Search results with tag "Fidelity investments"

Fund/Ticker - Fidelity Investments

www.fidelity.comwww.fidelity.com Phone Fidelity Automated Service Telephone (FAST®) 1-800-544-5555 To reach a Fidelity representative 1-800-544-6666 Mail Additional purchases: Redemptions: Fidelity Investments P.O. Box 770001 Cincinnati, OH 45277-0003 Fidelity Investments P.O. Box 770001 Cincinnati, OH 45277-0035 TDD - Service for the Deaf and Hearing Impaired

Automatic Withdrawal Terms and ... - Fidelity Investments

personal.fidelity.comA. Direct deposit into your non-retirement Fidelity Brokerage or Fidelity Mutual Fund only account. (If you do not have a Fidelity non-retirement account, one can be established today at . Fidelity.com, or call us at 1-800-544-6666 to obtain an application.) You will need that account number to appear online for this option to be chosen.

Defined Contribution etirement Plan - Fidelity Investments

www.fidelity.comDefined Contribution etirement Plan — 41 Salary Reduction Agreement 1.824975.116 On this form, “Fidelity” means Fidelity Brokerage Services LLC and its affiliates. Brokerage services are provided by Fidelity Brokerage Services LLC, Member NYSE,

Automatic Investments - Fidelity Investments - Retirement ...

www.fidelity.comapplicable fund prospectus, fact kit, or disclosure document. You cannot invest in accounts that are restricted. • There are no transaction fees for automatic investments into Fidelity funds or FundsNetwork® No Transaction Fee (NTF) funds. For all other funds, there is a $5 fee for each automatic invest-

Cashier Check - Fidelity Investments

personal.fidelity.comFidelity Representative for instructions on whether possible, and how to deposit the check back into your account. • Fidelity may charge a fee to issue a cashier’s check — please check with your Fidelity Representative. •s checks will be sent via overnight mail to the Cashier’ account owner’s address.

Guide to Selling Puts Webinar - Fidelity Investments

www.fidelity.comThe Complete and Useful Guide to Selling Put Options | Trading Strategies | Fidelity Author: Fidelity Investments Subject: A guide to learn when it is best to utilize short put strategies and how to build, evaluate, and manage these strategies. Keywords: put options, selling puts, strategy, trading strategies, short put strategies Created Date

Visa Gold Check Card Application - Fidelity Investments

www.fidelity.comPage 1 of 1 Questions? Go to Fidelity.com/debitcard. 1.9862858.104 032350101 On this form, “Fidelity” means Fidelity Brokerage Services LLC and its affiliates.

FDIC-Insured Deposit Sweep Program ... - Fidelity Investments

www.fidelity.comFidelity SIMPLE IRAs (each an Individual Retirement Account, or IRA) and/or the Fidelity Health Savings Account (HSA) (each an “Account”). It is incorporated into and forms a part of the Customer Agreement governing your Account. If you have questions about an IRA, you can call a Fidelity Representative at 800-544-6666.

Effective as of March 28, 2022. - Fidelity Investments

www.fidelity.comConversation Starter. Ask your FBS financial professional: 1 Fidelity Personal and Workplace Advisors LLC CLIENT RELATIONSHIP SUMMARY Effective as of March 28, 2022. Fidelity Personal and Workplace Advisors LLC (“FPWA”) is a registered investment adviser with the U.S.

Simple IRA Application - Fidelity Investments - Retirement ...

www.fidelity.comFidelity Brokerage Retirement Customer Account Agreement and Disclosure Statement (“Customer Agreement”), and other relevant information delivered from time to time. Helpful to Know Regarding this account: • Fidelity’s Savings Investment Match Plan for Employees (SIMPLE IRA) is for self-employed individuals and small businesses with

One and the Same Letter - Fidelity Investments

www.fidelity.comOne-And-The-Same Letter Use this form to notify Fidelity of any slight discrepancies in the way your name is listed on your Fidelity account and the account from which your assets are being transferred. For complete name changes, such as due to …

Send a Document - Fidelity Investments

www.fidelity.comapplications or consolidation forms, to Fidelity.* 1. After logging into the NetBenefits Mobile App, click on, ‘‘Actions,’’ at the bottom of screen. 2. Select, ‘‘Send a Document.’’ If you have multiple Fidelity accounts, you will be prompted to select one. …

Updated in February 2021, to ... - Fidelity Investments

www.fidelity.comUpdated in February 2021, to include Strategic Advisers funds. 2020 Tax-Exempt Income from Fidelity Funds . Information for state tax reporting . This information may help you prepare your state income tax return. If you owned shares of any of the Fidelity funds listed in the table on the following pages of this letter during 2020, a portion of the

Mutual Fund Share Splits - Fidelity Investments

www.fidelity.comMutual Fund Share Splits . Q1: I understand that several Fidelity funds conducted share splits. What can you tell me? A: That’s correct. After market close on August 10th, several Fidelity funds conducted 10-for-1 share splits.

Irrevocable Stock or Bond Power - Fidelity Investments

www.fidelity.comIf bonds, complete this portion: Number of Bonds Principal Amount Face Value Certifi cate Number $. Name of Issuer Company or Municipality Certifi cate Number MEDALLION SIGNATURE GUARANTEE MEDALLION SIGNATURE GUARANTEE Return the original form to Fidelity Investments, Attention: Banking Services, 100 Crosby Parkway, Mailzone KC1N, …

Fixed Income Investing - Fidelity Investments

www.fidelity.comFixed income can be an integral part of any diversified portfolio. Many investors find it hard to tolerate the fluctuations in their portfolios that come from the ups and downs of the markets, leaving them looking for investments that can help moderate volatility.

CHET 529 COLLEGE SAVINGS PROGRAM DIRECT PLAN

www.fidelity.comThe CHET 529 College Savings Plan - Direct Plan (the CHET Direct Plan) is a 529 College Savings Plan. 529 plans are tax-favored plans authorized under Section 529 of the Internal Revenue Code. More, page 37. The CHET Direct Plan is offered by the State of Connecticut and managed by Fidelity Investments (Fidelity).

WORKSPACE Active Trader Pro - Fidelity Investments

www.fidelity.comThe sooner you start using Active Trader Pro® the sooner you can benefit from all the advances we’ve built into it. Fidelity Active Trader Pro PlatformsSM is available to customers trading 36 times or more in a rolling 12-month period. *Options trading entails significant risk and is not appropriate for all investors.

Bank Wire Authorization - Fidelity Investments

www.fidelity.com1.9866439.106 Page 2 of 3 033710302 3. Bank Wire Standing Instructions Use to transfer money FROM Fidelity to your account or someone else’s account at a bank, credit union, or other financial institution. Provide bank account information to set up the bank wire feature.

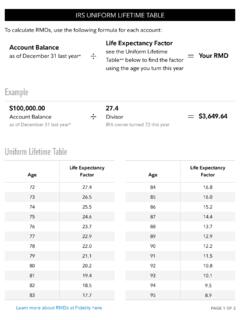

Life Expectancy Factor ÷ - Fidelity Investments

www.fidelity.comUniform Lifetime Table (continued) IRS UNIFORM LIFETIME TABLE PAGE 2 OF 2 Learn more about RMDs at Fidelity here Source: Amendments to the Income Tax Regulations (26 CFR part 1) under section 401(a)(9) of the Internal Revenue Code (Code), §1.401(a)(9)-9 Life expectancy and distribution period tables, (c) Uniform Lifetime Table.

Rollover Roth Supplemental - Fidelity Investments

www.fidelity.comEffective as of November 16, 2020. FBS is a registered broker-dealer with the U.S. Securities and Exchange Commission. Brokerage and ... charge their own separate management fees and other expenses. 2 You will pay fees and costs whether you make or lose money on your investments. Fees and costs ... Each wrap fee program charges an ...

Roth IRA Conversion - Fidelity Investments

www.fidelity.com1.908899.101 Page 2 of 4 006920402 Convert the following positions from your IRA to your Roth IRA. List the investments to be converted in-kind and indicate the amount,

FPPA Supplemental - Fidelity Investments

www.fidelity.comEffective as of November 16, 2020. FBS is a registered broker-dealer with the U.S. Securities and Exchange Commission. Brokerage and ... charge their own separate management fees and other expenses. 2 You will pay fees and costs whether you make or lose money on your investments. Fees and costs ... Each wrap fee program charges an ...

ADVENTIST HEALTHCARE RETIREMENT ... - Fidelity …

nb.fidelity.com3 nline www.ahrp.co AHRP Retirement Center 800-730-2477 Starting January 1, 2021, Fidelity Investments® will be the new recordkeeping service provider for Adventist Healthcare Retirement Plans (AHRP) and affiliated plan.

RIA How To Read Your Statement Brochure

www.fidelity.comYour Advisor is an independent organization and is not affiliated with Fidelity Investments. Brokerage services provided by Fidelity Brokerage Services LLC (FBS), Member NYSE, SIPC, (800) 544-6666. Brokerage accounts carried with National Financial Services LLC (NFS), Member NYSE, SIPC. 8 9 10 INVESTMENT REPORT Month 1, YYYY - Month 31, YYYY

BrokerageLink Commission Schedule - Fidelity Investments

www.fidelity.comA fund’s sales charges may apply. Fidelity does not charge a transaction fee on a load fund. A fund’s own redemption fees may apply. ... that fund minimums are not applied in all situations to BrokerageLink investors. EXPANDED INVESTMENT OPTIONS . ... Large block orders requiring special handling, restricted stock

Beneficiaries — IRA /HSA - Fidelity Investments

www.fidelity.comHSA Custodial Agreement. (Not applicable for annuities.) • Agree that if your beneficiary allocation totals at least 99%, but less than 100% (e.g., 3 named beneficiaries are each assigned a 33% interest in the account), Fidelity will assign the unallocated remainder to the first named beneficiary. (For annuities, see product prospectus.)

How To Read Your Fidelity Statement - Fidelity Investments

www.fidelity.comMay 01, 2017 · 03/23 03/23 BANK OF AMERICA BAC 500.000 17.75 8,875.00 03/23 03/23 COCA COLA COMPANY KO 100.000 39.60 -3,960.00 03/25 03/25 POWERSHARES QQQ TRUST SERIES 1 QQQ 250.000 108.17 -27,042.50 03/25 03/25 WHOLE FOODS MKT INC WFM 400.000 40.31 -16,124.00 Total Trades Pending Settlement -$25,301.50

Standing Transfer Instructions - Fidelity Investments

personal.fidelity.comStanding Transfer Instructions se this form to establish standing transfer instructions to another Fidelity broerage account registered in someone elses name. Establishing standing transfer instructions will allow you to reuest transfers of cash or shares to authoried accounts by phone.

Moving Money Out of Your Accounts - Fidelity Investments

www.fidelity.comMoving Money Out of Your Accounts . Sending Funds from your Fidelity account to your bank is easy with Electronic Funds Transfer or Wire Transfer. Prior to using these features, bank information is required and may be subject to a 7 to 10 day …

Products Services and Conflicts of ... - Fidelity Investments

www.fidelity.comuse information you provide about your financial goals, investment objectives, and financial situation (“Investment Profile”). When developing a recommendation that is in your best interest, we consider your Investment Profile as well as the potential risks, rewards, and costs associated with the investment, strategy, or account recommendation.

NATIONAL FINANCIAL SERVICES LLC - Fidelity Investments

www.fidelity.comCustomer receivables are carried net of an allowance for credit losses. An allowance against ... Other assets primarily consists of furniture, right-of-use lease assets ("ROU"), office equipment, leasehold improvements and software, net of accumulated depreciation and …

One-Time Withdrawal Nonretirement - Fidelity Investments

www.fidelity.comThe bank may charge for receipt of the wire. Additionally, if your transaction is an international wire subject to Part B of the Electronic Funds Transfer Act (a “Remittance Transfer”), the completion of this form is an indication of interest in this transaction. The transaction cannot be completed until you consent to prepayment disclosure

Deferred Fixed Annuities - Fidelity Investments

www.fidelity.comDeferred Fixed Annuities Guaranteed rate of return with tax-deferred savings How can I reduce risk to my overall portfolio? Having a well-diversified investment portfolio can help you weather the ups and downs of the market—especially over the long term. But the fact is that market volatility can be unsettling.

Capital Gain Distribution Estimates - Fidelity Investments

www.fidelity.comrealized short-term capital gains. Short-term capital gains realized by the fund include gains on the sale of securities that the fund owned for one year or less, regardless of how long shareholders owned their shares in the fund. Generally, short-term capital gain distributions are taxed as ordinary income. NOTE: Unrealized gains on

Retirement Plan Automatic ... - Fidelity Investments

www.fidelity.com• Distributions from the Defined Contribution Retirement Plan [i.e., Profit Sharing, Money Purchase Plan, or Self-Employed 401(k) Plan] are only permitted when a participant reaches age 59½, separates from service, becomes disabled, or dies, or the plan is terminated. Distributions for any other reason may result in plan disqualification.

An Overview of Factor Investing - Fidelity Investments

www.fidelity.comover time, and discuss the potential benefits of investing in factor-based strategies. Our goal is to provide a broad overview of factor investing as a framework that incorporates factor-exposure decision-making into the portfolio construction process. This article is the first in a series on factor investing.

IRA Recharacterization Reuest - Fidelity Investments

www.fidelity.comrecharacterization activity on IRS Form 8606, or as required by the IRS. Please see instructions for 8606 for further reporting information. • Recharacterizations generally must be completed by the federal income tax filing deadline (including extensions) for the year for which the contribution was made to the first IRA.

Cost basis regulations and you - Fidelity Investments

www.fidelity.com• Adjusted cost basis • Holding period (long-term or short-term) • Wash sale information 2011 Stock in a corporation purchased on or after January 1, 2011 2012 Securities eligible for average cost (mutual fund and DRIP), purchased on or after January 1, 2012 2014 and beyond Options, fixed income, and other securities as determined by the IRS,

Automatic Withdrawals - Fidelity Investments

www.fidelity.comAutomatic Withdrawals– IRA Use this form to establish, change, or delete an ongoing automatic withdrawal plan for a Brokerage or Mutual Fund Only Traditional, ... and may not be used to make transfers for commercial purposes. Provide the account information below. A Medallion signature guarantee is required in Section 8. Owner(s) Name(s ...

7628 FIDL BrokerageLink Part Agree ... - Fidelity Investments

www.fidelity.comthe Internal Revenue Code (“IRC”) and, if applicable, subject to the Employee Retirement Income Security Act of 1974 (“ERISA”). I acknowledge that this BrokerageLink® account is governed by certain Plan documentation that sets forth the respective rights and obliga-tions among the Plan, its fiduciaries, and Plan Participants.

Wealth Planning Overview - Fidelity Investments

www.fidelity.comRetirement income planning You work hard to save for the future. We can help you build a plan that’s designed to support the lifestyle you want in retirement. Retirement readiness Income generation Social Security and benefits Health and long-term care costs Employee benefits optimization Leaving a

Automatic Withdrawals Non ... - Fidelity Investments

www.fidelity.comof, the registered owner. One authorized signature is required unless you have a Mutual Fund Account (the account number begins with a 2 followed by two letters) in which case all owners must sign. A Medallion signature guarantee is required: • to establish EFT instructions for a bank account that is not in your name.

A Fidelity Investments Webinar Series Understanding ...

www.fidelity.comDetermine exit and entry •Generally, the area above 80 indicates an overbought region, while the area below 20 is considered an oversold region. •A sell signal is given when the oscillator is above the 80 level and then crosses back below 80. Conversely, a buy signal is given when the oscillator is below 20 and then crosses back above 20.

Retirement Plan Single Withdrawal ... - Fidelity Investments

www.fidelity.comYou are younger than 59½ at time of distribution. Must qualify under the Plan definition of “disability” as defined in Article 2.16 of the Defined Contribution Retirement Plan. Death of plan participant Plan termination Qualified birth or adoption . Distribution up to $5,000 must be made within the one-year period following the date of your

Fidelity U.S. Large Cap Equity Strategy - Fidelity Investments

www.fidelity.comFidelity® Strategic Disciplines provides non-discretionary financial planning and discretionary investment management for a fee. Fidelity® Strategic Disciplines includes the Fidelity® U.S. Large Cap Equity Strategy. Advisory services offered by Fidelity Personal and Workplace Advisors LLC (FPWA), a registered investment adviser.

Fidelity Brokerage Services ... - Fidelity Investments

www.fidelity.comprovide you with investment recommendations for certain investments upon request. Discretionary and non-discretionary investment advisory services are provided through our affiliated investment advisers, including Fidelity Personal and Workplace Advisors (FPWA) and Fidelity Institutional Wealth Adviser

Fidelity SIMPLE IRA - Fidelity Investments

www.fidelity.comSIMPLE IRA Plan contributions to your employees’ Fidelity SIMPLE IRA accounts via a direct debit from your company’s bank account. Instructions are provided each payroll period by accessing the Fidelity Plan Manager site. Note: This service may take 4–5 business days to become active after the processing of this form.

Fidelity Brokerage Services ... - Fidelity Investments

www.fidelity.com• For investments that we buy from or sell to you from our own accounts on a principal basis, we earn compensation from mark-ups, mark-downs and spreads. This creates an incentive to execute ... certain asset levels, on a stand-alone basis. Our financial planning services help you evaluate your ability

Fidelity Contrafund Commingled Pool - Fidelity Investments

www.fidelity.comof this Quarterly Review. Manager: William Danoff Start Date: January 17, 2014 Size (in millions): $47,324.96 The value of the fund's domestic and foreign investments will vary from day to day in response to many factors. Stock values may fluctuate in response to the activities of individual companies, and general market and economic conditions,

Similar queries

Fidelity Investments, Fidelity, Brokerage, Prospectus, Disclosure, Guide, Visa Gold, Card Application, Individual Retirement Account, Conversation Starter, Your, Retirement, Fidelity Brokerage Retirement Customer Account, Customer, Account, One and the Same Letter, One-And-The-Same Letter, Send a Document, February 2021, to include Strategic Advisers funds. 2020, Fidelity funds, Irrevocable Stock or Bond Power, Bonds, Number, Income, Moderate, 529 COLLEGE SAVINGS PROGRAM DIRECT PLAN, 529 College Savings Plan, Direct Plan, Trading, Options trading, Bank Wire Authorization, Uniform Lifetime Table, Supplemental, Fees and other, Fees, Charges, Fund, Situations, Special, Custodial, 8,875, Transfer, Money, Products Services and Conflicts of, Financial, NATIONAL FINANCIAL SERVICES LLC, Lease, Receipt, Electronic, Consent, Deferred Fixed Annuities, Deferred, Capital, Short, Term capital gains. Short-term capital gains, Gains, Term capital, Plan, Contribution, Factor investing, Investing, Factor, Based, 8606, Cost basis, Cost, Withdrawals, Transfers, Employee Retirement Income Security Act, ERISA, Planning, Registered, Entry, Under, Disciplines, Certain investments, Fidelity SIMPLE IRA, SIMPLE IRA, Investments, Stand, Review, Market