Search results with tag "C corporation"

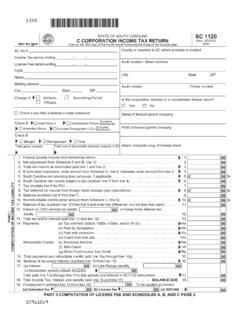

SC 1120 C CORPORATION INCOME TAX RETURN

dor.sc.gov3. Location of the registered office of the corporation in South Carolina In the city of Registered agent at this address 4. Principal office address Nature of principal business in South Carolina 5. Total number of authorized shares of capital stock, itemized by …

BY RICH SHAVELL Converting from a C to an S Corporation ...

shavell.comConverting from a C to an S Corporation? Beware the Built-in Gains Tax BY RICH SHAVELL To avoid double taxation, a C corporation may consider con-

Distinguishing Personal Goodwill from Entity Goodwill in ...

www.willamette.comwww .willamette .com INSIGHTS • WINTER 2016 . 55. transaction, the C corporation assets are valued on . the date of the tax status conversion.

C Corporation - Arkansas

www.dfa.arkansas.govForm AR1100-WH is a new form for 2017 and following years which corresponds with Line 36 on Form AR1100CT . for corporations to report withholding tax paid on their behalf by partnerships and will need to be included with Form AR1100CT. Corporations claiming withholding must attach Form AR1100-WH listing each partnership that withheld