Search results with tag "Annuities"

July 2014 Interest Rate Announcement - Immediate Annuities

www.immediateannuities.comThe effective date for Fixed Indexed Annuities is July 2nd, 2014. The effective date for Traditional Annuities is July 1st, 2014. Fixed Indexed Annuities 1-Year S&P® Monthly Pt-to-Pt S&P ... July 2014 Interest Rate Announcement . Author: F&G Life Ins. Created Date:

Fixed Annuities Rate Announcement - Annuities Educator

www.annuityeducator.comFixed Annuities Rate Announcement (continued) Last Updated 11/1/15 Effective 7/1/15 First-Year Rate 1.75% 2.20% 7 year GRO 2 85% 2 10% 2 20% 5-year GRO6 1.45% 1.60% Momentum Advantage® – Single Premium Deferred Annuity5 Rate for Remainder

Securian Financial Group SECUREOPTION FIXED ANNUITIES …

www.annuityeducator.comSecurian Financial Group Page 1 of 2 more SECUREOPTION FIXED ANNUITIES Rate Announcement – Increase Annuities are issued by Minnesota Life in all states except NY.

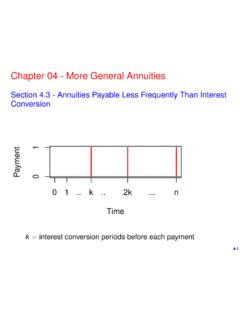

Chapter 04 - More General Annuities - University of Florida

users.stat.ufl.eduChapter 04 - More General Annuities Section 4.3 - Annuities Payable Less Frequently Than Interest Conversion Time Payment 0 1 .. k .. 2k ... n 0 1 k = interest conversion periods before each payment 4-1

Geometric Series and Annuities

math.ucr.eduGeometric Series and Annuities Our goal here is to calculate annuities. For example, how much money do you need to have saved for retirement so that you can withdraw a flxed

Voya™ Fixed Annuities Interest Rates and Features Voya ...

www.annuitymarketing.comFor agent use only. Not for public distribution. Voya™ Fixed Annuities Interest Rates and Features Effective Date: 11/05/2014 Rates in orange indicate a change from previous rate. New! Voya Wealth Builder Series Annuities

Deferred Fixed Annuities - Fidelity Investments

www.fidelity.comDeferred Fixed Annuities Guaranteed rate of return with tax-deferred savings How can I reduce risk to my overall portfolio? Having a well-diversified investment portfolio can help you weather the ups and downs of the market—especially over the long term. But the fact is that market volatility can be unsettling.

contracts, accounts, and annuities. DEPARTMENT OF THE ...

public-inspection.federalregister.govand (b)(3) for individual retirement accounts and individual retirement annuities (collectively, IRAs), section 408A(c)(5) for Roth IRAs, section 403(b)(10) for annuity contracts, custodial accounts, and retirement income accounts described in section 403(b) (section 403(b) plans), and section 457(d) for eligible deferred compensation plans.

July 2017 Interest Rate Announcement

amzfinancial.comJuly 2017 Interest Rate Announcement The effective date for Fixed Index Annuities and Traditional Annuities is July 01, 2017. (FG Guarantee-Platinum 5 rate effective June 15th, 2017.

March 2016 Interest Rate Announcement - asurea.com

www.asurea.comThe effective date for Fixed Indexed Annuities and Traditional Annuities is March 1st, 2016 (FG Guarantee-Platinum 5 rate effective February 26, 2016. Special interest rate for a limited time only.) March 2016 Interest Rate Announcement . Author: F&G Life Ins. Created Date:

Interest Rate September 2018 = Increase from the prior ...

www.labonteinsurance.netInterest Rate Announcement page 2 “Barclays Bank PLC and its affiliates (“Barclays”) is not the issuer or producer of Fixed Indexed Annuities and Barclays has no responsibilities, obligations or duties to contract owners of Fixed Indexed Annuities.

SECURITY BENEFIT Select Benefit Annuity

www.sbelitepartners.comFixed Account Interest Rate – – – 2.00% Effective November 5, ... It’s important to understand this is not a “window” of from the date of any rate announcement, rather, each individual ... Guarantees provided by annuities are subject to the financial strength of the issuing insurance company. Annuities …

SEC Ruling on Annuities – Right or Wrong? By David Beaty ...

www.sec.govFixed Indexed Annuities have a guaranteed minimum interest rate, usually lower than a fixed rate annuity, but offers a higher rate when the index used to calculate the rate shows a gain.

Judicial Survivors’ Annuities System Costs

www.gao.govPage 3 GAO-02-763 Judicial Survivors' Annuities System Costs Background Most federal civilian employees are covered by the Civil Service Retirement System (CSRS) or the Federal Employees’ Retirement System (FERS). Both of these retirement plans include survivor benefit provisions.

Via Afrika Mathematics

viaafrika.comUnit 2 Geometric sequences and series Unit 3 The sum to n terms(S. n): Sigma notation Unit 4 Convergence and sum to infinity : ... Unit 1 Future value annuities . Unit 2 Present value annuities : Unit 3 Calculating the period . Unit 4 Analysing investments and loans :

Nonqualified Deferred Compensation Audit Technique Guide

www.irs.gov"mere promise to pay" the deferred compensation benefits in the future, and the promise is not secured in any way. The employer may simply track the benefit in a bookkeeping account, or it may invest in annuities, securities, or insurance arrangements to help fulfill its promise to pay the employee, as long the annuities,

City of Philadelphia Board of Pensions and Retirement

www.phila.govThe Nationwide Group Retirement Series includes unregistered group fixed and variable annuities and trust programs. The unregistered group fixed and variable annuities are issued by Nationwide Life Insurance Company. Trust programs and trust services are offered by Nationwide Trust Company, FSB, a division of Nationwide Bank.

The Hartford Agrees to Sell Run-Off Life and Annuity ...

www.ubsnet.comvolatility of the assumed liability given the ongoing low interest rate environment and adverse impact of any ... • Individual Fixed Deferred Annuities – $4.25 billion. • Payout Annuities - $1.3 billion to $1.7 billion. ... S&P following the announcement of the sale of Talcott Resolution.

Understanding the Product Development Process of ...

www.soa.orgU.S. life insurance, 23% of U.S. annuities and 8% of Canadian life • Each section of this report opens with a key highlights page summarizing some of the subsequent charts and respondent comments. 4 *Source: LIMRA’s US Retail Individual Life Insurance Sales 2014, US Individual Annuities 2014, and Canadian Individual Life I nsurance Sales 2014

Content Outline for the S101 Regulatory Element Program

www.finra.orgknowledge and understanding. The Securities Industry Continuing Education Program (CE Program), which is required by the ... D.1.5 Variable Annuities and Variable Life . 7 This section focuses on the characteristics of variable annuities, variable life insurance policies

Financial Planning explained - Investec

www.investec.comRetirement Planning is about taking responsibility now by focusing on the future. It is about ensuring you can meet your ... Estate Planning Will the right people recieve the right amounts, and at the ... annuities and Self Invested Personal Pensions (SIPP). In …

The Annuity Ranking Report

www.annuitygator.comFeb 01, 2022 · As with other types of annuities, the funds that are inside of a hybrid annuity are allowed to grow on a tax-deferred basis. This means that the money will not be taxed until the time it is withdrawn. With an FIA, you can obtain a number of benefits, including safety of principal, the potential for growth, and guaranteed income for life.

MARCH 2018 Interest Rate Announcement - amzfinancial.com

amzfinancial.comMARCH 2018 Interest Rate Announcement The effective date is March 22, 2018. (FG Guarantee-Platinum 5 effective date is March 14, 2018 special interest rate for a limited time only.) Fixed Indexed Annuities S&P 500® 1-Year Monthly Pt-to-Pt

Fixed Annuities Rate Announcement - insourcemg.com

insourcemg.comContact the Sales Desk for current rate information. Payments of benefits under the annuity contract is the obligation of, and is guaranteed by, the insurance company issuing the …

Purposes and Procedures Manual of the NAIC Investment ...

www.in.govguides on annuities, long-term care insurance and Medicare supplement plans. Financial Regulation Useful handbooks, compliance guides and reports on fi nancial analysis, company licensing, state audit requirements and receiverships. Legal Comprehensive collection of NAIC model laws, regulations

Advanced Long-Term Actuarial Mathematics Exam – Draft ...

www.soa.orgvariable, and (2) a multiple state model. ... insurance and annuities on joint lives, using the equivalence principle. ... Use delta-hedging to reduce the risk to the insurer of issuing the options in Topic 6(b). d) Use deterministic (scenario -based) profit testing to assess emerging surplus for equity-linked life insurance.

Allstate Agency Support Line

www.accessallstate.comOct 14, 2013 · 1. Lincoln Benefit Products 2. Allstate Products 3. Good For Life 2 – In-Force Business 1. Claims 2. Anything Else 1 – Allstate Benefits 1.Change, Reinstatement, Lapse 2.Term Conversions 3.Fixed Life Products 4.Variable Life Products 5.Claim Questions 1 – Lincoln Benefit Products 1.Technology Support 2.Life Products 3.Annuities 4.Anything ...

New annuity Limited relationships - Challenger

www.challenger.com.aurelationships Challenger Limited. NEW ANNUITY RELATIONSHIPS . 27 October 2016 ... Challenger will issue Australian dollar fixed rate annuities with a 20 year term to support a reinsurance agreement with MS Primary. Challenger will provide a ... announcement on 14 February 2017.

Standard Agent Application Information Sheet

appoint.cmsmenu.comM1086-Standard Page 2 of 6 (R-2/2015) Product Line Information I would like to sell the following products: Fixed life or annuities Variable insurance products (BD must have active selling agreement) The Field Marketing Organization (FMO) that I will be conducting future Fixed Annuity business with is _____ FMO#_____.

Challenger Lifetime Annuity (Liquid Lifetime)

www.challenger.com.auof annuities in the country. Our vision is to provide customers with financial security for a better retirement. Challenger Limited is our parent company, an ASX-listed company with group assets under management of $110 billion*. It is regulated by the Australian Prudential Regulation Authority (APRA). To learn more

John Hancock Annuity claim package

www.johnhancock.comAnnuities Service Center, PO Box 55444, Boston, MA 02205-5444. If you received this package through the mail, a complimentary business reply envelope is included within this package. Final claim review Our annuity claim representatives review all submitted paperwork to ensure the required information has been provided. For items requiring

2021 tax planning guide - John Hancock Annuities

www.jhannuities.comKey tax-related changes are highlighted below. ... legal, or accounting advice, and neither John Hancock nor any of its agents, employees, or registered representatives are in the business of offering such advice. ... seek advice based on his or her particular circumstances from independent professional advisors. Required minimum distributions4 ...

CSRS FERS - United States Office of Personnel Management

www.opm.govExample 7: CSRS deferred retirement, with survivor benefits based on the full annuity ... computation of retired employees' annuities under CSRS. Subchapter 50C contains illustrations of computations using the general formula and job aids to facilitate the computations.

NON-ERISA - 403(b) withdrawal request

eforms.metlife.comAnnuities. NE403BWITHDRAWAL (10/20) Page 1 of 11 Fs/f. NON-ERISA - 403(b) withdrawal request . Metropolitan Life Insurance Company . Things to know before you begin ... Electronic Funds Transfer (EFT) Note: You must attach a copy of a voided check when requesting EFT. If a voided check is not provided, a paper check will be mailed to the ...

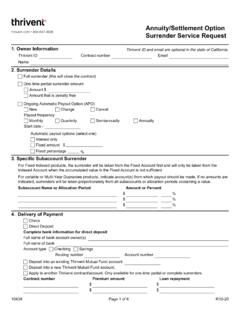

Annuity/Settlement Option Surrender Service Request - …

www.thrivent.comFor Fixed Indexed products, the surrender will be taken from the Fixed Account first and will only be taken from the ... Premium amount Loan repayment $ $ $ $ 10438. Page 2 of 6 R11-21. 5. Request for Waiver of Surrender Charges ... For Qualified Retirement Plan Surrenders from Deferred Annuities By signing in section 10, I certify that the ...

Fidelity Personal Retirement Annuity - Fidelity Investments

www.fidelity.comtax-deferred annuities. Once you have maximized all your traditional tax-deferred and tax-advantaged options—such as 401(k)s and IRAs—consider the benefits a tax-deferred annuity could provide to help expand your savings. A low-cost, tax-deferred variable annuity could help you: Save more for retirement by keeping more money in your portfolio.

Instructions for Form W-8BEN-E (Rev. July 2017)

www.irs.govAnnuities; Compensation for, or in expectation of, services performed; Substitute payments in a securities lending transaction; or Other fixed or determinable annual or periodical gains, profits, or income. This tax is imposed on the gross amount paid and is generally collected by withholding under section 1441 or 1442 on that amount.

Your Pension Rights - Ontario

www.fsco.gov.on.caannuity rates that are applied to purchase life annuities (or life pensions) are based on long-term interest rates. Some DC plans allow members to make investment choices for their individual ... MEPPs can be DB or DC or hybrid pension plans.

& Securities

www.americanschoolnj.comHybrid. Many Online classes are approved in all 50 states. ... a Securities license for individuals who sell variable annuities and other variable insurance products. passing the Insurance & Securities licensing exam(s). In addition, we provide Continuing Education Seminars to help

A guide to additional voluntary contributions (AVCs) in ...

www.yourpensionservice.org.ukA guide to additional voluntary contributions (AVCs) in the Local ... Annuities The amount in your account will depend on how long you pay AVCs for, the impact of charges and how ... as tax-free cash and buying an annuity with the remainder when you …

You’re getting a pension: What are your payment options?

www.bls.govretiree’s estate for the period designated. (See chart 7.) Period certain annuities can be offered for different time periods, such as 10-year certain, 15-year certain, or 20-year certain. Retirees pay a cost for this guarantee through a reduced annuity. Such an alternative might be appropriate for an older retiree or those in poor health.

General Securities Representative Qualification ... - FINRA

www.finra.org2330 – Members’ Responsibilities Regarding Deferred Variable Annuities 2360 – Options SEC Rules and Regulations Securities Act of 1933 Section 5 – Prohibitions Relating to Interstate Commerce and the Mails 156 – Investment Company Sales Literature 482 – Advertising by an Investment Company as Satisfying Requirements of Section 10

Required minimum distribution (RMD) form - MetLife

eforms.metlife.comAnnuities. MET-AUTORMD (10/20) Page 1 of 4 Fs/f. Required minimum distribution (RMD) form . This form is used to establish or change a systematic withdrawal program on your annuity contract. Metropolitan Life Insurance Company . Things to know before you begin • If you are referencing multiple contracts, please complete a separate

Retirement Income - IRS tax forms

apps.irs.govfrom annuities, retirement or profit sharing plans, insurance contracts, IRAs, etc. Retirement income may be fully or partially taxable. For information ... accumulate tax free or tax deferred until they are withdrawn as fully or partially taxable distributions. There are four kinds of IRAs, each with different tax implications:

Annuities Explained - Annuity.org - Everything You Need to ...

www.annuity.orgto as “equity-indexed annuities” (EIAs) until 2006 when the insurance industry began calling them “fixed-indexed annuities” to avoid any perceived connection to stocks — also known as equities. This is an important distinction because, unlike variable annuities, indexed annuities have no underlying investments.

Similar queries

Interest Rate Announcement, Annuities, Fixed, Fixed Annuities Rate Announcement, Rate, FIXED ANNUITIES, SECUREOPTION FIXED ANNUITIES Rate Announcement – Increase Annuities, Chapter 04 - More General Annuities, Geometric Series and Annuities, Fixed Annuities Interest Rates and Features, Deferred Fixed Annuities, Fidelity Investments, Deferred, July 2017 Interest Rate Announcement, Rate Announcement, Fixed rate, Judicial Survivors’ Annuities System Costs, Judicial Survivors' Annuities System Costs, Retirement System, Retirement, Via Afrika Mathematics, Geometric, Series, Philadelphia, Variable Annuities, Announcement, For the S101 Regulatory Element Program, Understanding, Variable, Planning, Retirement Planning, Estate Planning, Hybrid, Hedging, Lincoln, RELATIONSHIPS, Fixed rate annuities, Annuities Variable, Agents, Advisors, United States Office of Personnel Management, Electronic Funds Transfer, Annuity/Settlement Option Surrender Service Request, Fixed Indexed, Premium, Guide, Buying, Getting a pension: What are your payment options, Estate, FINRA, Required minimum distribution (RMD) form, Retirement income, IRS tax forms, Indexed annuities