For Deferred Tax

Found 5 free book(s)Accounting for Deferred Tax Assets, 9/29/00

faculty.babson.eduDeferred Tax Asset Valuation Allowance account as a major source of the Company’s increased earnings. Specifically, LENS eliminated its tax valuation allowance account in the June 2000 quarter, adding $6 million to net income and thereby increasing fiscal 2000 earnings per share by $0.25 – to $0.81 from

Deferred tax – a Chief Financial Officer’s guide to ...

www.grantthornton.globalcover some of the more complex areas of preparation of a deferred tax computation, for example the calculation of deferred tax balances arising from business combinations. The sections of the guide are as follows: Section 1: Calculating a deferred tax balance – the basics IAS 12 requires a mechanistic approach to the calculation of deferred tax.

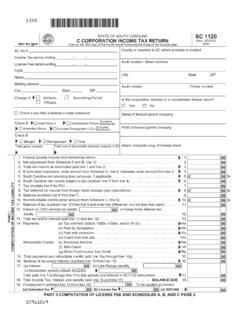

SC 1120 C CORPORATION INCOME TAX RETURN

dor.sc.govPayments: Pay online using our free tax portal, MyDORWAY, at dor.sc.gov/pay. Select Business Income Tax Payment to get started. If you pay by check, make your check payable to SCDOR, and include your name, FEIN, tax year, and SC1120 in the memo. Mail Refund or Zero Tax returns to: SCDOR Corporate Refund PO Box 125 Columbia, SC 29214-0032

Application For Refund of Retirement Deductions OMB …

www.opm.govWithhold 20% Federal income tax from amount rolled over to Roth IRA Mail the check to the above institution or plan. I elect to have my refund computed and a rollover package with all my options sent to me before I decide how it should be paid. (Electing this option delays payment of your refund at least an additional 30 days.) to me.

2021 Form 8853 - IRS tax forms

www.irs.govAdditional 50% tax. Enter 50% (0.50) of the distributions included on line 12 that are subject to the additional 50% tax. See instructions for the amount to enter if you had a Medicare Advantage MSA at the end of 2020. Also include this amount in the total on …