Search results with tag "Tax deduction"

Schedule A – Itemized Deductions - IRS tax forms

apps.irs.govtax deduction calculator. See the link to the IRS sales tax deduction calculator at the bottom of the page. The calcu-lator adds nontaxable income to AGI to give the taxpayer a larger sales tax deduction. Use the override button to enter the amount calculated. If not using the override feature, enter the ZIP code and number of days for ...

GOVERNMENT OF INDIA MINISTRY OF ... - Income Tax …

www.incometaxindia.gov.ingovernment of india ministry of finance (department of revenue) central board of direct taxes deduction of tax at source- income-tax deduction from salaries

GOVERNMENT OF INDIA CENTRAL BOARD ... - Income Tax …

www.incometaxindia.gov.ingovernment of india ministry of finance (department of revenue) central board of direct taxes deduction of tax at source- income-tax deduction from salaries

T.D.S./TCS TAX CHALLAN Copy

www.tin-nsdl.comTax Applicable(Tick One)* TAX DEDUCTED/COLLECTED AT SOURCE FROM Assessment Year CHALLAN NO./ ITNS 281 (0020) Company Deductees (0021) Non‐Company Deductees ‐ Tax Deduction Account No.(T.A.N.) Full Name

Truckers Tax Deductions - Trucker to Trucker

truckertotrucker.comyour tax pro). You CANNOT deduct charitable contributions against your self-employment earnings or on the Schedule C or Form 2106 on a business tax return…although it is possible to deduct “business gifts” to your broker, co-workers, employees, employers, supervisors, and/or vendors…but these are limited to $25 per specific individual or

Form 706: A Detailed Look at the Schedules mhaven

www.mhaven.netEstate Tax Deduction (ETD) • IRD is claimed as income on Form 1041 and as asset on 706 • To avoid double taxation, estate tax paid on IRD (Form 706) may be

CLAIM FOR REAL PROPERTY TAX DEDUCTION ON DWELLING …

www.state.nj.usform ptd rev. february 2007 claim for real property tax deduction on dwelling house of qualified new jersey resident senior citizen, disabled person, or surviving spouse/surviving civil union partner

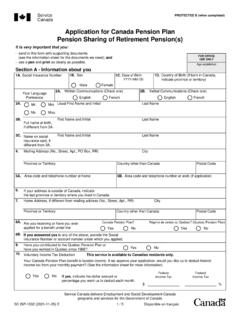

Application for Canada Pension Plan Pension Sharing of ...

catalogue.servicecanada.gc.caVoluntary Income Tax Deduction . This service is available to Canadian residents only. Your Canada Pension Plan benefit is taxable income. If we approve your application, would you like us to deduct federal ... and in accordance with the Treasury Board Secretariat Directive on the SIN, which lists the CPP as an authorized user of

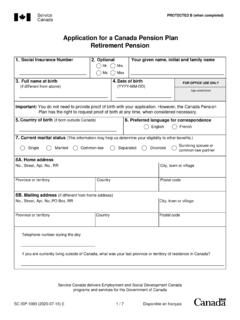

Application for a Canada Pension Plan Retirement Pension

catalogue.servicecanada.gc.caAllowance or Canada Child Tax Benefit payments and provide a reason. Do not list periods of time when you ... 12. Voluntary income tax deduction : ... and in accordance with the Treasury Board Secretariat Directive on the SIN which lists the CPP as an authorized user of the SIN. The SIN will be used as a file identifier and to ensure an

Page 1 Line-by-Line Instructions for the DR 0104AD ...

tax.colorado.govtax deduction but is disallowed by section 280E of the Internal Revenue Code because marijuana is a controlled substance under federal law. To calculate this deduction, you must create pro forma federal schedule(s) for Business Profit or Loss as if the federal government would have allowed the expenditures from the marijuana business.

LAWS OF TRINIDAD AND TOBAGO - OAS

www.oas.orgL.R.O. LAWS OF TRINIDAD AND TOBAGO Income Tax Chap. 75:01 3 2. Section 4 (1) (c) of the Premier Vesting Act, (No. 33 of 1997) is an exact replica of section 4 (1) (h) of the TIDCO Act. Note on Maternity Leave Pay Tax Deduction Section 11 of the Maternity Protection Act, (Ch. 45:57) provides for an employer to claim the

Rental properties - Interest expenses

www.ato.gov.aua new car. Yoko’s property is rented for the whole year from 1 July. Her total interest expense on the $400,000 loan is $35,000. To work out how much interest she can claim as a tax deduction, Yoko must do the following calculation: Total interest expenses × (rental property loan ÷ total borrowing) = deductible interest. That is:

PROPERTY TAX DEDUCTION CLAIM BY VETERAN OR …

www.state.nj.usA. Honorably discharged veteran with active wartime service in the United States Armed Forces.

A Donor’s Guide to - Internal Revenue Service

www.irs.gov1 f a tax deduction is an important consideration for you when donating a car to a charity, you should check out the charity; check the value of your car; and

TAX DEDUCTION/COLLECTION ACCOUNT NUMBER

www.incometaxindia.gov.in[As amended by Finance Act, 2018] TAX DEDUCTION/COLLECTION ACCOUNT NUMBER Meaning of TAN Tax Deduction Account Number or Tax Collection Account Number is a 10-digit alpha-

Tax Deductions for Damage Payments: What, Me Worry?

www.woodllp.com‘‘remedial.’’ In contrast to fines, payments that are reme-dial or compensatory in nature are deductible.10 Obviously, importing deductibility characterization

Similar queries

Schedule A, IRS tax forms, Tax Deduction, Number, OF ... - Income Tax, Deduction of tax at source, Income, T.D.S, AT SOURCE, Tax Deductions, Tax return, Detailed Look at the Schedules, Directive, Canada Pension Plan Retirement Pension, Deduction, LAWS OF TRINIDAD AND TOBAGO, Property, Internal Revenue Service, TAX DEDUCTION/COLLECTION ACCOUNT NUMBER, Tax Collection, Fines