Multistate tax commission

Found 7 free book(s)2643 -Misouri Tax Registration Application

dor.mo.govwith the tax laws, and exchange tax information with the Internal Revenue Service, other states, and the Multistate Tax Commission (Chapter 32 and 143, RSMo). In addition, statutorily provided non-tax uses are: (1) to provide information to the Department of Higher Education with respect to applicants for financial assistance

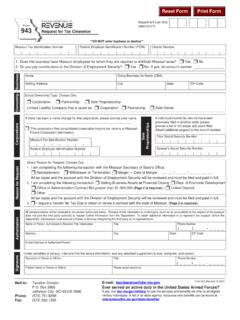

943 Request for Tax Clearance - Missouri

dor.mo.govthe correct amount of tax, to ensure you are complying with the tax laws, and to exchange tax information with the Internal Revenue Service, other states, and the Multistate Tax Commission (Chapter 32. and. 143, RSMo). In addition, statutorily provided non-tax uses are: (1) …

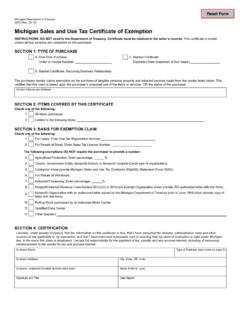

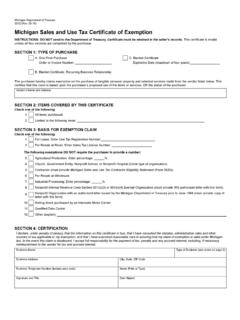

3372, Michigan Sales and Use Tax Certificate of Exemption

mi-aimh.orgMultistate Tax Commission, the Streamlined Sales and Use Tax Agreement Certicate of Exemption, the same information in another format from the purchaser, or resale or exemption certicates or other written evidence of exemption authorized …

Multistate Tax Commission Allocation and Apportionment ...

www.mtc.govMultistate Tax Commission Allocation and Apportionment Regulations Adopted February 21, 1973; as revised through July 29, 2010 (Applicable to Article IV of the Multistate Tax Compact and to the Uniform Division of Income for Tax Purposes Act.) The Allocation and Apportionment Regulations were adopted by the Multistate

UNIFORM SALES & USE TAX …

www.mtc.govAbsent strict compliance with these requirements, Oklahoma holds a seller liable for sales tax due on sales where the claimed exemption is found to be invalid, for whatever reason, unless the Tax Commission determines that purchaser should be pursued for collection of the tax resulting from improper presentation of a certificate. 17.

3372, Michigan Sales and Use Tax Certificate of Exemption

www.michigan.gov1. Michigan Department of Treasury 3372 (Rev. 01-21) Michigan Sales and Use Tax Certificate of Exemption. This exemption claim should be completed by the purchaser, provided to the seller, and is not valid unless the information in all four sections

DEPARTMENT OF REVENUE RESALE CERTIFICATE dor.sc

dor.sc.govSALES TAX - A sales tax is imposed upon every person engaged or continuing within this state in the business of selling tangible personal property at retail. USE TAX - A use tax is imposed on the storage, use, or other consumption in this state of tangible personal property purchased at retail for storage, use, or other consumption in this state.