Standard Deduction

Found 7 free book(s)Information and Filing Standard - IRS tax forms

www.irs.govStandard deduction increased. The stand-ard deduction for taxpayers who don't itemize their deductions on Schedule A of Form 1040 or 1040-SR is higher for 2019 than it was for 2018. The amount depends on your filing status. You can use the 2019 Standard Deduction Tables near the end of this publication to figure your standard deduction. Form ...

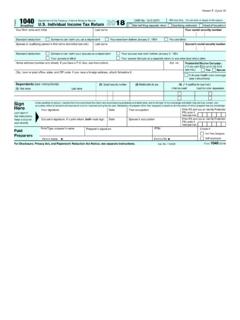

2018 Form 1040 - The Wall Street Journal

www.wsj.comStandard deduction: Someone can claim your spouse as a dependent Your spouse was born before January 2, 1954. Your spouse is blind Your spouse itemizes on a separate return or you were dual-status ...

Form 5129 Questionnaire—Filing Status, Exemptions, and ...

www.irs.govForm 5129 (Rev. December 2007) Questionnaire—Filing Status, Exemptions, and Standard Deduction Section I. Taxpayer Data 1. Name(s) and address (exactly as shown on your income tax return) 2. Social Security Number 3.

Salaries Tax / Personal Assessment

www.ird.gov.hkTax payable is calculated at progressive rates on your net chargeable income or at standard rate on your net income (before deduction of the allowances), whichever is lower. It is further reduced by the tax reduction, subject to a maximum. Net Chargeable Income = Income – …

IB Mathematics Standard Level (SL) - Weebly

livelovedomath.weebly.comand automatic 50% point deduction. Work that is not turned in by the end of the 9 week grading period will receive a zero. All projects will be given a grade reduction of 10% per day with a maximum reduction of 60%. Lost Book Policy: The student will be charged full replacement cost for any textbook lost, regardless of condition.

Standard Operating Procedure for Vendor Master - Netafim

services.netafimindia.com7.7 Lower Tax deduction at source (If any) 7.8 Declaration required in case of transporter non-deduction of TDS NOTE: The Term of payment is mandatory to mention in the vendor form which purchase department has agreed upon negotiation. The terms of payment require written

OHIO IT 3

tax.ohio.govOhio IT 3. Transmittal of W-2 Statements. Instructions. 1. Filing Deadline: The Ohio IT 3 must be filed by January 31st or within 60 days after discontinuation of business.