Search results with tag "Retirement income"

The Real Deal - Retirement - Health | Aon

www.aon.comRetirement Income Adequacy at Large Companies: The Real Deal Results The Real Deal study shows that more employees are on track to retire with adequate retirement income when

Federal Employee Benefits Analysis - Federal Retirement

www.federalretirement.netFederal Income Analysis - Monthly Current Income First Year in Retirement Income Biweekly Monthly Monthly Gross Salary $4,094.40 $8,901.08 $3,049.25 Gross Annuity

When to Start Receiving Retirement Benefits - ssa.gov

www.ssa.govof retirement income. Again, you’ll want to choose a retirement age based on your circumstances so you’ll have enough Social Security income to complement

Course Description for Retirement Planning …

www.cifp.caTopics Include: Introduction to Retirement Planning Client Engagement Skills Government Sponsored Retirement Income Programs …

Leakage of Participants’ DC Assets: How ... - Retirement

www.aon.comLeakage of Participants’ DC Assets: How Loans, Withdrawals, and Cashouts Are Eroding Retirement Income 3 Background As many studies have shown, there’s a growing gap between retirement …

STATE PERSONAL INCOME TAXES ON PENSIONS AND …

www.ncsl.orgNational Conference of State Legislatures April 2015 Prevalence of retirement income exclusions Of the 50 states, seven–Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming–do not levy a personal income tax.

Options Trading Strategies: Retirement Income from …

www.tradingtips.comChapter 1: Option Basics Exchange-traded options, the subject of this guide, are contracts between two individuals: a buyer and a seller. There are options available for nearly every kind of financial security.

Deferred Compensation Program - Pennsylvania

collab.pa.govTHE POWER OF 1%: HOW SAVING PENNIES CAN ADD UP TO MORE RETIREMENT INCOME How much can a penny buy you these days? You may be able to find an old-fashioned gumball machine that will

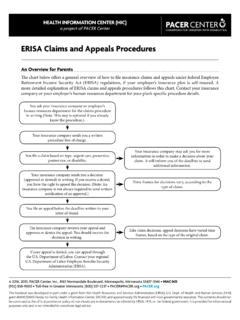

ERISA Claims and Appeals Procedures - PACER

www.pacer.org© 2016, 2010, PACER Center, Inc. • HIAC-h15 • PACER.org 2 ERISA Claims and Appeals Procedures The federal Employee Retirement Income Security Act (ERISA) sets the national standards for the claims and

Retirement Income Tax - Financial Services | CIBC

www.cibc.comA Supplementary Executive Retirement Plan (SERP) may provide additional pension income for certain key employees. An Individual Pension Plan (IPP), is used most commonly for owners of private corporations. A Retirement Compensation Arrangement (RCA), can provide for pension-like payments after retirement for

Retirement Income - IRS tax forms

apps.irs.govfrom annuities, retirement or profit sharing plans, insurance contracts, IRAs, etc. Retirement income may be fully or partially taxable. For information ... accumulate tax free or tax deferred until they are withdrawn as fully or partially taxable distributions. There are four kinds of IRAs, each with different tax implications:

Similar queries

The Real Deal, Retirement, Retirement income, Federal Employee Benefits Analysis, Federal Retirement, INCOME, Retirement Planning, Participants, Income tax, Options Trading Strategies: Retirement Income, Options, Deferred Compensation Program, ERISA Claims and Appeals Procedures, CIBC, Pension income, Pension, IRS tax forms, Annuities, Deferred