Search results with tag "Deferred"

Petition for Order of Nondisclosure

www.txcourts.govplaced Petitioner on deferred adjudication community supervision pursuant to Texas . Code of Criminal Procedure, article 42.12, Section 5(a). A copy of this Court’s “Order of . Deferred Adjudication” ____ attached to this Petition. The term of Petitioner’s period of (8) deferred adjudication began on _____ and ended on

What are Deferred Submittals? - MyBuildingPermit

mybuildingpermit.comdesign professional is required, shall list the deferred submittals on the construction documents for review by the building official. C. Generally, if an element has not been reviewed and approved under the original permit, it is required to be submitted as a deferred submittal to the City for review and approval.

457(b) Deferred Compensation - Voya Financial Login

voyacustom.voya.comA 457(b) deferred compensation plan sponsored by a governmental entity (which would include a public school) is “portable.” This means that if you go to work for another employer, you may be able to roll over your account balance to your new employer’s eligible retirement plan, such as a governmental 457(b), 403(b), or

Go to www.irs.gov/Form1040 - IRS tax forms

www.irs.govIncome you received from a nonqualified deferred compensation plan that fails to meet the requirements of section 409A . . . 17h i . Compensation you received from a nonqualified deferred compensation plan described in section 457A . . . . . . . 17i. j

Criminal History Questionnaire - Texas Department of ...

www.tdlr.texas.gov15. SENTENCE OR ACTION IMPOSED BY THE COURT – (ex: six months in Travis County Jail, deferred adjudication, probation, etc.) 16. RENEWALS – If you are renewing your license, did the conviction or deferred adjudication you described in item 11 occur since your license was last issued? Place a check in the box for No or Yes. 17.

TAX REPORTING FOR DISTRIBUTIONS FROM NQDC PLANS

www.lockton.comnonqualified deferred compensation plan are normally earned in prior years, these amounts should be included in Box 11. Tax reporting for distributions from nonqualified deferred compensation plans depends on the employment status of the plan participant. Tax information for employees is reported using Form W-2, while tax information for

ROLLOVER IN - Deferred Compensation

www.ohio457.orgInvestment Option % of Funds Ohio DC Stable Value Option 100% l I elect to execute a rollover of the market value of the account named above to an account administered by the Ohio Deferred Compensation Program (Ohio DC), an IRC 457 plan, and agree to follow the rollover rules of both plans.

BENEFICIARY FORM - Deferred Compensation

www.ohio457.org9. The execution of this form and acceptance by Ohio DC revokes all prior designations that you have made. 10. If you have any questions, please contact our Service Center at 877-644-6457 or visit Ohio457.org. Return form to: Ohio Deferred Compensation 257 East Town Street, Suite 457 Columbus, Ohio 43215-4626 Fax: 614-222-9457. OHIO-0781-0620 ...

1. How will the global minimum tax rules ensure that MNEs ...

www.oecd.orgdifferences. MNEs already use deferred tax accounting principles to track differences between financial accounting and local tax in the timing in the recognition of income and expenses. The GloBE rules leverage these deferred tax accounting …

LEOFF Plan 2 Retirement Know -how - Wa

leoff.wa.govLEOFF Plan 2 Retirement Know -how 1 . ... o Deferred Compensation or other deferred savings programs o Retirement application process o Insurance coverage for medical, life and long-term care ... You also have the option of watching a retirement planning seminar online.

Accounting for Deferred Tax Assets, 9/29/00

faculty.babson.eduDeferred Tax Asset Valuation Allowance account as a major source of the Company’s increased earnings. Specifically, LENS eliminated its tax valuation allowance account in the June 2000 quarter, adding $6 million to net income and thereby increasing fiscal 2000 earnings per share by $0.25 – to $0.81 from

Restoration of Firearm Rights Application

www.tdcj.texas.govThe applicant will be notified in writing upon final action. ... IF convicted and the sentence is probated or deferred, furnish the Complaint/Indictment or Information, Judgment, Sentence and Dismissal. ... I understand that compliance with these requirements is sufficient for the Board's consideration of this application, but compliance does ...

Tier 6 Basic Plan Fact Sheet NYCERS ˙ ˙ˆ˙˜ ˝ ˚ ˙ˆ

www.nycers.orgcompensation is compensation paid at a rate greater than the standard rate. The definition of wages excludes: 1. Wages in excess of the annual salary paid to the Governor of the State of New York ($250,000 for 2021); 2. Lump sum payments for deferred compensation, sick leave, accumulated vacation or other credits for time not worked; 3.

Deferre Compensation NJSEDCP - State

www.state.nj.usTax Consequences The NJSEDCP is an eligible deferred compensation plan under IRC Section 457. Distributions from the Plan may be eligible for rollover; however, they do not qualify for special five-year or 10-year averaging. Distributions are defined as pension payments and are subject to federal income tax, unless rolled over

Horizons 2030 Target Date Fund - docs.retirementpartner.com

docs.retirementpartner.comCOUNTY OF LOS ANGELES Deferred Compensation and Thrift Plan & 401(k) Savings Plan 1 The Inception Date listed is the date the fund was initially offered. 2 The portfolio operating expenses reflect the most current data available at the time of production, which may differ from the data previously provided. The portfolio operating expenses

Horizons Stable Income Fund*

docs.retirementpartner.comCOUNTY OF LOS ANGELES Deferred Compensation and Thrift Plan & 401(k) Savings Plan 1 The Inception Date listed is the date the fund was initially offered. 2 The portfolio operating expenses reflect the most current data available at the time of production, which may differ from the data previously provided. The portfolio operating

Fidelity® Personalized Planning & Advice at Work Terms …

nb.fidelity.comuse a stable value fund in constructing model portfolios. Please see “Methods of ... Advisers for your workplace savings plan account or assetized nonqualified deferred compensation account (“Plan Account,” and the managed portion referred to herein as ... emergency fund, financial situation, investment knowledge, investment experience ...

Ohio DC Stable Value Option - Deferred Compensation

www.ohio457.orgU.S. Agencies (for example, Fannie Mae or Freddie Mac) or by other non-Agency entities such as banks. U.S. Treasury: Debt issued by the U.S. Treasury. Wrap Exposure: Indicates the net difference between book value and market value wrap contracts or the effective potential credit exposure of the Option to the wrap issuers.

Colorado Wage Act § 8-4-101, et seq., C.R.S.

cdle.colorado.govpension plan, or other similar deferred compensation programs. (4) Every employer shall at least monthly, or at the time of each payment of wages or compensation, furnish to each employee an itemized pay statement in writing showing the following: (a) Gross wages earned;

Inventories

www.mca.gov.in18 An entity may purchase inventories on deferred settlement terms. When the arrangement effectively contains a financing element, that element, for example a difference between the purchase price for normal credit terms and the amount paid, is recognised as interest expense over the period of the financing.

Application For

forms.fdacs.gov• are currently in a Pre-Trial Intervention or Deferred Prosecution Program [Section 493.6118(3), F.S. Rule 5N- 1.114, Florida Administrative Code]. You must provide complete information about your arrest(s) and include certified copies of court

Types of Coverage Exemptions - IRS tax forms

apps.irs.govFor this purpose, an immigrant with Deferred Action for Childhood Arrivals (DACA) status is not considered lawfully present and therefore qualifies for this exemption. For more information about who is treated as lawfully present in the U.S. for purposes of this coverage exemption, visit

Relief and Guidance on Corrections of Certain Failures of ...

www.irs.govInformation and Reporting Requirements . A. Information Required with Respect to Correction of an Operational Failure in the Same Taxable Year as the Failure Occurs . ... respect to certain failures of a nonqualified deferred compensation plan to comply with § 409A(a) in operation (an operational failure), including: ...

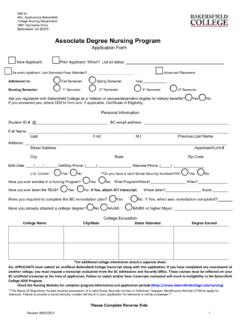

Associate Degree Nursing Program - do-prod-webteam ...

do-prod-webteam-drupalfiles.s3-us-west-2.amazonaws.comDo you meet requirements under the DACA (Deferred Action for Childhood Arrivals? Yes . No . Were you a part of the Umoja Community ASTEP program? Yes. No . Are you a registered DSPS student (Disabled Students Programs & Services) with BC? Yes . No . If you are a registered DSPS student with BC, mark all accommodations you are entitled to receive:

Winter 2022 Retirement Outlook

www.drs.wa.govEarly retirement March 16 Upcoming live webinars See more webinars at drs.wa.gov/webinars Deferred Compensation Program DCP makes saving for retirement easy. Find out about flexible contributions, tax benefits and withdrawal options. Nearing Retirement Retiring in the next few years? Half-day retirement seminars are currently being offered online.

Tax-Deferred 403(b) Plan Summary Plan Description

ucnet.universityofcalifornia.eduare eligible to participate in the 403(b) Plan. An employee begins participation when contributions are made to the 403(b) Plan on the employee’s behalf. An employee or former employee continues participation until all funds held on the employee’s behalf are distributed. The provisions of the Plan are subject to collective bargaining for

SECTION 29 DEFERRED TAX - South African Institute of ...

www.saipa.co.zawould no longer be an obligation to deliver a service to the tenant or return the money. Carrying amount at end of 2015: R16 000 Carrying amount at end of 2016: R0 B The income received in advance is a liability for the company at the end of 2015. In the case of

contracts, accounts, and annuities. DEPARTMENT OF THE ...

public-inspection.federalregister.govand (b)(3) for individual retirement accounts and individual retirement annuities (collectively, IRAs), section 408A(c)(5) for Roth IRAs, section 403(b)(10) for annuity contracts, custodial accounts, and retirement income accounts described in section 403(b) (section 403(b) plans), and section 457(d) for eligible deferred compensation plans.

OHIO DEFERRED COMPENSATION PROGRAM (Ohio DC)

www.ohio457.orgthe court) domestic relations order is a qualified domestic relations order is being determined, the Plan Administrator shall separately account for the amounts which would have been payable to the alternate payee during such period if the order had been determined to be a qualified domestic relations order .

Ohio DC International Stock - Deferred Compensation

www.ohio457.org1 Year 3 Year 5 Year 10 Year Morningstar Rating™ . . . . Fund Rank Percentile 96 . . . Out of # of Investments 327 . . . Portfolio Analysis Composition as of 12-31-21 % Assets U.S. Stocks 5.20 Non-U.S. Stocks 91.78 Bonds 0.00 Cash 2.90 Other 0.11 Morningstar Equity Style Box™ as of 12-31-21 % Mkt Cap Large Mid Small Size Value Blend Growth ...

Horizons Mid Cap Equity Fund

docs.retirementpartner.comCOUNTY OF LOS ANGELES Deferred Compensation and Thrift Plan & 401(k) Savings Plan 1 Equity securities of medium-sized companies may be more volatile than securities of larger, more established companies. 2 The Inception Date listed is the date the fund was initially offered.

U.S. ARMY NAF EMPLOYEE RETIREMENT PLAN

www.armymwr.comDeferred Annuity 10 Disability Annuity 10 ... Retirement Plan who accept appropriated fund employment within one year ... option, your spouse will receive a retirement benefit for the rest of his or her life! If you get a refund, you lose these benefits. Note: If you are married for longer than one year and have more than 5 years ...

SPECIFICATIONS FOR REPORTING W-2 INFORMATION VIA ...

www.state.nj.usand NJ-W-3 reporting requirements see the New Jersey Income Tax Withholding Instructions (NJ-WT) or call the Division of Taxation Customer Service Center at (609) 292-6400. ... Deferred Compensation Amount : Blank Blank Blank . 1 1 : 9 . 39 . 75 . 25 “P” Only if employee was an active participant (for any part of the

Title 27: Personnel Part 220: PERS, Deferred Compensation ...

www.pers.ms.govJan 01, 2021 · income for the calendar year but for a compensation reduction election under Code Sections 125, 132(f), 401(k), 403(b) or 457(b) (including an election to defer compensation under Article IV). For purposes of an Independent Contractor, "Compensation" shall mean all amounts payable to a Participant from the Employer as

2021 W2 Instructions - ssc.jhmi.edu

ssc.jhmi.educompensation or nongovernmental section 457(b) plan, or (b) included in box 3 and/or box 5 if it is a prior year ... ($13,500 if you only have SIMPLE plans; $22,500 for section 403(b) plans if you qualify for the 15-year rule explained in Pub. 571). Deferrals under code G are limited to $19,500. ... Z—Income under a nonqualified deferred ...

Do you have to file? Any EIC that is more than your tax ...

rsishifts.comaccount that is part of a section 401(k) arrangement. E—Elective deferrals under a section 403(b) salary reduction agreement. F—Elective deferrals under a section 408(k)(6) salary reduction SEP G—Elective deferrals and employer contributions (including nonelective deferrals) to a section 457(b) deferred compensation plan

Financial Overview FISCAL YEAR 2023

governor.delaware.govJan 27, 2022 · $500 Bonus for State Retirees Moving toward $15 Minimum Wage Investing in our State Workforce COMPENSATION AND PAY EQUITY $88.7 MILLION. Highlights: Governor Carney’s FY 2023 Capital Budget}} 26 ... deferred maintenance $10.5 million - Carvel State Office Building renovations

Condominium Project Questionnaire Addendum

sf.freddiemac.commeeting minutes to document findings and action plan. 3 Is the HOA/Cooperative Corporation aware of any deficiencies related to the safety, soundness, structural integrity, or habitability of the ... Does the project have a schedule for the deferred maintenance components/items to be repaired or replaced? Yes No If Yes, provide the schedule. 8

Horizons Large Cap Equity Fund - docs.retirementpartner.com

docs.retirementpartner.comCOUNTY OF LOS ANGELES Deferred Compensation and Thrift Plan & 401(k) Savings Plan 1 The Inception Date listed is the date the fund was initially offered. 2 The portfolio operating expenses reflect the most current data available at the time of production, which may differ from the data previously provided. The portfolio operating

VI-87 - Vehicle Inspection Operations & Training Manual ...

www.dps.texas.gov1.5.1 PROCEDURE FOR APPOINTMENT AS AN OFFICIAL VEHICLE INSPECTION STATION . ... adjudication of guilt or an order of deferred adjudication for the offense is entered against the person by a court of ... Texas Code of Criminal Procedures, Article 42.12 (3g) or 62.001 (Sexually Violent Offense).

Deferred Compensation Plan (457 Plan)

www.nypa.govDeferred Compensation Plan (457 Plan) The need to save for a more secure tomorrow is clear. Financial planners estimate that you will need about 70% of what you are making before you retire to maintain your standard of living in retirement. The Deferred Compensation Plan provides tax advantages to help you save for your future.

Deferred Fixed Annuities - Fidelity Investments

www.fidelity.comDeferred Fixed Annuities Guaranteed rate of return with tax-deferred savings How can I reduce risk to my overall portfolio? Having a well-diversified investment portfolio can help you weather the ups and downs of the market—especially over the long term. But the fact is that market volatility can be unsettling.

Similar queries

Petition for Order of Nondisclosure, Deferred adjudication, Code of Criminal Procedure, Deferred, Under, 457(b) deferred compensation, IRS tax forms, Nonqualified deferred, Action, Reporting, Deferred compensation, Option, Deferred Compensation Program, Rules, BENEFICIARY FORM, Form, 4626, DEFERRED TAX, Recognition, Plan, Retirement, For Deferred Tax, Consideration, NYCERS, Compensation, New York, State, OF LOS ANGELES Deferred Compensation and Thrift, LOS ANGELES Deferred Compensation and Thrift Plan, Personalized Planning & Advice at Work, Stable value fund, Fund, Fannie Mae, Code, Deferred Action for Childhood, Exemption, Deferred Action, Tax-Deferred 403(b) Plan Summary Plan Description, Employee, Service, Annuities, Domestic relations, Qualified domestic relations, Retirement Plan, Part 220: PERS, Deferred Compensation, Reduction, Section 457, Plans, Section, Bonus, PROCEDURE, Adjudication, Code of Criminal, Deferred Fixed Annuities, Fidelity Investments