Search results with tag "Purchase"

Driver Agreement template - taxi.vic.gov.au

taxi.vic.gov.au5.2 The Operator can nominate the places of purchase for items under clause 5.1. If the Operator nominates the place of purchase, then the Driver must purchase the items at the nominated places, unless the purchase is an emergency (for example, the engine’s oil light comes on and the nominated place of purchase is not near).

Government-wide Commercial Purchase Card Program - ed

www2.ed.govFederal agencies a new way to pay for commercial goods and services. II. Policy . It is the Department's policy to use the Purchase Card for the authorized purchase of goods and services in accordance with the requirements contained in this directive, the Federal Acquisition Regulation (FAR 48 CFR 1), Part 13, titled "Simplified Acquisition

CONTRACT DATA - GOV.UK

assets.publishing.service.gov.ukThe Purchase Order and any other documentation to which the Purchase Order refers. The language of this contract is English. The law of the contract is the law of England. The period for reply is 2 weeks. 3 Time The starting date is the date of the Purchase Order. The Supplier submits revised programmes at intervals no longer than 4 weeks

GENERAL TERMS AND CONDITIONS FOR THE PURCHASE OF …

terms.nordson.comThis Agreement expressly limits Seller’s acceptance to the terms of this Agreement. Fulfillment of this Purchase Order constitutes acceptance of these Terms. 2. Delivery of Goods and Performance of Services. ... Purchase Order or as otherwise agreed in writing by the parties ...

Procurement Policy - Harvard University

hcsra.sph.harvard.edu2. Purchases => $25,000: Before Harvard makes a purchase commitment, the purchaser must obtain a signed Debarment Certification Form or make sure debarment attestation language is included in a contract. The Debarment Form must be uploaded into HCOM. HCOM Approvers should review the debarment form prior to approving requisitions or payments.

Indiana Residential Real Estate Purchase Agreement

asapcashhomebuyers.comthe agreed upon Purchase Price. If the Property does not appraise to at least the amount of the Purchase Price, or if the appraisal discovers lender-required repairs, the Parties shall have ____ business days to re-negotiate this Agreement (“Negotiation Period”). In

Sage 300 2021 Purchase Orders User's Guide

cdn.na.sage.comAug 25, 2020 · Learn how to find and use Sage 300 screens. Each screen guide includes navigation information, field help, and a list of tasks you can use the screen to perform. l Appendix B: Purchase Orders Security Authorizations If security is turned on for your Sage 300 system, the system administrator must assign these

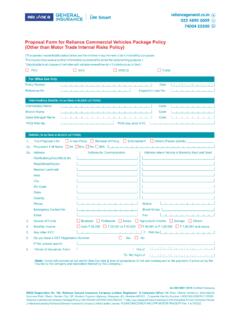

Proposal Form for Reliance Commercial Vehicles Package ...

www.reliancegeneral.co.inDetails of Hire Purchase / Hypothecation / Lease 44. Please state if the vehicle is under Hire purchase Lease Agreement Hypothecation Agreement If so, give name and address of concerned parties. 45. Full Name M/s 46. Address

How to Use Your EBT Card to Purchase Food

www.cdss.ca.govwith your new EBT food and cash balance. You cannot be charged a fee to use your EBT food benefits and you cannot get cash or change back from your EBT food benefit account. How to Use Your EBT Card to Make a Cash Purchase (if you get cash benefits) Each type of POS device might be different. Don’t be afraid to ask the clerk for help.

Your Purchase Supports Youth Marksmanship PURCHASER …

thecmp.orgDec 15, 2021 · Completed order forms and payment should be mailed to: CMP Sales Dept, 1401 Commerce Blvd, Anniston, AL 36207. Your check will be deposited when the order is received. All orders shipped via FedEx, adult signature required. Please allow 30 days for delivery, unless otherwise specified for the item . ordered. Prices subject to change without notice.

Government Contracting 101 - Small Business Administration

www.sba.govNov 29, 2011 · Government Purchase Card or credit card, without the involvement of a procurement officer. It is important to note, about 70 percent of all government procurement transactions are for micro-purchases under$3,000 and are facilitated with a credit card. In fiscal year 2010, this represented over

FORM 20 [See Rule 47 and Rule 53A] APPLICATION FOR ...

parivahan.gov.inThe motor vehicle above described is – (i) Subject to Hire-purchase agreement/lease agreement with (ii) Subject to Hypothecation in favour of (iii)Not held under Hire-purchase agreement, or lease agreement or subject to Hypothecation. Strike out whatever is inapplicable. If the vehicle is subject to any such agreement the signature of the

Combined Income and Purchase Price Limits Table

thetexashomebuyerprogram.comCombined Income and Purchase Price Limits Table Effective March 30, 2022 My FIRST and Texas MCC considers the income of all person(s) who will sign the Deed of Trust (including Non-Purchasing Spouse).

OFFER TO PURCHASE REAL ESTATE - The Law Office of …

www.thebestclosings.comStandard Form Purchase and Sale Agreement, which, when executed, shall be the agreement between the parties hereto. 4. A good and sufficient Deed, conveying a good and clear record and marketable title shall be delivered at _____ (Time), on _____ (Closing Date) at, at the

APPLICATION TO PURCHASE A FIREARM Pursuant to C.G.S.

portal.ct.govAPPLICATION TO PURCHASE A FIREARM ... C.G.S. §§ 29-33 and 29-37a WEAPON TYPE: HANDGUN LONG GUN OTHER SALE AUTHORIZATION NUMBER(S) Name: (Last, First, Middle) Date of Birth: (MM/DD/YYYY) Address: Include number, street, town, state and ... Are you the subject of an active restraining or protective order issued by a court, after notice and …

Role of Derivatives in Carbon Markets

www.isda.org(ii) entities in compliance and voluntary markets that purchase carbon credits generated by emissions reduction projects. Depending on the structure of an ETS, allowances can either be allocated to polluters for free or purchased at an auction. Secondary markets include all subsequent trading of emission allowances and offset credits. Market

DELAWARE CNA RECERTIFICATION/ RENEWAL PROCESS

www.dhss.delaware.govOnce your purchase is complete, go to the ‘My Courses’ tab and select your courses. You will see your courses listed as below. You can begin your lessons by selecting one course at a time. Each course requires you to complete a post-test. Remember you are required to complete 24-hours of learning in order to qualify for renewal/recertification.

Request for Quotation

download.acbar.orgNote: The selected vendor bid security will be kept till end of the Blanket Purchase Agreement (BPA) Vendors who do not meet the above minimum eligibility requirements, WILL NOT BE CONSIDERED for further evaluation. III. Evaluation Criteria Final selection of eligible vendors will be based on Lowest Price/Technically Acceptable (LPTA).

January 31-February 6, 2022

www.baylor.eduCanyon, UT! These trips will be a multiday backcountry experience, complete with camping, hiking, and one-of-a-kind views. Cost is $550 which ... A panel of student and Waco service leaders will be speaking on the ... available for purchase. Sponsored by the Bears Quidditch Association. For more information, ...

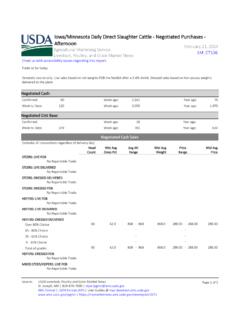

Iowa/Minnesota Daily Direct Slaughter Cattle - Negotiated ...

www.ams.usda.govIowa/Minnesota Daily Direct Slaughter Cattle - Negotiated Purchases - Afternoon Agricultural Marketing Service Livestock, Poultry, and Grain Market News LM_CT136 February 23, 2022 Email us with accessibility issues regarding this report. Total all grades 818 63.5 1,350 - 1,500 1,357.0 144.00 - 144.00 144.00

TRANSFORMER OIL PURCHASE SPECIFICATIONS

www.doble.comoxidation inhibitors for use in oils meeting this specification. Passivators have also been used to improve the oxidation stability of oils. If such compounds are added in any concentration, Type II limits will be applied to oxidation stability data. k Sludge-Free Life (SFL): The oil is sampled and tested for sludge precipitation every 8 hours

U.S. Equity Funds - Wells Fargo Asset Management

www.allspringglobal.comCommon Stock Fund ... Frequent Purchases and Redemptions of Fund Shares ... by the Federal Deposit Insurance Corporation or any other governmental agency, and is primarily subject to the risks briefly summarized below. Market Risk. The values of, and/or the income generated by, securities held by the Fund may decline due to ...

Year-End Report 2021

group.vattenfall.com• Agreement on sale of 49.5% of offshore wind farm Hollandse Kust Zuid in the Netherlands • Sale of Stromnetz Berlin completed on July 1. The purchase price totalled EUR 2.1 billion • Inauguration of Scandinavia's largest wind farm, Kriegers Flak in Denmark, and final investment decision for the Vesterhav Syd and Nord wind farms

Improper Evidence of Ownership Procedure - State

www.state.nj.uspurchase price of the vehicleis also re quired to be submitted to this office. There will be a $25 penalty fee, in addition to the title fee, if the vehicle is not titled within 10 days of the date of saleonly if the original state of record is New Jersey. One check or money order may be submitted for title and sales tax fees.

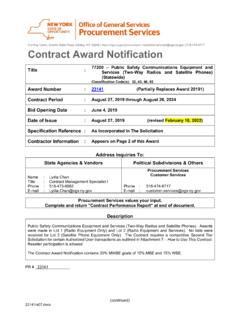

Contract Award Notification - Government of New York

online.ogs.ny.govClassification Code(s): 32, 43, 46, 92 . Award Number : 23141 (Partially Replaces Award 20191) ... Description . Public Safety Communications Equipment and Services (TwoWay Radios and Satellite Phones)- . Awards ... contracts at the time of purchase was the most practical and economical alternative and was in the best interests of the State).

Massachusetts Investors Trust - MFS

www.mfs.comFact Sheet Massachusetts Investors Trust Q4 | 2021 As of December 31, 2021 ... (lesser of purchases or sales)/average market value. Portfolio characteristics are based on equivalent exposure, which measures how a portfolio's value would change due to price changes in an asset held either directly or, in the case of a derivative contract ...

LDSS-4942 NYSOTDA SUPPLEMENTAL NUTRITION …

otda.ny.govAllowing someone else to use your electronic benefit transfer (EBT) card in exchange for cash, firearms, ammunition, explosives, or drugs or to purchase food for individuals who are not members of the SNAP household. Note: Both the applicant and/or authorized representative are subject to the above penalties.

HOTLINE - Michigan REALTORS®

www.mirealtors.comI represent buyers who terminated a purchase contract a˛er discovering black mold in the house. I now have another interested buyer who would like to make an o˜er on the same home. ˚e listing agent said that I cannot tell my buyer about the prior buyers’ discovery of mold because I obtained that information during a prior agency relationship.

Sugar Changed The World: A Story of Magic, Spice, Slavery ...

www.achs.netThe Sugar Purchase and the Death State: 1. Why did Napoleon sell the Louisiana Territory to the United States? 2. Bubble Map: Describe life as a slave in Louisiana? 3. What effect did the introduction of machines have? Sugar in Paradise: “I came seeking the dream”: 1. What groups of people were brought to Hawaii to produce sugar? 2.

GSA Schedule Order: Contract File Checklist

www.gsa.govSchedule” or “GSA Schedule” contracts) and the establishment of Blanket Purchase Agreements (BPAs) against GSA FSS contracts. Note 1: Additional Agency level and/or local requirements may apply and should be followed in addition to the items identified below. Note 2: All items listed below will not apply to every order. This checklist ...

MICRO-PURCHASE NATIONAL DEFENSE AUTHORIZATION …

basesupply.comservice that uses covered telecommunications equipment or services. The Offeror shall provide the additional disclosure information required at paragraph (e)(2) of this section if the Offeror responds “does” in paragraph (d)(2) of this section. Signature of Merchant Owner or Designated Representative Date 2. Return this document to the sender.

Title 35 Mississippi State Tax Commission

www.dor.ms.govThe direct pay permit holder is responsible for accruing and paying the applicable sales and use tax on purchases of tangible personal property, utilities and services, as well as sales of tangible personal property that become a component of the structure or construction activities taxed under Miss. Code Ann. Section 2765-18. This section -

Motorcarrier MN IRP License Manual - Minnesota

dps.mn.govapplicable title fees (if vehicle is a new purchase) • Proof of the previous registration if registered in another jurisdiction • Proof of payment of HVUT • Lease agreement (if applicable) After the application is approved, an account number will be assigned. •Please retain account number for future use as it is used as a unique

What is insurance? - Consumer Financial Protection Bureau

files.consumerfinance.govBUILDING BLOCKS STUDENT HANDOUT. What is insurance? Insurance is a way to manage your risk. When you buy insurance, you purchase protection against unexpected financial losses. The insurance company pays you or someone you choose if something bad happens to you. If you have no insurance and an accident happens, you may be responsible for all

Chapter 3. The VA Loan and Guaranty Overview

www.benefits.va.gov• the lenders needs in terms of secondary market requirements. 3 of this chapter Downpayment No downpayment is required by VA unless the purchase price exceeds the reasonable value of the property, or the loan is a Graduated Payment Mortgage (GPM). The lender may require a downpayment if necessary to meet secondary market requirements. 3 of this

LEAD-BASED PAINT AND LEAD-BASED PAINT HAZARDS …

xenon.stanford.edupurchase contract, to conduct a risk assessment or inspection for the presence of lead-based paint and/or lead-based paint hazards; OR, (if checked) 1519 Sunshadow Lane SAN JOSE, CA 95127 July 2, 2014 House of Homes Realty Edwin Su 7/30/2014

Supply Chain Management: Contract

www2.unb.caSupply Chain Contracts are agreement between buyer and supplier on issues like Pricing and volume discounts. Minimum and maximum purchase quantities. Delivery lead times. Product or material quality. Product return polices. We will use the Newsboy model to address the supply chain contract. Earlier we model the Newsboy problem as a cost ...

Provincial Sales Tax (PST) Bulletin - British Columbia

www2.gov.bc.caGoods do not Remain Available for Sale – Taxable . If the goods being used for demonstration or display purposes do not remain available for sale, you must: pay PST when you purchase these goods, or self-assess the PST due based on the change in use rules (if you are removing these goods from your exempt resale inventory) . Example 4

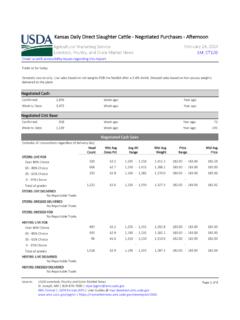

Kansas Daily Direct Slaughter Cattle - Negotiated ...

www.ams.usda.govKansas Daily Direct Slaughter Cattle - Negotiated Purchases - Afternoon Agricultural Marketing Service Livestock, Poultry, and Grain Market News LM_CT120 March 04, 2022 Email us with accessibility issues regarding this report.

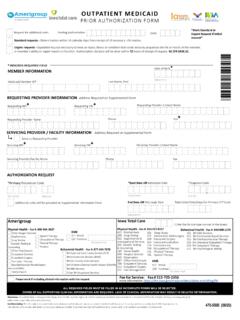

Outpatient Medicaid - PA Form - Iowa Total Care

www.iowatotalcare.com120 Purchase . Behavioral Health - Fax #: 877-434-7578. BH Asserive Community Service (ACT) ... Services must be a covered Health Plan Beneit and medically necessary with prior authorization as per Plan policy and procedures. ... outpatient medicaid, prior authorization form, member, servicing provider, facility information, authorization ...

Purchase Money Mortgages, Purchase Money Security ...

www.irs.gova motor vehicle, or other consumer goods or property? When a loan is made to purchase real property, the lender may obtain a Purchase Money Mortgage (PMM); when a loan is made to purchase personal property, the lender may obtain a Purchase Money Security Interest (PMSI). Provided all requirements of state law are complied with, these types of ...

Purchase Order Process Flowchart

images.template.netSigns/Approves purchase Order Process Decision Start/End Symbol Description Legend Purchase Order Purchase Order Process Flowchart Color Legend Purchasing Department Department Receives goods/services from Vendor Signs and dates a PO copy Attaches packing slip (if applicable) indicating that the order has been received and sends to Purchasing ...

Purchase Protection Plan Documents - American Express

www.americanexpress.comJan 01, 2020 · Purchase Protection Coverage Period as described below. Benefits are providedfor Replacement Cost up to the lesser of the Eligible Payment or the per item and calendar year maximums as described below. Benefits also includes a per occurrence maximum for any one Purchase Protection Covered Event related to a Natural Disaster as …

PURCHASE PRICE ALLOCATION IN REAL ... - Womble Bond …

www.womblebonddickinson.comOct 15, 2019 · 5 See Michael Allen, Price Allocation, Gain Tax Benefits by Allocating Price Before Closing Sale of Business, PRACTICAL TAX STRATEGIES, Aug. 25, 2008. 6 See AI Handbook, p. 101-107. 7 APPRAISAL INSTITUTE, DICTIONARY OF REAL ESTATE APPRAISAL 25 (5th ed. 2010). 8 APPRAISAL INSTITUTE, APPRAISAL OF REAL ESTATE 29 (13 th ed. 2008).

Similar queries

Driver Agreement template, Purchase, Government-wide Commercial Purchase Card, Goods, Purchase Order, Limits, Harvard, Requisitions, Residential, Purchase agreement, Agreement, Sage, Purchase Orders, Hire Purchase, Hypothecation, Lease, Hire purchase Lease, Your EBT Card to Purchase Food, Food, Food benefits, Benefits, Order, Small Business Administration, Motor vehicle, Hire, Vehicle, Income, Purchase Price Limits, PURCHASE REAL ESTATE, Number, Secondary, Market, DELAWARE, PROCESS, Blanket Purchase Agreement BPA, Experience, Student, Negotiated, Negotiated Purchases, Agricultural Marketing Service, TRANSFORMER OIL PURCHASE SPECIFICATIONS, Oxidation, Oxidation stability, Stock, Purchases, Redemptions, Corporation, Sale, State, PURCHASE PRICE, Classification Code, Description, Massachusetts Investors Trust, Fact Sheet Massachusetts Investors Trust, Asset, Your, Card, To purchase food, Authorized representative, The Louisiana, Louisiana, Schedule Order: Contract File Checklist, Purchase Agreements, MICRO-PURCHASE NATIONAL DEFENSE AUTHORIZATION, Service, Sales, Minnesota, Insurance, Consumer Financial Protection Bureau, BUILDING, Secondary market, Lead, Based paint, Contracts, Outpatient Medicaid - PA Form, Plan, Medicaid, Purchase Order Process, Purchase Protection Plan Documents, American Express, Protection, Eligible, Price

![FORM 20 [See Rule 47 and Rule 53A] APPLICATION FOR ...](/cache/preview/6/5/9/e/4/6/b/5/thumb-659e46b5af737051bea08701b40bd50c.jpg)