Search results with tag "Deduction"

Information and Filing Deduction, Standard Dependents,

www.irs.govStandard deduction increased. The stand-ard deduction for taxpayers who don't itemize their deductions on Schedule A of Form 1040 is higher for 2018 than it was for 2017. The amount depends on your filing status. You can use the 2018 Standard Deduction Tables near the end of this publication to figure your stand-ard deduction.

Information and Filing Standard

www.irs.govStandard deduction increased. The stand-ard deduction for taxpayers who don't itemize their deductions on Schedule A of Form 1040 or 1040-SR is higher for 2021 than it was for 2020. The amount depends on your filing status. You can use the 2021 Standard Deduction Tables near the end of this publication to figure your standard deduction ...

Information and Filing Standard - IRS tax forms

www.irs.govStandard deduction increased. The stand-ard deduction for taxpayers who don't itemize their deductions on Schedule A of Form 1040 or 1040-SR is higher for 2019 than it was for 2018. The amount depends on your filing status. You can use the 2019 Standard Deduction Tables near the end of this publication to figure your standard deduction. Form ...

Tax Deduction Worksheet - Oxford University Press

global.oup.comTax Deduction Worksheet . This worksheet allows you to itemize your tax deductions for a given year. Tax deductions for calendar year 2 0 ___ ___ HIRED HELP SPACE $_____ Accountant

Oregon Itemized Deductions

www.oregon.govOther miscellaneous deductions 22. List type and amount. Important! Don’t include employee business expenses, tax preparation fees, or other deductions subject to the 2 percent of AGI limitation (see instructions) ..... 22. Oregon itemized deductions 23. …

2021 Estimated Tax Worksheet, Line 6a Phaseout of Itemized ...

www.maine.govPhaseout of Itemized / Standard Deductions Worksheet 36 M.R.S. 5124-C(2) and 5125(7) TAXPAYER NAME: _____ SSN: _____ You must use this Worksheet to calculate the reduction of your standard deduction amount or itemized deduction amount if your estimated Maine adjusted gross income for 2021 is greater than $83,850 if single or married fi ling ...

Impairment-Related Work Expenses - Ticket to Work

choosework.ssa.govIRWE deduction for monthly transportation expenses. $690. Income left after deductions and exclusions. $690 / 2. Social Security considers half of your income after deductions and exclusions as countable income. $345. Although Ellen earns $1025 per month, Social Security only counts $345 of it when calculating her eligibility for her SSI cash ...

2020 Deductions Worksheet Small Business Tax

3938vt31fpm84aufi94co9yh-wpengine.netdna-ssl.comSmall Business Tax Deductions Worksheet 2020 Neat For small business owners, staying on top of taxes can ... 1/4 of small business owners don't think about tax season until it’s at least two months away. But, to claim the money-saving deductions that will help you lower your income tax bill, you’ll need to keep accurate records and keep up ...

CT-706 NT Instructions, Connecticut Estate Tax Return (for ...

portal.ct.govEnter allowable estate tax deductions as computed for federal estate tax purposes (other than the deductions allowable for state death taxes under I.R.C. §2058) even if no federal estate tax return was required. Subject to federal rules, allowable deductions may include all or a part of:

2021 Form W-4 - NC

files.nc.govpayments for that income. If you prefer to pay estimated tax rather than having tax on other income withheld from your paycheck, see Form 1040-ES, Estimated Tax for Individuals. Step 4(b). Enter in this step the amount from the Deductions Worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2021 ...

LOAN REPAYMENT SALARY DEDUCTION …

tdsplans.orgLOAN REPAYMENT SALARY DEDUCTION AUTHORIZATION FORM ... As a participant of a voluntary 403(b)/457(b) plan, the Employee will be ... **No payroll deductions for repayment of your loan will be initiated or stopped without returning this form to your payroll department**

Income Tax Deduction on Timber and ... - US Forest Service

www.fs.fed.usIncome Tax Deduction on Timber and Landscape Tree Loss from Casualty Linda Wang, National Timber Tax Specialist, USDA Forest Service October 2018 Timber or landscape trees destroyed by the hurricane, fire, earthquake, ice, hail, tornado, and other storms are “casualty losses” that may allow the property owners

NO EMPLOYEE IS PERMITTED TO WORK UNTIL ALL …

selfservice.ascentis.com• Pay Card or Direct Deposit information ... Payroll Deduction Form (Send to ACCTG) O:\PeterPiperPizza\New Hire Paperwork\New Hire Hourly Packet 2021.docx . ... EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION FORM …

Department of Taxation and Finance Instructions for Form ...

www.tax.ny.govDecember. Your standard deduction on your joint New York State return for the entire year is $16,050. Your standard deduction for the nine months that you and your spouse were New York City residents, based on the Proration chart, is $12,038. If you have more than one dependent exemption, use the Proration chart on page 2 and multiply the value ...

Income Types and Income Deductions - CALFRESH …

calfreshinduction.weebly.comIncome Types and Income Deductions 19 Verification Payments of child support must be verified. If the household fails or refuses to cooperate by not supplying the necessary verifications, their eligibility and benefit level will be determined without a child support exclusion. Nonrecurring Lump Sum Payments Overview

Individual Income Tax Louisiana Individual Income Tax ...

revenue.louisiana.govDec 30, 2021 · 294, and 295(B); the combined personal exemption, standard deduction, and other exemption deductions must be deducted from the lowest tax bracket first and then the remaining brackets in increasing order.

Tax Deductions for FireFighters - Summit Accounting

summitaccounting.netTax Deductions for FireFighters In order to deduct expenses in your trade or business, you must show that the expenses are “ordinary and necessary.” An ordinary expense is one that is customary in your particular line of work. A necessary expense is one that is appropriate but not necessarily essential in your business.

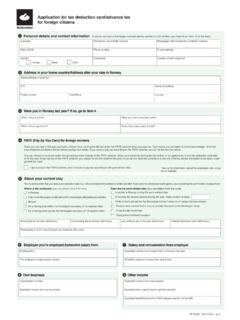

Application for tax deduction card/advance tax for foreign ...

www.skatteetaten.noLive/stay in Norway during the work-related stay: In Norway for several periods during the year. ... Salary and remuneration from employer: Expected income from employment in Norway this year ... general tax rules instead of the PAYE scheme. Make your choice by ticking the box below, or by applying for a new tax deduction card later : on in the ...

Trade or Business Expenses Under IRC § 162 and Related ...

www.taxpayeradvocate.irs.govClearly it was not the intention of Congress to automatically allow as deductions operating expenses incurred or paid by the taxpayer in an unlimited amount.” 176 F.2d 815, 817 (6th Cir. 1949), cert. denied, 338 U.S. 949 (1950). 15 IRC § 162(a). IRC § 263. No current deduction is allowed for the cost of acquisition, construction ...

SCHEDULE K-1 OWNER’S SHARE OF INCOME, CREDITS, …

revenue.ky.govitemized deductions. For a federal 1065 Schedule K-1, enter the amounts from Lines 1 through 12 and include amounts from Line 13 that do not pass through to Form 740 or 740-NP, Schedule A, as itemized deductions. NOTE: f Form 8582-K is required, adjust the amounts entered on I Kentucky Schedule K-1 in Section A, Lines 1, 2, and 3 to exclude

TAX DEDUCTION AT SOURCE ON PURCHASE OF GOODS …

itatonline.orgpurchase of goods (section 194 q) The Finance Bill, 2021 has introduced a new section 194Q to the Income Tax, 1961 for deduction of tax at source in case of purchase of goods.

FILING THE RETURN OF INCOME - Income Tax Department

incometaxindia.gov.in9. Person claiming deduction under Section 57 from income taxable under the head 'Other Sources'(other than deduction allowed from family pension) 10. Who wants to claim relief under Section 90 or 91 11. Who wants to claim credit of tax deducted at …

Schedule OR-A Instructions 2021 Oregon Itemized Deductions

www.oregon.govCoordination with the special see “Federal tax liability subtraction” in Publication OR-17 medical subtraction If you or your spouse turned age 66 by the end of the tax year, and your federal AGI wasn’t more than $200,000 ($100,000 if your filing status is single or married filing separately), you may qualify for the special Oregon medi-

CARGO LOSS & DAMAGE CLAIM - YRC Worldwide

admin.yrcw.comexceptions on freight bills or other documents, inspection reports ... assignment or other proof to determine the claimant is the proper party to receive any claim payment. ... or an extract therefrom, certified by the claimant or his authorized involved in the claim and reflecting all trade or other discounts, allowances, or deductions of any ...

Invoicing and payment process guide

help.sap.comthe advance payment. The ERP system handles the deduction when processing the payment. Also, payment requests on the invoice Reference tab don't indicate the use of advance payments. 14.The system exports the payment request to the external system for payment processing. 8 PUBLIC Invoicing and payment process guide Advance payment workflow

Instructions for Form CT-3.4 Net Operating Loss Deduction ...

www.tax.ny.govyear, multiplied by the combined apportionment factor for that year as determined under §210-C.5. An NOL sustained in a tax year is reported on Form CT-3 or CT-3-A, Part 3, line 19. NOLs that are incurred for tax years beginning on and after January 1, 2015, are used in the computation of the business

CARES Act Tax Law Changes & Colorado Impact

tax.colorado.gov27, 2020 and January 1, 2021, sections 39-22-104(3)(l) and 39-22-504(1)(b), C.R.S., require taxpayers to add back to federal taxable income net operating loss deductions taken on the federal return to the extent they are in excess of the taxable income limitation imposed by section

IB Mathematics Standard Level (SL) - Weebly

livelovedomath.weebly.comand automatic 50% point deduction. Work that is not turned in by the end of the 9 week grading period will receive a zero. All projects will be given a grade reduction of 10% per day with a maximum reduction of 60%. Lost Book Policy: The student will be charged full replacement cost for any textbook lost, regardless of condition.

Box 14, W-2 Employee Tax Form Information - AccuPay

www.accupay.comIf you wish to talk with us about adding payroll deduction "accumulators" for annual W-2 reporting, call your processor, or Lisa Reed, SPHR, CPP at 317-885-7600. PayDay is an email communication of payroll news, legal updates and tax considerations intended

Teacher Education Assistance for College and Higher ...

studentaid.govLoan, the interest rate that will apply after the conversion will be the interest rate that was in effect for ... If a TEACH Grant that you received as a graduate student is converted to a Direct Unsubsidized Loan, the ... You may be able to claim a federal income tax deduction for interest payments you make on Direct Loans. For further ...

Form W-9S Request for Student’s or Borrower’s Taxpayer ...

heartland.ecsi.netinterest (Form 1098-E, Student Loan Interest Statement). The information about your tuition will help to determine whether you, or the person who can claim you as a dependent, may take either the tuition and fees deduction or claim an education credit to reduce federal income tax. The information about your student loan interest will help to

2021 Form 8865 - IRS tax forms

www.irs.govIf “Yes,” enter the amount of gross income derived from sales, leases, exchanges, or other dispositions (but not licenses) from transactions with or by the foreign partnership that the filer included in its computation of foreign-derived deduction

LOUISIANA FILE ONLINE Fast. Easy. Absolutely Free.

revenue.louisiana.govIf you did not itemize your deductions on your federal return, leave Lines 8A, 8B, and 8C blank and go to Line 9. ... been decreased by a federal disaster credit allowed by the IRS, see Schedule H. 10 ... 39 PAYMENTS 28 AMOUNT OF LOUISIANA TAX WITHHELD FOR 2019 – Attach Forms W-2 and 1099.

GENERAL CONTRACTOR OVERHEAD AND PROFIT …

www.mwl-law.comThe only difference between RC and ACV is a deduction for depreciation. Both are based on the cost today to replace the damaged property with new property. More complicated formulas take the replacement cash value, or RCV, which is the cost to purchase the item new, and multiply it by the depreciation rate, or DPR, as a

Realtors Tax Deductions Worksheet - BOBBY'S BUSINESS …

www.bobbysbusinessservices.comThe basic local telephone service costs of the first telephone line provided in your residence are not deductible. However, toll calls from that line are deductible if the calls are business- related. The costs (basic fee and toll calls) of a second line in your home are also deductible if the line is used exclusively for business.

The Uses of Argument, Updated Edition - Weebly

johnnywalters.weebly.comI. Fields of Argument and Modals 11 The Phases of an Argument 15 Impossibilities and Improprieties 21 Force and Criteria 28 The Field-Dependence of Our Standards 33 Questions for the Agenda 36 ... but a rigidly demonstrative deduction of the kind to be found in Euclidean geometry. Thus was created the Platonic tradi-

Income Tax Regulations 1996 - Mauritius Revenue Authority

www.mra.muUnauthorised deductions 9. [Prescribed funds and schemes] Revoked 10. [Approval of personal pension schemes] Revoked ... 23H. Admissibility of documents produce by computer ... For the purposes of section 13 of the Act, the value of trading stock to be taken into account shall, subject to paragraphs (2) and (3), be determined in accordance with ...

FORM NO. 12BB 192 1. 2. 3. DETAILS OF CLAIMS AND …

www.incometaxindia.gov.inFORM NO. 12BB [See rule 26C] Statement showing particulars of claims by an employee for deduction of tax under section 192 1. Name and address of the employee: 2. [Permanent Account Number or Aadhaar Number] of the employee: 3. Financial year: DETAILS OF CLAIMS AND EVIDENCE THEREOF Sl. No. Nature of claim Amount (Rs.) Evidence/particulars (1 ...

Lesson Three Buying a Home - Practical Money Skills

www.practicalmoneyskills.comactivity teenagers young adults adults (14-18)(1-25)(26+) 9 Survey/Interview Student Activity 3-1 Student Activity 3-2 ... Few financial benefits in the form of tax deductions ... Jess, age 19, has just taken her first job as a sales representative trainee for a computer software company. RENT BUY DEPENDS 5: Barb and Frank, ages 54 and 57, are ...

2021 FTB Publication 1034 Disaster Loss How to Claim a State …

www.ftb.ca.gov“Recent Disaster Loss Relief” chart on page 7 through page 10. This publication is designed to help you with financial recovery and explains how you can claim your financial loss as a deduction on your California tax return. For additional information specific to your disaster see page 7 through page 10 of this publication or form

Truckers Tax Deductions - Trucker to Trucker

truckertotrucker.comyour tax pro). You CANNOT deduct charitable contributions against your self-employment earnings or on the Schedule C or Form 2106 on a business tax return…although it is possible to deduct “business gifts” to your broker, co-workers, employees, employers, supervisors, and/or vendors…but these are limited to $25 per specific individual or

Similar queries

Deduction, Standard deduction, Stand-ard deduction, Standard, IRS tax forms, Oxford University Press, Itemized deductions, Deductions, Itemized, Maine, Deductions Worksheet Small Business Tax, Small Business Tax Deductions Worksheet, Small, Think, Connecticut Estate Tax Return for, Estate tax deductions, Estate tax, Income, LOAN REPAYMENT SALARY DEDUCTION, LOAN REPAYMENT SALARY DEDUCTION AUTHORIZATION FORM, Voluntary, Payroll, Tax Deduction on Timber and Landscape, Direct Deposit, Payroll Deduction, PAYROLL DEDUCTION AUTHORIZATION, Chart, CALFRESH, Individual Income Tax, Personal exemption, Exemption, Brackets, Tax Deductions for FireFighters, Related, Remuneration, Trade or Business Expenses Under IRC § 162, Allowed, Kentucky, DEDUCTION AT SOURCE ON PURCHASE OF GOODS, Purchase of goods section 194, At source, Purchase of goods, Special, Freight, Other, Proper, Instructions for Form CT, 3.4 Net Operating Loss Deduction, Year, Apportionment, 2 Employee Tax Form Information, Deduction "accumulators, Loan, Interest, Student, Student loan interest, GENERAL CONTRACTOR OVERHEAD AND PROFIT, Realtors Tax Deductions Worksheet, Residence, Uses of Argument, Modals, Income Tax Regulations 1996, Section, FORM, Practical Money Skills, Adults adults, Just, California, Tax Deductions, Tax return