Search results with tag "Residence"

Application for Farm Residence Property Tax Exemption

www.tax.nd.govResidence on unplatted land. A residence . located on unplatted land within the boundaries of an incorporated city is eligible for exemption if it (1) is located on agricultural land, (2) is used as a farmer’s residence or is part of a farm plant, and (3) otherwise satisfies the exemption requirements. Residence on platted land. A residence

ORDINARY RESIDENCE: Guidance on the identification of …

assets.publishing.service.gov.ukPart 1: provides advice on the identification of the ordinary residence of people who require social care services. Part 2: sets out particular situations in which a person’s ordinary residence may be an issue. Part 3: covers other legislation under which an ordinary residence determination can be sought from the Secretary of State.

Michigan Department of Treasury Principal Residence ...

www.michigan.govprincipal residence exemption? Yes. A person must be an owner as defined by . MCL 211.7dd (a) to be eligible for the principal residence exemption. Since Chris is a person and he is listed on the deed as the grantee, he is an owner that is eligible for the principal residence exemption. 9. Dawn Smith deeds Blue Acre to Chris, a married man.

STATE OF LEGAL RESIDENCE CERTIFICATE - United States …

www.usarj.army.milresidence/domicile; and (5) preparing a new last will and testament which indicates your new State of legal residence/domicile. Finally, you must comply with the applicable tax laws of the State which is your new legal residence/domicile.

Declaration of Tax Residence for Individuals – Part XIX of ...

www.rbcdirectinvesting.comSection 2 – Declaration of tax residence. Tick ( ) all of the options that apply to you. I am a tax resident of Canada. I am a tax resident of a jurisdiction other than Canada. If you ticked this box, give your jurisdictions of tax residence and taxpayer identification numbers (TIN) or …

Instructions for Form 8898 (Rev. October 2021) - IRS tax forms

www.irs.govmust have the same tax residence. If you choose to keep your prior tax residence after such a relocation, the source of income for services performed (for example, wages or self-employment) by you is considered to be (the jurisdiction of) the prior tax residence. As a result, the amount of income tax withholding (from Form(s) W-2, Wage and Tax ...

GUIDE TO RESIDENCE LIVING 2021-2022 - Florida State …

housing.fsu.eduResidence Hall Staff ... Temporary lockout keys are available at the residence hall’s main desk. Upon c onfirmation of your identity, staff will sign out a key and expect you to return the key within 30 minutes, or staff will escort you to your room with the key and unlock the door. If you have lost a key or are unable to locate your

Guidelines for Permission for Permanent Residence

www.moj.go.jpnationals, special permanent residents or permanent residents, and requirement (2) does not apply for those who have been recognized as refugees 2. Special requirements for 10-year residence in principle (1) The person is a spouse of a …

WEST VIRGINIA CERTIFICATE OF NONRESIDENCE

tax.wv.govorders; (b) you are present in West Virginia solely to be with your spouse; and (c) you maintain your domicile in another State and you are claiming exemption under the Servicemember Civil Relief Act, enter your state of domicile (legal residence) on the following statement and attach a copy of your spousal military identification card.

Guidance for the Pandemic COVID-19 Mandatory Vaccination ...

www.health.vic.gov.auplace of residence that: (a) clause 7 obliges the employer to collect, record and hold the information specified in that clause in relation to the worker; and (b) clause 10(1) obliges the employer not to permit a worker to work for that employer outside the worker’s ordinary place of residence unless the

DS-5507 Affidavit of Physical Presence or Residence ...

pt.usembassy.govAFFIDAVIT OF PHYSICAL PRESENCE OR RESIDENCE, PARENTAGE AND SUPPORT OMB NO. 1405-0187 EXPIRES - 01-30-2019 Estimated Burden - 30 minutes ... affidavit is for the purpose of establishing my relationship to the aforementioned child/children and his/her/their claim to U.S. citizenship. Signature of affiant PART III (Oath: To be completed by all ...

ALMANAC 2022 - sun.ac.za

www.sun.ac.zaresidences and PSO wards (1) First year Law students arrive Assessment free day – Chinese New Year Readmission Appeals Committee (08:30) Research Committee: Subcommittee B (14:00) Social and Business Ethics Committee (8/2) 2 Wed Newcomer first-years arrive at residences and PSO wards (2) Welcoming programme for Law students

Ministry of Finance Tax Bulletin - British Columbia

www2.gov.bc.caIf a principal residence is transferred to two or more people who are not all related individuals of the transferor, the exemption applies only to the interest acquired by the people who are related individuals of the transferor. For example, your mother transfers her principal residence jointly to you and your fiancé, but you are not living in

Form R-5 Virginia Department of Taxation Nonresident …

www.tax.virginia.govForm R-5 Virginia Department of Taxation Nonresident Real Property Owner Registration Do not complete if exemptions on Form R-5E apply If the property is disposed of by the non-resident payee, indicate the use of the property by the non-resident payee immediately prior to disposal: Primary Residence; Secondary Residence (Vacation Property, etc.) ;

DOCUMENTS ACCEPTABLE AS PROOF OF RESIDENCE Not …

www.macrobert.co.zaDOCUMENTS ACCEPTABLE AS PROOF OF RESIDENCE Not older than three months Utilities Account, e.g. rates, taxes, water etc. Telephone Account e.g Telkom Bank statement from a bank posted Retail accounts Affidavit from the individuals spouse or employer confirming the residential address Mortgage Statement Site visit by MacRobert Employee

96-1740 Texas Property Tax Exemptions

comptroller.texas.govResidence Homestead (Tax Code Section 11.13) Most residential exemption court cases concern the owner’s qualifications for the exemption; whether the exemption cov-ers specific improvements or amounts of land; or whether the property is the principal residence of the owner .

Assisted Living Facility COVID Related Deaths Statewide ...

www.health.ny.govELDERWOOD ASSISTED LIVING AT HAMBURG 240-S-117 Erie 0 1 0 FIELD OF DREAMS SENIOR LIVING 040-F-030 Cattaraugus 0 1 0 FIVE STAR PREMIER RESIDENCES OF YONKERS 800-F-992 Westchester 2 4 0 FIVE STAR PREMIER RESIDENCES OF YONKERS 800-S-143 Westchester 0 3 0 FREDONIA PLACE 060-S-003 Chautauqua 0 1 0 FREWSBURG …

INZ 1113 Employer Supplementary Form - Ezy Migrate

ezymigrate.co.nz– a Critical Purpose visitor visa either granted as a critical health worker, or granted for more than six months as an ‘other critical worker’. You must answer the questions below and attach evidence to show that you have made genuine attempts to recruit New Zealand citizens or residence class visa holders for the position.

Partnerships, Companies and Funds Certification of Tax ...

www.revenue.ieTax and Duty Manual Part 35-01-05 5 2 Certification of Tax Residence for Funds (in accordance with Sections 731, 738 and 739B of the Taxes Consolidation Act 1997)

Voter Registration and This form is for absent Uniformed ...

www.fvap.govstate of legal residence. For overseas citizens, it is usually the last place you lived before moving overseas. You do not need to have any current ties with this address. DO NOT write a PO Box # in section 2. • Most states allow you to provide a Driver’s License number or the last 4 digits of your SSN. New Mexico, Tennessee, and Virginia ...

SOUTHERN AFRICA LITIGATION CENTRE Applicant and

www.southernafricalitigationcentre.orgadmission into the Republic or a permanent residence permit. 5. Directing the Second Respondent to take such steps as are necessary to deport the Third Respondent to the Kingdom of the Netherlands without delay. 6. Condoning the late filing of this application in terms of section 9(2) of the Promotion of Administrative Justice Act No. 3 of 2000.

RETURNING UNDERGRADUATE STUDENT REGISTRATION …

www.uj.ac.zaregistered with access granted to the campuses and facilities. Accommodation in campus residences will be allowed. Students have until 31 March 2022 to comply with the conditional registration, i.e. to become fully vaccinated or risk having their studies cancelled. Un-vaccinated students will receive a conditional registration status.

Wisconsin Department of Safety and Professional Services

dsps.wi.govA temporary permit cannot be processed until all of those requirements are satisfied. ... State of primary residence: State(s) of current practice: / If you are on active military duty and/or work only in federal facilities, please check here. #2434 (Rev. 5/2021) Page 1 of 1 .

ARTICLE 7. MEANS OF EGRESS Sub-Article 1. General Egress ...

www1.nyc.govfrom the residence occupancy by ceilings having a fire resistive rating of at least one hour. (b). In case of failure to meet such conditions, a second means of egress shall be required. Such means may be a fire escape, and in the discretion of the superintendent such a fire escape may be located on the rear of the structure. (c).

2021 Form 1099-A

www.irs.govProperty means any real property (such as a personal residence), any intangible property, and tangible personal property that is held for investment or ... identification number (ATIN), or employer identification number (EIN)). However, ... taxable gain or ordinary income. Box 5.

APPLICATION FOR CERTIFICATE OF RESIDENCE IN JAPAN

www.nta.go.jpcorporation name and representative name ※日本語及び英語で記入してください。 を (電話番号 Telephone number: ) 租税条約上の特典を得る目的で、下記のとおり居住者証明書の交付 …

Assisted Living Facility Regulation

cga.ct.govAssisted Living Regulation Assisted living residences primarily serve adults age 55 and older who need some health or nursing care or assistance with activities of daily living, including dressing, eating, bathing, and transferring from a bed to a chair, but not the skilled care a nursing home provides. Connecticut does not

PLANILLA DE INFORMACION PERSONAL Y ECONOMICA …

asume.pr.gov(Include a certification if you are studying) 3 Salario mensual, quincenal, bisemanal, semanal- Incluya ... Préstamo Auto - Car loan Gastos de mantenimiento auto - (Car maintenance expenses) Estacionamiento - Parking ... (Principal Residence) Otras propiedades - (Other properties) 7. Vehículo de motor -Indique

Public Health (COVID-19 Self-Isolation) Order (No 4) 2021

legislation.nsw.gov.auThe basis for concluding that a situation has arisen that is, or is likely to be, a risk to ... of residence, or a place suitable for the household contact to reside, for a period of 7 days from when the household contact last had contact with the diagnosed person.

FORM ITR-6 2 0 2 1 - 2 2 - Income Tax Department

www.incometaxindia.gov.in[For Companies other than companies claiming exemption under section 11] (Please see rule 12 of the Income-tax Rules,1962) ... Directors, Secretary and Principal officer(s) who have held the office during the previous year and the details of ... S.No Name Address Country of residence PAN (if allotted) Taxpayer’s registration number or

Realtors Tax Deductions Worksheet - BOBBY'S BUSINESS …

www.bobbysbusinessservices.comThe basic local telephone service costs of the first telephone line provided in your residence are not deductible. However, toll calls from that line are deductible if the calls are business- related. The costs (basic fee and toll calls) of a second line in your home are also deductible if the line is used exclusively for business.

FORM NO. 10F Information to be ... - Income Tax Department

www.incometaxindia.gov.in(iv) Assessee's tax identification number in the country or specified territory of residence and if there is no such number, then, a unique number on the basis of which the person is identified by the Government of the country or the specified territory of …

Detached Garages - New York City

www1.nyc.govThis publication is a guide to provide a general overview of the requirements to legally construct a detached garage as an accessory to a private residence. There may be additional, applicable NYC Zoning Resolution and/or NYC Construction Code requirements.

10 Illegal and Legal Interview Questions

usm.maine.eduVerifying legal U.S. residence or work visa status. o. What languages do you speak, read or write fluently? _____ 8. Race or Skin Color Questions . Inappropriate to ask: o. What race are you? o. Are you a member of a minority group? Appropriate to ask: o. None . …

Guidance for COVID-19 Exposure Management in Institutes of ...

www.publichealth.lacounty.govcases among students or staff who were not on campus but live nearby in off-campus residences, reporting should be limited to students or staff who had interacted with other students or staff from the IHE within the 14 days prior to the illness onset date.

HOUSE ALLOTMENT RULES - Visakhapatnam Steel Plant

www.vizagsteel.comviii.'TEMPORARY TRANSFER OF AN EMPLOYEE' means a transfer of an employee which involves an absence for a period not exceeding four months. ix. 'TYPE' in relation to an employee means a class of residence which may be allotted to an employee in accordance with classification of houses notified by Estate Department. x.

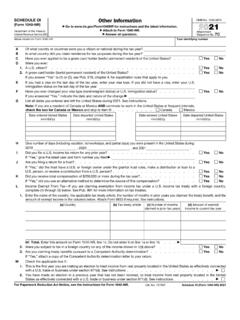

2021 Schedule OI (Form 1040-NR) - IRS tax forms

www.irs.govName shown on Form 1040-NR. Your identifying number. A . Of what country or countries were you a citizen or national during the tax year? B . In what country did you claim residence for tax purposes during the tax year? C . Have you ever applied to be a green card holder (lawful permanent resident) of the United States? . . . . . Yes. NoD ...

TRIENNIAL TENDER FOR THE APPOINTMENT OF A PANEL OF ...

www.etenders.gov.zaC1.1 Form of offer and acceptance C1.2 Contract data Part 1 – Data by the Employer Part 2 ... CLEARANCE FROM RELEVANT LOCAL AUTHORITY / PROOF OF RESIDENCE FROM A RELEVANT ... Technical enquiry cut-off date is 21 January 2022. Bids received by telegram, fax or e-mail will not be considered. ...

HMDA transactional coverage

files.consumerfinance.gov§ Principal residences § Apartment buildings § Mixed-use property if primary § Second homes; or complexes; use is residential § Vacation homes § Manufactured home § Properties for long-term § Manufactured Homes or; communities; housing and related services: other factory built homes § Condominium buildings (such as assisted living for ...

Family member of a qualifying British citizen - GOV.UK

assets.publishing.service.gov.ukexercised their free movement rights under EU law for more than 3 months elsewhere in the European Union (EU), the European Economic Area (EEA) or Switzerland (they may have been employed, self-employed, self-sufficient or a student, or had a right of permanent residence) immediately before returning to the UK with that family member.

W8-BEN-E Definitions - George Mason University

fiscal.gmu.eduGIIN means a Global Intermediary Identification Number assigned to a PFFI or Registered Deemed Compliant FFI. ... its jurisdiction of residence and it is a professional organization, business league, chamber of commerce, labor organization, agricultural or horticultural organization, civic league or an ... the ordinary course of such dealer’s ...

Residence Homestead Exemption Application

tx-johnson.publicaccessnow.com2. that I/the property owner meet(s) the qualifications under Texas law for the residence homestead exemption for which I am applying; and 3. that I/the property owner do(es) not claim an exemption on another residence homestead or claim a residence homestead exemption on a residence homestead outside Texas.

Residence, remittance basis etc notes - GOV.UK

assets.publishing.service.gov.ukResidence, remittance basis etc notes Tax year 6 April 2019 to 5 April 2020 (2019–20) basis etc. pages online you’ll need to purchase you’re your A Use these notes to help you fill in the Residence, remittance basis etc pages of your tax return If you want to submit the Residence, remittance software from a commercial supplier. A

RESIDENCE: RURAL and URBAN - Maine

www.maine.govCritical Access Hospital Program (Maine Rural Hospital Flexibility Program) This Federally-funded program, administered by the Maine Department of Human Services’ Bureaus ... (15 acute care beds and 10 swing beds for a total of 25 licensed beds). This program was created in 1997 by Congress to address the problem that many of our country’s

Similar queries

Residence, ORDINARY RESIDENCE: Guidance on the identification, Identification of the ordinary residence, People, Ordinary, Principal residence, Principal residence exemption, STATE OF LEGAL RESIDENCE CERTIFICATE, Last will and testament, Tax residence, Instructions, IRS tax forms, TEMPORARY, Permanent Residence, Permanent, Virginia, Place of residence, Affidavit, PHYSICAL PRESENCE OR RESIDENCE, PARENTAGE AND SUPPORT, Claim, Residences, Ministry of Finance Tax Bulletin, Exemption, Virginia Department of Taxation Nonresident, Virginia Department of Taxation Nonresident Real Property Owner Registration, PROOF OF RESIDENCE, Assisted Living Facility, Assisted Living, Living, Visa, Partnerships, Companies and Funds, Certification of Tax Residence for, Place, AFRICA, Republic, Permanent residence permit, Application, Campus residences, Wisconsin, General, Conditions, Identification, APPLICATION FOR CERTIFICATE OF RESIDENCE, Corporation, Assisted living residences, Certification, Auto, Basis, Principal, Realtors Tax Deductions Worksheet, New York City, Requirements, Garage, Illegal and Legal Interview Questions, Legal, Campus, HOUSE ALLOTMENT RULES, Name, Number, Year, Form, Enquiry, HMDA, Free movement rights, W8-BEN-E Definitions, Residence Homestead Exemption Application, Residence homestead exemption, Residence homestead, RESIDENCE: RURAL and URBAN, Maine, Critical Access Hospital, Hospital, Swing