Search results with tag "Irrevocable"

SAMPLE CORPORATE BYLAWS - National Paralegal College

nationalparalegal.eduirrevocable if it states that it is irrevocable and if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power. A proxy may be made irrevocable regardless of whether the interest with which it is coupled is an interest in t he stock itself or an

MODIFYING AND TERMINATING IRREVOCABLE TRUSTS - …

texasprobate.netModifying and Terminating Irrevocable Trusts 1 MODIFYING AND TERMINATING IRREVOCABLE TRUSTS I. INTRODUCTION Trusts, being creatures of equity, are subject to the

How Your Accounts are Federally Insured Brochure

www.ncua.govIrrevocable trusts have separate coverage based on the beneficial interest. The interest of each beneficiary in an account (or accounts) established as an irrevocable trust has separate NCUSIF coverage of up to $250,000. In cases where a beneficiary has an interest in more than one trust arrangement created by the same owner, the interests

SAMPLE IRREVOCABLE TRUST DECLARATION OF TRUST

nysba.orges to create an irrevocabte an irrevocable trust of the prople trust o with such monih monies, securities and other ases, securities and o uire hereunder (said under (saidproperty, monies, secroperty, monie ons thereto received pursuo received pursant to the Grantot to the Grant Sereinafter set forth.

Make your life a little bit simpler

www.massmutual.comType (Select one): Irrevocable Trust Revocable Trust Trust under Insured’s Will (Skip to next beneficiary) Estate of Insured (Skip to next beneficiary) Corporation Other (Specify): Full legal name: Date Trust was established (Complete if Irrevocable Trust or Revocable Trust is selected above; mm/dd/yyyy):

Change of Ownership - Ameriprise Financial

www.ameriprise.comBrokerage and Managed Accounts Is this transfer pursuant to divorce decree? Yes No Revocable Trust Irrevocable Trust Irrevocable Trust treated as Grantor Trust with one Grantor with two Grantors who are spouses with multiple Grantors If the current owner is a trust, select the type of trust:

Basics of Irrevocable Life Insurance Trusts (ILITS)

www.cpsimis.comAn ILIT is an irrevocable trust created to own life insurance. The ILIT is both the owner and the beneficiary of one or more life insurance policies, typically insuring the life of the person or persons creating the ILIT, known as the grantor. If the trust is structured properly, life insurance proceeds received by an ILIT

When is an irrevocable trust’s income taxable in California?

www2.csudh.eduWhen is an irrevocable trust’s income taxable in California? Certain rules apply to California, but each applicable state’s rules will need to be reviewed. By Richard B. Malamud, J.D., LL.M., CPA Guest Contributor When a California resident with a revocable living trust dies, what was once a grantor trust

CAP. 190, LAW OF PROPERTY ACT

www.belizelaw.org123. Execution under power of attorney. 124. Payment by attorney under power without notice of death, etc. 125. Recording of instrument conferring power to dispose of land. 126. Irrevocability of power expressed to be irrevocable. 127. Effect of power of attorney irrevocable for a fixed time. 128. Devolution of power of attorney given to a ...

THE IRREVOCABLE LIFE INSURANCE TRUST - AATEELA

aateela.orgplanning), esta te t axes wil l con sum e 35% of their life insurance proceeds. ... nature of the Irrevocable Life Insurance Trust and what it can accompli sh. ... revocable living trust. This last option would be important if your estate had

Virginia Department of Social Services Medicaid Fact Sheet ...

www.dss.virginia.gova life insurance policy and using the proceeds of the policy to pay a funeral home for the ... The funds in a revocable trust or an irrevocable trust you establish may be exempted when Medicaid eligibility is determined. The nonexempt funds will be counted as a resource. If a funeral director establishes an irrevocable trust to pay for your

HOW TO STEP UP BASIS IN IRREVOCABLE TRUST ASSETS

www.dickinson-wright.comassets of an irrevocable trust to become subject to the estate tax of a decedent whose taxable estate is under $5,000,000, and whose estate could absorb the trust assets in his or her taxable estate without creating an estate tax liability. By including the asset in the taxable estate, tax …

Transferring a Life Insurance Policy to an Irrevocable Trust

www.summitgroupla.comThe irrevocable life insurance trust (ILIT), when structured properly, is a staple of estate planning for high net worth families. An ILIT can provide a means to make leveraged transfers to heirs free of both estate and income tax. Ideally, the trust is drafted prior to application for and purchase of the life insurance policy

Department of Business and Professional Regulation ...

www.myfloridalicense.comDoes the submitted credit report show a credit score of 660 or higher? Yes No . If no, the financial stability requirement may be met by providing a bond or irrevocable letter of credit from a bank authorized to do business in the State of Florida, with proof. of completion of an approved 14-hour financial responsibility course, in the amount of:

Application for Change of Beneficiary

content.mutualofomaha.compolicy, have the right to change the beneficiary. If the previous beneficiary was designated as an irrevocable beneficiary, ... holder of power of attorney. must provide a copy of the power of attorney and include, following his or her ... interest of any collateral assignee under a collateral assignment on record with the company. L4237_1014.

Application for Service Retirement (VRS-5)

www.varetire.org• If you intend to purchase service credit with your sick leave payment or convert disability credit to service credit, request your benefits administrator complete the necessary online certification. These options are irrevocable and cannot be reversed.

2016 – 2021 Flight Attendant Agreement

unitedafa.orgentered into unless it is agreed as a material and irrevocable condition of entering into, concluding and implementing such transaction that the rates of pay, rules and working conditions set forth in this Agreement will be assumed by the successor employer, and employees on the then current Flight Attendant

Using the Irrevocable Trust to Provide Estate Liquidity)

www.legacylaw.netof the value of the insurance proceeds paid to the trustee (without taking state death taxes into account). The reason for this dramatic result is that ‐‐ in a technical, tax sense ‐‐ you do not “own”

SAMPLE OF A REVOCABLE TRUST by Karin Sloan DeLaney, Esq.

nysba.orgbecome irrevocable. 3. DISPOSITION. (A) The Trustee may accumulate, or pay or apply the income of the ... property in the trust is not in the hands of the agent under a power of attorney, the power cannot be used to carry out the gifting. Some authority should be given to the Trustee, ... including accumulated income and any stock of any

SPECIAL POWER OF ATTORNEY By In favour of

www.bankofindia.co.in32. I confirm and declare that I have not executed any other power of attorney in favour of any other person(s) and this power of attorney is irrevocable till the entire loan together with interest, costs, charges, expenses and all other amounts payable to Bank of India are fully paid by me and Bank of India discharges me in writing .

Revocable Trust Accounts - Federal Deposit Insurance ...

www.fdic.govThe trust generally becomes irrevocable upon the owner’s death. Typically, formal revocable trust agreements will refer to the trust owner as the grantor, settlor, trustor, ... and formal revocable trust accounts at an IDI are added together for deposit insurance purposes, and the insurance limit is applied to the combined total. Please note ...

Change of Ownership Form – Life Insurance

content.mutualofomaha.comChange of Ownership Form – Life Insurance ... (Note: If the New Owner is a Trust, skip to 2. New Joint Owner . Paragraph 3. Below.) Name ... of Ownership is unconditional and irrevocable, and the New Owner(s) shall have the power to exercise all rights of ownership under said Policy.

Instructions for Form IT-205 Fiduciary Income Tax Return ...

www.tax.ny.govirrevocable, the residence of the trust will be deemed to have been changed at the date it ceases to be revocable. In that case the fiduciary must, for the tax year in which the change of status of the trust occurs, file Form IT-205-A. The New York source income of a part-year resident trust is the sum

Internal Revenue Service Department of the Treasury

www.irs.govpower, by vote or otherwise, to make all of the substantial decisions of the trust, with no ... for purposes of the estate tax, shares of stock owned and held by a nonresident not a citizen of the United States shall be deemed property within the United States only if issued by a domestic corporation. ... established an irrevocable trust ...

Trust Accounts, Representative Payee and Deceased Accounts

upchap.secure.cusolutionsgroup.netTrust Accounts • Revocable Trust becomes an Irrevocable Trust upon Death of grantor • Successor Trustee now becomes Trustee, if no other current trustee • Change in Beneficiaries –Person(s) named in trust documents to inherit assets become the new beneficiaries • Assets pass to the Beneficiaries similar to the way if they

A Closer Look Private Placement Life Insurance: A ...

www.bessemertrust.comPrivate Placement Life Insurance If ownership is structured properly (e.g., in an irrevocable trust), life insurance proceeds may be free from estate taxes as well. Yet because PPLI comes with certain fees and other limitations, only a careful case-by-case analysis can determine whether PPLI is right for a given client and situation.

Leimberg Information Services

leimbergservices.comTrusts (SLANTs) After the 2017 Tax Reform “Most practitioners are well-versed in drafting and planning with irrevocable grantor trusts. Few consider whether, how and when someone may want to craft an intervivos bypass or QTIP trust as a non-grantor trust. Drafting and administering such a trust when a spouse is involved can be tricky.

P.O. Box 942715 Sacramento, CA 94229-2715 888 CalPERS (or ...

www.calpers.ca.govYou have received this letter because one or more of your former employers have notified us that you ... • A refund is irrevocable and will terminate your CalPERS membership. ... service credit (Second Tier members must be at least age 55 with 10 years of second tier service

Distribution Agreement ~ Non-Exclusive - Business Power Tools

www.businesspowertools.comWe will do our best to accommodate your shipping requirements assuming we have stock on hand but, if you haven’t paid us, we might hold shipments until you send us the money. ... [Company] accepts from [Supplier], an irrevocable, nontransferable, Distribution Agreement ...

CERTIFICATION OF TRUST - pct.com

pct.comThe trust is revocable; irrevocable (check one) and the following party(ies) if any, is/are identified as having the power to revoke the trust: 6. The trust does; does not have multiple trustees (check one). If the trust has multiple trustees, the signatures of all the trustees or of any ...

Account Ownership Categories - Federal Deposit Insurance ...

www.fdic.govAccounts held by a depository institution as the trustee of an irrevocable trust — 12 C.F.R. § 330.12 • Annuity contract accounts — 12 C.F.R. § 330.8 • Public bond accounts — 12 C.F.R. § 330.15(c) • Custodian accounts for Native Americans — 12 C.F.R. § 330.7(e) •

How to Apply for a Trust EIN - Kate Downes

katedownes.comIf the decedent had assets in the name of a revocable trust, that trust becomes irrevocable at the decedent’s death and the successor Trustee is the one who needs to apply for the EIN. If the asset was held in the decedent’s individual name, without a joint owner or a named

WILLS, ESTATES, AND TRUSTS OUTLINE

bwp.tnble.organd revocable trusts that became irrevocable upon the death of the settlor. Tenn. Code § 32-3-105(b). G. Bequest of Common Stock 1. Generally Accepted View: At common law, a specific bequest of common stock included additional shares obtained by stock splits, but not additional shares obtained by stock dividends.

A Roadmap to Estate and Trust Income - IRS tax forms

www.irs.gov• Irrevocable trust • Incapacitated. Definitions - Continued • Transfer on Death (TOD) • Pay on Death (POD) • Specific Bequest • A/B Trust. General Rule Who Pays the Tax on Estate/Trust • Step 1 – Income to Beneficiaries; • Is the lessor of distribution to beneficiaries or

HOW TO COMPLETE THE TRUST CERTIFICATION - PurePoint

www.purepoint.com- The date and in which state the Trust was established and (if any) dates amended. Line 4 - Select if the Trust is Revocable or Irrevocable. If the Trust is Revocable, insert the names of the individual(s) with the power to revoke the Trust. Line 5 - Names of the Trust creators, commonly known as the Grantors or Trustors of the Trust. Line 6

Form 712 Life Insurance Statement - IRS tax forms

www.irs.gova Total cost, on date of death, assignment, or irrevocable designation of beneficiary, of a single-premium policy on life of insured at attained age, for original face amount plus any additional paid-up insurance (additional face amount $ ) 59a (If a single-premium policy for the total face amount would not have been

State of Indiana Indiana Family and Social Services ...

www.in.gov• The trust must be irrevocable. • The trust must state: “Upon the death of the beneficiary, the trust assets shall be paid to the Medicaid agency of the State of Indiana up to the total amount of the Medicaid payments made to or on behalf of the beneficiary,” or …

Form 4682 - Application for Dealer, Auction, or ...

dor.mo.govIrrevocable Letter of Credit (ILC) Type of units to be sold or manufactured (select all that apply): r Boat r Boat Trailer r Classic MV r Emergency Vehicle Only r Historic MV r New ATV r. New Motorcycle . r New MV . r. New Personal Watercraft . r. New RV . r. Trailer . r. Used ATV. r Used Emergency Vehicle . r. Used Motorcycle . r.

Irrevocable Contribution Form and Letter of Instruction

www.fidelitycharitable.orgIrrevocable Contribution Form and Letter of Instruction Use this form to make irrevocable contributions to a Fidelity Charitable® Giving Account® or a Giving Account® that is enrolled in the Charitable Investment Advisor Program (CIAP). All …

IRREVOCABLE ASSIGNMENT AND POWER OF ATTORNEY

www.betacapitalcorp.comirrevocable assignment and power of attorney for value received, i(we), the undersigned beneficiary(ies) under the insurance policy( ies), or death benefit certificate(s) (collectively, iesthe “policy()”) referred to below, or being the person equitably entitled to the benefits thereunder issued by_____ (name of insurance company)

Irrevocable Trust Accounts - Federal Deposit Insurance ...

www.fdic.govtransferred, they are beyond the grantor’s reach. However, grantors at times retain an interest in some or all of the trust assets. When a trust provides for the trustee to be able to return assets to the grantor, those assets are the grantor’s retained interest. John, for example, funded his irrevocable trust with a $250,000 deposit.

IRREVOCABLE LIFE INSURANCE TRUSTS - Rossdale CLE

www.miamilegalresources.com4839-8253-5200.1 ii. There are two separate approaches, each with different benefits and risks. (1) Transfer an existing policy to the ILIT

IRREVOCABLE LIVING TRUST AGREEMENT - dhs.state.or.us

www.dhs.state.or.usnursing home care. g. Excess. Any excess income may be distributed to or on behalf of the beneficiary only to the extent allowed under the Oregon Administrative Rules governing Medicaid assistance. Excess income may be distributed to the State to repay it for any Medicaid assistance that it provided to the beneficiary, even if recovery for the

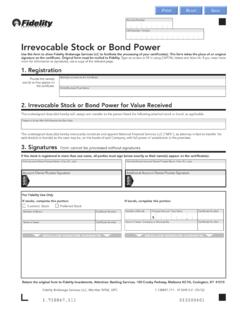

Irrevocable Stock or Bond Power - Fidelity Investments

www.fidelity.comIf bonds, complete this portion: Number of Bonds Principal Amount Face Value Certifi cate Number $. Name of Issuer Company or Municipality Certifi cate Number MEDALLION SIGNATURE GUARANTEE MEDALLION SIGNATURE GUARANTEE Return the original form to Fidelity Investments, Attention: Banking Services, 100 Crosby Parkway, Mailzone KC1N, …

Similar queries

Irrevocable, Irrevocable power, Stock, MODIFYING AND TERMINATING IRREVOCABLE TRUSTS, Accounts, Federally Insured, Irrevocable trust, Trust, An irrevocable trust, Life, Trust Trust, Ameriprise Financial, Trust Irrevocable Trust Irrevocable Trust, Irrevocable life insurance, Life Insurance, California, Power, The Irrevocable Life Insurance Trust, Wil l, Living, Virginia, Credit, Irrevocable Letter of Credit, Assignment, Flight Attendant, Trust Accounts, Trusts, CalPERS, Letter, WILLS, ESTATES, AND TRUSTS OUTLINE, Settlor, Roadmap to Estate and Trust Income, IRS tax forms, Insurance, Indiana Indiana, Indiana, Dealer, Irrevocable assignment and power of, Benefits, Irrevocable Trust Accounts, Grantor, Retained, IRREVOCABLE LIFE INSURANCE TRUSTS, ILIT, IRREVOCABLE LIVING TRUST AGREEMENT, Nursing, Oregon, State, Irrevocable Stock or Bond Power, Fidelity Investments, Bonds, Number