEEKLY PAYROLL SCHEDULE - 2021; PERIOD COVERED; December 24 - January 6 January 07 - January 20 January 21 - February 03 Febraury 04 - Febraury 17 Febraury 18 - March 03

2022 Payroll Calendar - consumerdirectwa.com

www.consumerdirectwa.com2022 Payroll Calendar OCTOBER NOVEMBER DECEMBER JANUARY FEBRUARY MARCH APRIL MAY JUNE JULY AUGUST SEPTEMBER 2022 Federal and State Holidays Independence Day ‐ Monday, July 4*† New Year's Day ‐ Friday, December 31, 2021*† Labor Day ‐ Monday, September 5*† Martin Luther King, Jr. Day ‐ Monday, January 17*†

Protect Your Business—Prevent Penalties Agriculture

www.dir.ca.govworkplace Have appropriate licenses Give rest and meal breaks Pay all payroll taxes and keep ... 4 Not giving pay stubs or not paying payroll tax. You must give out pay stubs, list the deductions, and pay ... for an injury and illness prevention model program for agricultural employers with intermittent workers, and a heat ...

Biweekly 2022 Payroll Calendar - dartmouth.edu

www.dartmouth.eduBiweekly 2022 Payroll Calendar. Author: Lynn M. Thorp Created Date: 10/4/2021 12:19:16 PM ...

Premium Audit – Payroll Report Instructions – QUICKBOOKS

business.thehartford.com1. Log in to QuickBooks 2. Click Reports and select Payroll Summary 3. At the top of the page, enter the policy period dates. The report will capture all check dates within this period. • For example, if the policy period is 9/1/2018 – 9/1/2019, the provided report should include: – 1st pay date that occurred on or after 9/1/2018 until ...

LOAN REPAYMENT SALARY DEDUCTION …

tdsplans.orgLOAN REPAYMENT SALARY DEDUCTION AUTHORIZATION FORM ... As a participant of a voluntary 403(b)/457(b) plan, the Employee will be ... **No payroll deductions for repayment of your loan will be initiated or stopped without returning this form to your payroll department**

Off-payroll working rules (IR35) - flowchart for client ...

assets.publishing.service.gov.ukThe off-payroll working rules changed from 6 April 2021. As the client, you will be responsible for determining your contractor’s employment status for tax purposes. You must determine your contractor’s employment status for tax purposes and provide them with

Calandar Year 2021 Bi-Weekly Payroll Calandar

ysu.eduPayroll Calendar Calendar Year 2021 Bi-Weekly Bi-weekly employees are required to complete an electronic time sheet every pay period, but are not required to complete an electronic leave report. They are paid every other Friday. Processing of any personel actions must be submitted to Human Resources no later than the date listed in the

iSolved Payroll Processing User Guide - PayPros, Inc

www.payprosinc.comPayroll Processing User Guide PAGE 5 JULY/2015 Default Sort Fields: The first field will automatically default to employee name but can be changed to an organization field such as department or division. Sort the employee list in the order that you receive and enter time.

Additional Superannuation Contribution (ASC) Guidance for ...

www.hse.iePensions Act 2017 (“the Act”). Whereas PRD was a temporary emergency measure, ASC is a permanent contribution in respect of pension. 2. Effective Date While the effective date is 1 January 2019, similar to PRD the operative date is the first payroll date in 2019. In this regard PRD will run up to the last payroll date in 2018 (and/or

St. Vrain Valley School Professional/Technical Salary Schedule

www.svvsd.orgJan 07, 2022 · Manager - Payroll Craft/Trade/Food Svc Manager 248 Day Manager - Student Data Craft/Trade/Food Svc Manager 248 Day Non-Instructional Program Consultant Non-Instructional Coordinator 248 Day Senior Accountant Accountant 248 Day 6 $78,800 $108,819 7 $84,257 $116,354 Instructional Program Consultant Instructional Coordinator 5 $73,345 $101,286

CAI Professional Manager Code of Ethics

www.caionline.orgAug 18, 2021 · Client accounts, nor does it prohibit a central disbursement or payroll account that is promptly reimbursed by each Client’s individual cash account. When a Manager’s engagement has ended for a Client, all funds must be returned to the Client the earlier of: • the time limit under state statute, or

Metro Supportive Housing Services Program Tax Information

www.oregonmetro.govJan 08, 2021 · Beginning January 1, 2021 withholding will be voluntary. However, an employer must offer to its employees in writing to withhold the Metro personal income tax from the employees’ wages as soon as the employer’s payroll system(s) can be configured to capture and remit the taxes withheld.

LCEA Labor Contract 2021-2024

www.lincoln.ne.govLCEA Agreement - 8/19/2021-8/31/2024 3 Pay period shall mean payroll payments normally made to employees on a bi-weekly basis. Personnel Board shall mean the duly appointed Personnel Board of the City of Lincoln, Nebraska. Personnel Code shall mean Chapter 2.76 of the Lincoln Municipal Code entitled “Personnel System”. Position Description shall refer to each …

NYS-50-T-Y Yonkers Withholding Tax Tables and Methods ...

www.tax.ny.govunder Chapter 60 of the Laws of 2016 (Part TT). They have also been revised to reflect certain income tax rate increases enacted under Chapter 59 of the Laws of 2021 (Part A). Accordingly, effective for payrolls made on or after January 1, 2022, employers must

How To Prepare a Budget for a Service Business A Step by ...

www.bizmove.comWhen determining variable expenses, Mrs. Doe uses her trade journals for information on budgeted purposes, all costs are expressed as a percentage of the sales dollar. In her case, the percentages are: beauty shop supplies 10, laundry, including uniforms 3, water and variable utilities 1; and payroll costs 5.

Center for ClinicalStandards and Quality/Quality, Safety ...

www.cms.govtransitioning to using data electronically submitted through the Payroll-Based Journal (PBJ) system, as required under section 1128I(g) of the Social Security Act (the Act) and 42 CFR §483.70(q). After the transition to the use of PBJ data, CMS continued to implement enhancements to the information posted on the . Care Compare. website and ...

ADVANCED DIPLOMA IN ACCOUNTING AdvDip (Accounting) …

www.tut.ac.zaThis module uses technology-assisted learning (Pastel Accounting and VIP Payroll) with the purpose to enhance the skills acquired in WIL in Accounting III (in the Diploma) in working with computer accounting applications. This module integrates the theory from Accounting and Taxation with a practical element and the

2021 REAL ESTATE COMPENSATION SURVEY All Companies ...

celassociates.com2021 REAL ESTATE COMPENSATION SURVEY All Companies - Consolidated Results Position Median (1) Executive & Corporate Positions ... Payroll/Benefits Manager $59,900 $72,200 $87,900 8.9% ... Operations Director/Manager $93,300 $111,000 $132,400 14.6%

A leading ISO Certified Grade A MEP Contractor www.gulf-times

img.gulf-times.com& Closing, Payroll & WPS. Knowledge in SAP DBM, Oracle, Tally, ERP software and MS Office. Valid DL and QID transferable NOC. Mob: 30891019, email: hasimuhammed@ gmail.com B. E MECHANICAL HVAC/QA-QC Engineer (M.E.P) with 5 years experience in Qatar in a well reputed company in the Manufacturing, Installation and Maintenance of all the HVAC

NetSuite SuiteProjects

www.netsuite.comtraditional accounting software and equips you with the visibility you need to make better, faster and accurate decisions. HR SuitePeople offers capabilities for organizations to manage their HR and workforce management processes including employee new hires, onboarding, payroll, organization charts and compensation changes. Combined with

CAPPS HR/PAYROLL EMPLOYEE SELF-SERVICE TRAINING - …

tmd.texas.govStatus of Employee’s Timesheet Entry Entry on Timesheet •After an employee enters time or leave on a timesheet and selects E-sign & Submit, the timesheet moves through the following stages. Needs Approval •Waiting on action by an approver (Manager, Time Administrator or HR Super User). An auto-

RECORDS TO BE KEPT BY EMPLOYERS - Office of …

www.uc.pa.govpayroll records required under subsection (a) and all other business records, including, without limitation, cash books, journals, ledgers and corporate minutes at any reasonable time and as often as may be deemed necessary. The employer or entity in possession of the records shall keep the records in a condition that the

Virginia Employment Commission | Virginia Employment ...

www.vec.virginia.govWeb-07-05-2012. T-FC-34. Combined Amended Quarterly Tax and Wage Report (FC-34) II. Amended Employer’s Quarterly Payroll Report (FC-21) Social Security Number / Reason Code

HOW TO CREATE A DIR REGISTRATION NUMBER ... - Peralta …

web.peralta.eduJan. 01, 2016 ALL Contractors must submit Certified Payroll Records (Online) to the Labor Commissioner. Effective IMMEDIATELY, the District / Campuses shall file with DIR a Notice of Award of the Contract for ALL public works projects valued at $1,000.00 and up within FIVE (5) days of award utilizing FORM PWC 100.

2020 Publication 15-A - IRS tax forms

www.irs.govtypically paid a fee based on payroll costs. To become and remain certified under the certification program, certi-fied professional employer organizations (CPEOs) must meet various requirements described in sections 3511 and 7705 and related published guidance. Certification as a CPEO may affect the employment tax liabilities of both

ADP Payroll Instructions - Navy Exchange

www.mynavyexchange.comDuring registration, if you provided a mobile phone number that is not shared by other users in your organization, look out for a text message from ADP and reply with the code to complete the activation. In some countries, your activation process will differ; so, follow the instructions in the text message to activate your mobile number.

Automated Clearing House (ACH) services - BofA Securities

business.bofa.comNOC Manager ACH NOC Manager applies corrected account information, provided by the account holder’s bank, ... and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, ... a payroll vendor or an ACH initiation service offered by Bank of America.

Payroll Based Journal (PBJ) - CMS

www.cms.govPayroll-Based Journal (PBJ): •Exported file (XML) from automated systems (e.g., payroll, timekeeping), or •Manual entry directly through PBJ system, or •Combination of XML and manual entry (merging data) Voluntary submission period: October 2015 to June 30, 2016 Mandatory submission period begins July 1, 2016 Page 3

Payroll tax calendar 2021/2022 - Sage

help.accounting.sage.comsage.co.uk/pye Tax Month 1 6 April –5 May 2021 Tax Month 7 6 October –5 November 2021 Week Tues Wed Thu Fri Sat Sun Mon Week Tues Wed Thu Fri Sat Sun Mon 1 6 7 8 ...

Similar queries

Payroll, Information, Payroll reporting, CalPERS, Records, WEEKLY PAYROLL, Payroll records, Summary of Monthly Payroll Report, NEW JERSEY, Payroll Calendar, 2021, ADP Payroll, EMPR, REFERENCE, Processing, Off-payroll working rules, Employment, Direct Deposit, Payroll Deduction, PAYROLL DEDUCTION AUTHORIZATION, BI-WEEKLY PAYROLL, Personnel Payroll, ATTENDANCE AND PUNCTUALITY, Personnel, New jersey 2021 payroll calendar, Workplace, Giving, Program, QuickBooks, LOAN REPAYMENT SALARY DEDUCTION, LOAN REPAYMENT SALARY DEDUCTION AUTHORIZATION FORM, Voluntary, Off-payroll working rules (IR35) - flowchart, ISolved Payroll, User, Code of Ethics, Engagement, Chapter, Payrolls, To Prepare, Based Journal, VIP Payroll, SURVEY, Operations, Tally, NetSuite, Accounting, PAYROLL EMPLOYEE SELF-SERVICE TRAINING, Timesheet, Virginia Employment, Public works projects, IRS tax forms, Navy Exchange, Shared, Automated Clearing House (ACH) services, Manager, Financial, Payroll Based Journal, Payroll-Based Journal