Search results with tag "Estate tax"

2021 Form CT-706 NT Instructions Connecticut Estate Tax ...

portal.ct.govTherefore, Connecticut estate tax is due from a decedent’s estate if the Connecticut taxable estate is more than $7.1 million. The Connecticut taxable estate is the sum of: • The decedent’s gross estate, as valued for federal estate tax purposes, less allowable federal estate tax deductions, as determined under

A Guide to Kentucky Inheritance and Estate Taxes

revenue.ky.govEstate Tax Since January 1, 2005, there has been no Kentucky estate tax. The American Taxpayer Relief Act was signed into law on January 2, 2013 and permanently extends the deduction for state estate taxes on the Federal 706. Before 2005, a credit was allowed against the federal estate tax for state estate, inheritance, legacy, or succession taxes.

PENNSYLVANIA ESTATE TAX

www.revenue.pa.govEstate Tax Return, IRS Form 706, by eliminating the Federal Credit for State Death Taxes and replacing it with a deduction for death taxes actually paid to the states. As the Federal Credit for State Death Taxes was discontinued, there no longer is a basis for Pennsylvania estate tax. However, the estate tax provisions of

Form ET-30:1/20:Application for Release(s) of Estate Tax ...

www.tax.ny.gov2. The estate obtained an extension of time to file the estate tax return, and more than 15 months have passed since the date of death (the extension has expired). Use Form ET‑85, New York State Estate Tax Certification, if either of the following applies: 1. Delivery Services,The estate is not required to file a New York State estate tax

CT-706 NT Instructions, Connecticut Estate Tax Return (for ...

portal.ct.govEnter allowable estate tax deductions as computed for federal estate tax purposes (other than the deductions allowable for state death taxes under I.R.C. §2058) even if no federal estate tax return was required. Subject to federal rules, allowable deductions may include all or a part of:

Canadian Real Estate Tax Handbook - assets.kpmg

assets.kpmgWelcome to the 2017 edition of KPMG’s Canadian Real Estate Tax Handbook. This book is intended for tax, accounting and finance professionals and others with an interest in the Canadian income tax and GST/HST issues impacting the Canadian real estate industry. KPMG has prepared this tax handbook in order to provide the Canadian real estate ...

The Estate Tax: Ninety Years and Counting

www.irs.govsuccession tax—a tax on bequests of real estate—and an increase in legacy tax rates (Figure A). In ad-dition, the tax was applied to any transfers of real estate made during the decedent’s life for less than adequate consideration, except for wedding gifts, thus establishing the nation’s first gift tax. Transfers

NJ Form O-10-C -General Information - Inheritance and ...

www.state.nj.usalong with the New Jersey Estate Tax Return whether or not the estate is subject to Federal Estate Tax. For decedents dying on or after Jan. 1, 2018 There is no New Jersey Estate Tax imposed on the estates of resident decedents dying on or after Jan. 1, 2018. This provision does not affect the New Jersey Inheritance Tax, which remains in force.

10 income and estate tax planning strategies

www.putnam.comTen income and estate tax . planning strategies for 2018. Key tax facts for 2018. ... of states that are “decoupled” from the federal estate tax system. This means the state applies different tax rates or exemption amounts. A taxpayer may have net worth comfortably below the $11,200,000 exemption

Itemized Deductions - IRS tax forms

apps.irs.gov– Some real estate taxes or charges that may be included on the real estate tax bill are not deductible. These include taxes for local benefits and improvements that tend to increase the value of the prop-erty, itemized charges for services, transfer taxes, rent increases due to higher real estate taxes, and homeowners’ association fees.

Real Estate FAQs What is the real estate tax rate for 2019 ...

www.richmondgov.comReal Estate FAQs What is the due date of real estate taxes in the City of Richmond? Real estate taxes are due on January 14th and June 14th each year unless the dates fall on a weekend or holiday, in which case the taxes will be due on the next business day.

NJ Transfer Inheritance and Estate Tax

www.nj.govNEW JERSEY TRANSFER INHERITANCE TAX - ESTATE TAX GENERAL New Jersey has had a Transfer Inheritance Tax since 1892 when a 5% tax was imposed on property transferred from a decedent to a beneficiary. Currently, the law imposes a graduated Transfer Inheritance Tax ranging from 11% to 16% on the transfer of real and

Form ET-14:6/19:Estate Tax Power of Attorney:et14

www.tax.ny.govEstate Tax Power of Attorney ET-14 (6/19) Read the instructions before completing this form. Form ET-14 is for estate tax matters only. For all other tax matters, use Form POA-1, Power of Attorney. Filing this power of attorney (POA) does not automatically revoke any POAs previously filed with the New York State

Massachusetts Estate Tax - houlihanmuldoon.com

houlihanmuldoon.comMassachusetts Estate Tax Massachusetts “decoupled” its estate tax laws from the federal law effective January 1, 2003. For deaths occurring on or after January 1, 2006, if a decedent’s Massachusetts gross estate exceeds $1,000,000 (the

Kentucky Inheritance and Estate Tax Forms and Instructions

revenue.ky.govsary to file an Inheritance Tax Return with the Kentucky Department of Revenue (DOR). An Affidavit of Exemption will be accepted for the final settlement and closing of the administration of an estate. If inheritance tax or estate tax is due the Commonwealth of Kentucky, Form 92A200 or 92A205 should be used.

Instructions for Form 1041 - IRS tax forms

www.irs.govbasis reporting between an estate and a person acquiring property from an estate. Consistent basis reporting between estate and person acquiring proper-ty from a decedent. Section 2004 of Public Law 114-41 has two major requirements. 1. An executor of an estate (or other person) required to file an estate tax return after July 31, 2015, must ...

Transfer Inheritance And Estate Tax - New Jersey

www.state.nj.usINTRODUCTION NEW JERSEY TRANSFER INHERITANCE TAX - ESTATE TAX GENERAL New Jersey has had a Transfer Inheritance Tax since 1892 when a 5% tax was imposed on property transferred from a decedent

New York State Estate Tax Return Department of Taxation ...

www.tax.ny.govNew York State Estate Tax Return For an estate of an individual who died on or after January 1, 2019 ET-706 (9/19) If the decedent was a nonresident of New York State (NYS) on the date of death, mark an X in the box and attach ... 15 Total allowable federal deductions (from federal Form 706, page 3,

INTRODUCTION NEW JERSEY TRANSFER …

www.state.nj.usINTRODUCTION NEW JERSEY TRANSFER INHERITANCE TAX - ESTATE TAX GENERAL New Jersey has had a Transfer Inheritance Tax since 1892 when a 5% tax was imposed on property transferred from a decedent

2017 M706, Estate Tax Return

www.revenue.state.mn.us2017 Form M706, Estate Tax Return Forestates of a decedent whose date of death is in calendar year 2017. Check box if amended return . Decedent’s irst name, middle iniial

NYC-RPT / Real Property Transfer Tax Return

www.judicialtitle.comNEW YORK THE CITY OF NEW YORK ... CERTIFICATION Name of Attorney Telephone Number ... Name of Real Estate Tax Bill Recipient Address City State Zip Code IF YOUR MORTGAGE PAYMENTS INCLUDE YOUR REAL ESTATE TAXES, FILL IN THE NAME AND ADDRESS OF YOUR BANK/LENDER IN THE SPACE PROVIDED IN 9 BELOW. IF NOT, …

MARYLAND ESTATE TAX RETURN - forms.marylandtaxes.gov

forms.marylandtaxes.govCOM/RAD-101 18-49 Form MET 1 Rev. 07/18 USE THIS AREA FOR DATE STAMPS Revenue Administration Division P.O. Box 828 Annapolis, MD 21404-0828 MARYLAND ESTATE TAX RETURN

Petition for Certificate Releasing Liens PC-205B REV. 1/19 ...

www.ctprobate.govestate tax lien and/or the probate fee lienfor a decedent’s estate from the Probate Court before filing the estate tax return or payment of the probate fee. If there is more than one fiduciary, each co-fiduciary must sign the petition. 2) Include the address of the real property being sold, transferred or mortgaged for which a release of lien

2017 Estate Tax Return (M706) Instructions

www.revenue.state.mn.us1 2017 Estate Tax Form M706 Instructions Questions? You can find forms and information, includ-ing answers to frequently asked questions and options for paying electronically, on our

PRACTICE AND PROCEDURE BEFORE THE ... - Philadelphia …

www.philadelphiabar.org5. “Leave” to Transfer Securities 6. Award Subject to Unpaid Inheritance Tax 7. Reserve for Unpaid Federal Estate Tax 8. Exceptions and Appeals 9. Review of Adjudication D. Distribution 1. Schedule of Distribution 2. Notice and Consents 3. Re-appraisement of Securities 4. Unconverted Real Estate E. Review of Schedule of Distribution 1 ...

Form 4768 Application for Extension of ... - IRS tax forms

www.irs.govAddress of executor (number, street, and room or suite no.) Estate tax return due date City, state, and ZIP code Domicile of decedent (county, state, and ZIP code) Daytime telephone number of executor. Part II Extension of Time To File Form 706, 706-A, 706-NA, or 706-QDT (Section 6081) Form for which extension of time to file is being requested:

United States Estate (and Generation-Skipping Transfer ...

www.irs.govNote: By electing section 6166 installment payments, you may be required to provide security for estate tax deferred under section 6166 and interest in the form of a surety bond or a section 6324A lien. 3. 4

NJ Transfer Inheritance and Estate Tax

www.state.nj.usreturn of contributions or benefit payable by the Government of the United States pursuant to the Civil Service Retirement Act, Retired Serviceman’s Family Protection Plan and the Survivor Benefit Plan to a beneficiary or beneficiaries other than the estate or the executor or administrator of a decedent are exempt. 10.

Valuation Adjustment for Built-in Capital Gains in a C ...

www.willamette.comwww .willamette .com INSIGHTS • SUMMER 2012 25 Valuation Adjustment for Built-in Capital . Gains in a C Corporation. Robert P. Schweihs. Gift and Estate Tax Valuation Insights

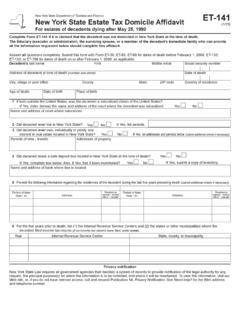

Form ET-141:1/15:New York Estate Tax Domicile Affidavit:et141

www.tax.ny.govComplete Form ET-141 if it is claimed that the decedent was not domiciled in New York State at the time of death. The fiduciary (executor or administrator), the surviving spouse, or a member of the decedent’s immediate family who can provide

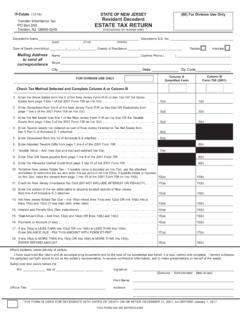

STATE OF NEW JERSEY (68) For Division Use Only Resident ...

www.state.nj.usNEW JERSEY INHERITANCE AND ESTATE TAX: RETURN PROCESSING INSTRUCTIONS Follow these procedures to avoid delays in processing returns, waivers, and

Form 706: A Detailed Look at the Schedules mhaven

www.mhaven.netClassification of Estate Tax Returns Rgnl. Svc. Ctr. mathematically verified . 1st classification for "audit worthiness" District Office Screened for

Determining the Discount for Lack of Marketability with ...

www.willamette.com32 INSIGHTS • WINTER 2017 www .willamette .com inTroducTion Business valuations prepared for gift and estate tax purposes usually involve the valuation of a privately . held company, which are nonmarketable (or, at

Estate, Inheritance, and Gift Taxes in CT and Other States

www.cga.ct.govConnecticut’s Gift and Estate Tax Estate Tax Basis Connecticut’s estate tax applies to both resident and nonresident estates valued at more than the taxable threshold; for 2020, that threshold is $5.1 million. The tax applies only to the value of the estate above the threshold. A resident estate is an estate of a decedent who was domiciled in

Estate Tax Waivers

www.tax.ny.govestate for estate tax purposes. For estate tax purposes, a decedent’s estate consists of all property in which the decedent had an interest, and includes property that is often excluded from the probate estate. Letters of appointment are legal documents issued by a court that has jurisdiction over the estate of the deceased individual.

ESTATE TAXES & PLANNING - Bergen County …

www.bergencountysurrogate.comNew Jersey Estate Tax IMPORTANT NOTE: According to the New Jersey Division of Taxation, “… the New Jersey Estate Tax exemption will increase from $675,000 to $2 million for the estates of resident decedents dying on or …

Estate Tax Filing Checklist - Wa

dor.wa.govEstate Tax Filing Checlist REV 85 0051 (07/30/21) Page 2 Common filing errors • The return and/or addendums are not signed by the executor. • Using the net estate rather than the gross estate to determine if the estate meets the filing threshold.

TAXATION BAR EXAM QUESTIONS ON ESTATE TAX

irp-cdn.multiscreensite.comThe tax return and the payment of the estate tax are both due within six (6) months from death. ... 1Section 85(B) Transfer in Contemplation of Death. - To the extent of any interest therein of which the decedent has at any time made a transfer, by trust or otherwise, in contemplation of or intended to take effect in possession or ...

TAXATION AT ATURITY CASH VALUE LIFE INSURANCE

www.themadisongroup.com2008 The Madison Group, Inc. page 2 of 3 How is this sum treated in terms of income tax and estate tax when received by a trust?2 If the policy is owned by an irrevocable trust, the trust is responsible for payment of the income tax.

Estate Planning - thelyongroup.net

www.thelyongroup.net1 . for Non. Overview The Federal gift and estate tax laws that apply to United States citizens are different from those for non-citizens (aliens).

Similar queries

Estate tax, Estate, Estate tax deductions, Kentucky, Kentucky estate tax, Connecticut Estate Tax Return for, Deductions, Federal Estate Tax, Income and estate tax planning strategies, Income and estate tax . planning strategies, Itemized Deductions, IRS tax forms, Real Estate FAQs, Estate Tax Power of Attorney, Power of attorney, Massachusetts Estate Tax - houlihanmuldoon.com, Massachusetts Estate Tax Massachusetts, Massachusetts, Transfer Inheritance And Estate Tax, NEW JERSEY, Inheritance Tax, INTRODUCTION NEW JERSEY TRANSFER, INTRODUCTION NEW JERSEY TRANSFER INHERITANCE TAX, Transfer Inheritance Tax, 2017 M706, Estate Tax Return, 2017, YORK, CERTIFICATION, State, Petition for Certificate Releasing Liens PC-205B, Estate tax lien, Lien, Estate Tax Return (M706) Instructions, M706 Instructions, PRACTICE AND PROCEDURE BEFORE THE, Philadelphia, Transfer, Real Estate, Form 4768, Inheritance, Return, United, Valuation Adjustment for Built-in Capital, Gift, ESTATE TAX: RETURN, Detailed Look at the Schedules, Determining the Discount for Lack of Marketability, Estate Tax Estate Tax, ESTATE TAXES & PLANNING, TAXATION AT ATURITY CASH VALUE LIFE, Estate Planning