Search results with tag "Apportionment"

Cost Allocation, Apportionment and Absorption of Overheads

courseware.cutm.ac.inapportionment deals with proportion of items of cost. •Allocation is direct process of departmentalization of overheads, where as apportionment needs a suitable basis ... of postage used during a year. 3. Survey or Analysis Method •The …

Multistate Tax Commission Allocation and Apportionment ...

www.mtc.govMultistate Tax Commission Allocation and Apportionment Regulations Adopted February 21, 1973; as revised through July 29, 2010 (Applicable to Article IV of the Multistate Tax Compact and to the Uniform Division of Income for Tax Purposes Act.) The Allocation and Apportionment Regulations were adopted by the Multistate

Setting the Table on Allocation and Apportionment in New …

www.hodgsonruss.comTAX NOTES STATE, APRIL 27, 2020 475 tax notes state NOONAN'S NOTES Setting the Table on Allocation and Apportionment in New York by Timothy P. Noonan, Doran J. Gittelman, and Jeffrey S. Gold Every state employs a combination of sourcing rules and apportionment formulas to determine how much of a business’s income will be taxable. 1

11th Annual Domestic Tax Conference - EY - United States

www.ey.comApr 28, 2016 · Page 4 Agenda Interplay between Nexus and apportionment Nexus expansion Move toward single sales factor apportionment and market-based sourcing for services and non-tangible property Alternative apportionment Interplay between state and international ALAS, transfer pricing and OECD BEPS State implications of Section 385 regulation proposal

Application for Mergers or Apportionments - New York City

www1.nyc.govRP-602 Rev. 7.8.2019 Department of Finance TM APPLICATION FOR APPORTIONMENTS OR MERGERS New York City Department of Finance l Property Division l Tax Map Office The applicant hereby certifies that, in making this application for merger/apportionment, s/he is the owner, or acting under the direction of the owner.

2020 Schedule R Apportionment and Allocation of Income ...

www.ftb.ca.govBusiness Income (Loss) before Apportionment (subject to a separate apportionment formula) Nonbusiness Income (Loss) Allocable to California. If no income (loss) is allocable to California, do not complete line 19 through line 26, enter -0- on line 27 and go to Side 2, line 28. __ __ __ . Name as shown on your California tax return.

The Intersection of Estate Tax Apportionment and Blended ...

leimbergservices.comSubject: Paul Hood on Tom Clancy’s Estate: The Intersection of Estate Tax Apportionment and Blended Families, A Legal Thriller! “There are important lessons to be learned from this case. Estate tax apportionment provisions often are included in the so-called boilerplate legalese in the document, but they might be the most important provision in

Surplus Apportionment Information Booklet - MIBFA

www.mibfa.co.zaPage 4 3. Stakeholders The following parties are considered as “stakeholders” in terms of the Act and must be included in the surplus apportionment scheme as at 1 April 2008:

STATE APPORTIONMENT OF CORPORATE INCOME

www.taxadmin.orgSTATE APPORTIONMENT OF CORPORATE INCOME (Formulas for tax year 2022 -- as of January 1, 2022) ALABAMA * Sales MONTANA * Double wtd Sales ALASKA* 3 Factor NEBRASKA Sales ARIZONA * Sales/Double wtd Sales NEVADA No State Income Tax ARKANSAS * Sales NEW HAMPSHIRE (3) Double wtd Sales

Tax Apportionment in Estate Planning: Drafting …

media.straffordpub.comTax Apportionment in Estate Planning: Drafting Clauses to Preserve Dispositive Provisions Navigating Techniques for Estate, Gift, Income, Generation …

HUDACO INDUSTRIES GROUP PROVIDENT FUND

www.hudaco.co.zaHUDACO INDUSTRIES GROUP PROVIDENT FUND SURPLUS APPORTIONMENT PLAN Status of the plan and related payments The surplus apportionment plan has been approved and ...

2017 MICHIGAN Schedule of Apportionment MI-1040H

www.michigan.gov2017 MI-1040H, Page 2. Instructions for Form MI-1040H, Schedule of Apportionment. Purpose. Business income from business activity that is taxable both

FY22 1st Apportionment of Section 402 and Section 405 ...

www.nhtsa.govFY22 1st Apportionment of Section 402 and Section 405 Authorized Grant Amounts FY 2022 S. 402 and S. 405 Awarded Grant Amounts ...

A quick guide to Regulated Apportionment Arrangements

www.thepensionsregulator.gov.ukA quick guide to Regulated Apportionment Arrangements Information for journalists Key points The best security for a defined benefit pension scheme is a strong, ongoing sponsoring employer.

SUPREME COURT OF THE UNITED STATES

www.supremecourt.govdicial remedy of equitable apportionment; Mississippi’s complaint is dismissed without leave to amend. Pp. 7–12. (a) The doctrine of equitable apportionment aims to produce a fair allocation of a shared water resource between two or more States, see Colorado v. New Mexico, 459 U. S. 176, 183, based on the principle that

FORM Business Tax - Connecticut

portal.ct.govForm CT‑1120A, Corporation Business Tax Return Apportionment Computation, is used to compute the apportionment factors for the net income and the minimum tax base. Form CT‑1120K, Business Tax Credit Summary, is used to summarize a corporation’s claim for available business tax credits.

720U - revenue.ky.gov

revenue.ky.govMultistate Tax Commission (MTC) for partnership audits. Under the new audit rules, partnerships may be ... Apportionment and Allocation, indicating the use of an alternative allocation and apportionment formula if the corporation has not received written

Table of contents - Department of Taxation and Finance

www.tax.ny.govCT-3-I (2021) Page 3 of 30 this state means the receipts included in the numerator of the apportionment factor determined under §210-A. Also, receipts from processing credit card transactions for merchants include merchant discount fees received by …

SOUTH AFRICAN LAW REFORM COMMISSION …

www.justice.gov.zasouth african law reform commission project 96 the apportionment of damages act 34 of 1956 report july 2003

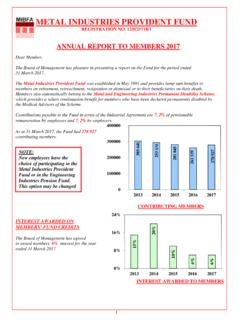

METAL INDUSTRIES PROVIDENT FUND - MIBFA

www.mibfa.co.za3 ACTUARIAL REVIEW AS AT 31 MARCH 2016 In terms of the Pension Funds Second Amendment Act of 2007, the Surplus Apportionment date (SAD) of the

Instructions for Form CT-3.4 Net Operating Loss Deduction ...

www.tax.ny.govyear, multiplied by the combined apportionment factor for that year as determined under §210-C.5. An NOL sustained in a tax year is reported on Form CT-3 or CT-3-A, Part 3, line 19. NOLs that are incurred for tax years beginning on and after January 1, 2015, are used in the computation of the business

2018 Guide for Property Owners

www.revenue.wi.govBack to table of contents 6 e for roert ners Wisc epar enue If the assessed values were used, the apportionment of the county levy would be: Town 28 .4 % of …

SN 2017(1), Legislative Changes Regarding Single-Sales ...

www.ct.govSN 2017(1) Page 3 I. Summary This Special Notice addresses apportionment changes to the Connecticut Corporation Business Tax (the Corporation Business Tax), which are applicable to income years beginning on or after January 1, 2016, and the Connecticut

Form 41S, S Corporation Income Tax Return ... - tax.idaho.gov

tax.idaho.govSep 27, 2021 · with an Idaho Form ID K-1. This form shows the shareholder’s proportionate share of Idaho additions, subtractions, and credit information. For shareholders who aren’t individuals, the Form ID K-1 also provides apportionment factor information that’s needed to complete their Idaho income tax return. Form ID

Act 67 - AGC

www.agc.gov.my4 Laws of Malaysia ACT 67 PART V CONTRIBUTORY NEGLIGENCE AND COMMON EMPLOYMENT Section 12. Apportionment of liability in case of contributory negligence 13. Saving for Merchant Shipping Ordinance 1952

MC 522 I, Agreement to Prepare and Maintain Records in ...

www.dmv.ca.govMC 522 I, Agreement to Prepare and Maintain Records in Accordance with International Registration Plan and California Apportionment Requirements Author: CA DMV Subject: Index ready This form is used for All IRP applicants are required to read, understand, and adhere to the record keeping provisions of the IRP Agreement.

Form CT-3 General Business Corporation Franchise Tax ...

www.tax.ny.govPart 2 – Computation of balance due or overpayment Part 6 – Computation of business apportionment factor Part 3 – Computation of tax on business income base Part 7 – Summary of tax credits claimed Part 4 – Computation of tax on capital base Legal name of corporation Trade name/DBA

CIFT-620 (1/19) Department of Revenue • Page 21 GENERAL ...

revenue.louisiana.govALLOCATION AND APPORTIONMENT OF NET INCOME AND FRANCHISE TAXABLE BASE Louisiana income tax is imposed only upon that part of the net income of a corporation that is derived from sources within Louisiana. When a corporation does business within and without Louisiana, the Louisiana

Income & Franchise Tax Audit Manual - mtc.gov

www.mtc.gov2.04 Apportionment Formula.The manner of computing the portion of a taxpayer’s income subject to tax in a particular state. The standard Uniform Distribution of Income for Tax Purposes Act (UDITPA) formula is ors the average of three fact

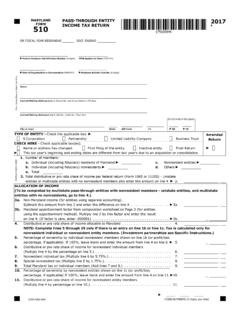

MARYLAND PASS-THROUGH ENTITY 2017 FORM INCOME …

forms.marylandtaxes.govMARYLAND FORM 510 PASS-THROUGH ENTITY INCOME TA RETURN COM/ RAD069 NAME FEIN 2017 page 3 Schedule A - COMPUTATION OF APPORTIONMENT FACTOR (Applies only to multistate pass-through entities.

Corporation Income Tax

tax.idaho.govInstructions for: Form 41 Form 42 Corporation Income Tax Return Idaho Apportionment and Combined Reporting Adjustments Form 41S Form 44 S Corporation Income Tax Return Idaho Business Income Tax Credits

EBF Sp Ed Personnel Offset Examples - isbe.net

www.isbe.net2. Determine the current year apportionment of Special Education Personnel base amount: a. Run Personnel Approval in I-Star

Important changes to the Section 14 transfer process

www.libertyfinancials.co.zaSurplus enhancements for active members The section 14 documents may be amended to reflect any enhanced benefit as a result of an approved surplus apportionment scheme, provided that the section 14 transfer has not yet been approved by the

STATE OF RHODE ISLAND DIVISION OF TAXATION BUSINESS ...

www.tax.ri.gov1 state of rhode island – division of taxation business corporation tax apportionment of net income regulation ct 15-04 table of contents rule 1.

SUBJECT : WEAR-AND-TEAR OR DEPRECIATION ALLOWANCE …

www.sars.gov.zaNov 02, 2012 · 4.1.5 Apportionment ... assets of a “small business corporation” ... The reference to section12E has been replaced with section 12E(1) by the Taxation Laws Amendment Act No. 7 of 2010 in order to limit the scope of application of this paragraph only to sub-section (1) of section 12E and not to the entire section 12E. ...

GENERAL INSTRUCTIONS - Louisiana

www.revenue.louisiana.govthat do business outside of Louisiana must complete Form CIFT-620A, which provides schedules for the apportionment and allocation of net income. When a corporation does business within and without Louisiana, the Louisiana franchise tax is imposed only on that part of the total taxable capital that is employed in Louisiana.

PennDOT Pub 181

www.dot.state.pa.usID – Idaho MT – Montana OR – Oregon WI – Wisconsin IL – Illinois NE – Nebraska PA – Pennsylvania WY – Wyoming IN – Indiana NB – New Brunswick PE – Prince Edward Island ... APPORTIONMENT PERCENTAGE - the ratio of the distance traveled in the Member Jurisdiction by a Fleet during

International Registration Plan (IRP) Manual

wisconsindot.govFeb 14, 2019 · Apportionment is a requirement under IRP for all buses traveling regularly scheduled routes. At the option of the registrant, total miles may be the sum of actual in-jurisdiction miles or a sum equal to the scheduled route miles per jurisdiction from the farthest point of origination to the point of destination of the route scheduled.

AFI10-401, Air Force Operations Planning and Execution

irp.fas.orgforce apportionment document; and deletes references to primary wings. This AFI is current and applicable as of the release date, but will re quire periodic update due to the continuing revisions in the Joint and Air Force planning and execution processes, new system field-

2021 Schedule K-3 (Form 8865) - IRS tax forms

www.irs.govFor calendar year 2021, or tax year beginning / / 2021 , ending / ... Exclusive apportionment with respect to total R&E expenses entered on Part II, line 32. Enter the following. A: R&E expense with respect to activity performed in the United States (i)

Apportionment & Market-Based Sourcing

www.rathlaw.comNESTOA, Stowe, VT September 18, 2017 Apportionment & Market-Based Sourcing Moderator: David Davenport Rath, Young and Pignatelli, P.C. Speakers: Michael Fatale

APPORTIONMENT - Maryland

btrc.maryland.gov2. What is Apportionment? • Under the Due Process and Commerce Clauses of the U.S. Constitution, States are permitted to tax the income of a multistate corporation if the State applies a formula

Similar queries

Apportionment, Year, Multistate Tax Commission, Multistate Tax Commission Allocation and Apportionment Regulations, Multistate Tax, Allocation and Apportionment Regulations, Multistate, ALLOCATION AND APPORTIONMENT, And apportionment, 11th Annual Domestic Tax Conference, New York City, California, The Intersection of Estate Tax Apportionment, Estate, The Intersection of Estate Tax Apportionment and Blended Families, A, Estate tax apportionment, Surplus Apportionment, Apportionment in Estate Planning: Drafting, Apportionment in Estate Planning: Drafting Clauses to Preserve Dispositive Provisions, HUDACO INDUSTRIES GROUP PROVIDENT FUND, HUDACO INDUSTRIES GROUP PROVIDENT FUND SURPLUS APPORTIONMENT, Income, Guide to Regulated Apportionment Arrangements, Pension, Business tax, Corporation Business Tax Return Apportionment Computation, Corporation, Allocation, Taxation, SOUTH AFRICAN LAW REFORM COMMISSION, South african law reform commission project 96 the apportionment, Report, METAL INDUSTRIES PROVIDENT FUND, Instructions for Form CT, 3.4 Net Operating Loss Deduction, Guide for Property Owners, Legislative Changes Regarding Single-Sales, Connecticut, Idaho, Accordance with International Registration Plan and California Apportionment Requirements, Business corporation, Business apportionment, Business, Income & Franchise Tax Audit Manual, Of Income, MARYLAND PASS-THROUGH ENTITY, FORM INCOME, Schedule, Corporation Income Tax, Idaho Apportionment, Year apportionment, Rhode island, Taxation business corporation tax apportionment of, Louisiana, Air Force, IRS tax forms, Apportionment & Market-Based Sourcing