Search results with tag "Mortgage"

Description FLORIDA MORTGAGE LOAN ORIGINATOR …

mortgage.nationwidelicensingsystem.orgOct 04, 2011 · Description FLORIDA MORTGAGE LOAN ORIGINATOR LICENSE Who is required to have this license? This license is required for an individual who, directly or indirectly, solicits or offers to solicit a mortgage loan, accepts or offers to accept an application for a mortgage loan, negotiates or offers to negotiate the

The Perimeter Guidance manual - FCA Handbook

www.handbook.fca.org.uk4.10A Activities within scope of the Mortgage Credit Directive 4.10B Regulation of buy to let lending 4.11 Link between activities and the United Kingdom 4.12 Appointed representatives 4.13 Other exemptions 4.14 Mortgage activities carried on by professionalfirms 4.15 Mortgage activities carried on by 'packagers' 4.16 Mortgage activities

Statement Request for Mortgage Discharge or Transfer …

www.scotiabank.comScotiabank Central Mortgage Unit, Statement Unit Page 1 of 3. STATEMENT REQUEST Statement Type Required: Discharge Transfer Authorization and Consent to Request Statement is attached: Reason for Payout: Sale of Property – No New Mortgage Sale of Property – New Mortgage with: ...

4235.1 REV-1 - HUD

www.hud.gov9-2 BASIC SERVICING ISSUES. The servicing of a reverse mortgage differs from a standard forward mortgage in the following ways: A.The local HUD Office must be able to make payments to the borrower. 1)A mortgage assigned to HUD will require that HUD make payments to the borrower or be able to disburse funds from a line of credit.

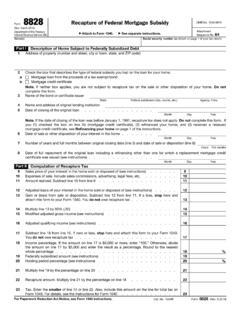

Form 8828 Recapture of Federal Mortgage Subsidy

www.irs.gova Mortgage loan from the proceeds of a tax-exempt bond b Mortgage credit certificate Note. If neither box applies, you are not subject to recapture tax on the sale or other disposition of your home. Do not complete this form. 3 Name of the bond or certificate issuer State Political subdivision (city, county, etc.) Agency, if any

Requesting information from your mortgage servicer

files.consumerfinance.govRequesting information from your mortgage servicer New federal mortgage servicing rules require servicers to provide you with information you request related to the servicing of your loan. An information request allows you to get useful information about your account or copies of documents that you may have misplaced.

Summary Prospectus | December 29, 2021 Performance Trust ...

ptam.comThe risk profile of Alt-A mortgages falls between prime and subprime. The Fund may invest a substantial portion of its portfolio in RMBS and CMBS. These investments may consist of “agency” securities RMBS created by one of three quasi-governmental agencies (Government National Mortgage Association (“Ginnie Mae”), Federal National Mortgage

Adjustable-Rate Mortgage Loan Disclosure

www.flcbmtg.comFLCBank 5/1 2-2-5 ARM -Floor 3.75-Advantage ARM Combined P&I Option and IO Option Rev. 2.03.2022 Adjustable-Rate Mortgage Loan Disclosure (No Fixed Rate Conversion Option)This disclosure describes the features of the Adjustable-Rate Mortgage (ARM) program you are …

2020 Form 1098 - IRS tax forms

www.irs.govIf you hold a mortgage credit certificate and can claim the mortgage interest credit, see Form 8396. If the interest was paid on a mortgage, home equity loan, or line of credit secured by a …

CFPB Mortgage Examination Procedures Origination

files.consumerfinance.govof a foreclosure or bankruptcy. A mortgage that is in a first lien position, sometimes called a senior loan, has priority for payment over a mortgage in a junior lien position if there is a foreclosure or bankruptcy proce eding. The proceeds from the foreclosure sale are divided according to lien position.

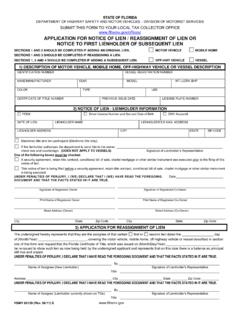

STATE OF FLORIDA DEPARTMENT OF HIGHWAY SAFETY AND …

flhsmv.govA security agreement, retain title contract, conditional bill of sale, chattel mortgage or other similar instrument was executed prior to the filing of this notice of lien. This notice of lien is being filed before a security agreement, retain title contract, conditional bill of sale, chattel mortgage or other similar instrument is being executed.

Your Mortgage Checklist - Allied Irish Banks

aib.ieFor Self-Employed/Sole Trader/Director of a Company/Partnerships • 3 years (2 years if you are switching to AIB or Topping Up your AIB mortgage) audited accounts or trading accounts certified by your accountant • Please send us the following Revenue documents to confirm your declared level of income:

2. 3. Filing and service of process in foreclosure ...

www.nycourts.govexpiration of L. 2021, c. 417, which relates in part to residential and commercial foreclosures [“Act”], I hereby direct that, effective immediately: 1. Resumption of Residential and Commercial Mortgage Foreclosure Matters: All residential and commercial mortgage foreclosure matters may resume in the normal course. 2.

Plus Second Mortgage

www.virginiahousing.com• A completed Uniform Residential Loan Application (Form 1003); and • The credit report. Note: If unable to confirm from the Exhibit E, Form 1003, or the credit report all ... Maximum DTI Follow first mortgage requirements. Foreclosures / Deed in Lieu / Short Sales

Approved & Eligible Lenders - USDA Rural Development

www.rd.usda.govSunTrust Bank CDC Nicholas Olaya Atlanta GA 404-588-8909 mailto:nick.olaya@suntrust.com Approved & Eligible Lenders Page 2 of 3 ... Harry Mortgage Company Luke Harry Oklahoma City OK 405-606-2501 mailto:lukeh@harrymortgage.com Puerto Rico Housing Finance Authority Enid Rivera Sanchez San Juan PR 787-756-7577

Memorandum of Mortgage - Westpac NZ

www.westpac.co.nzMemorandum of Mortgage ... 2.3 Costs 1 2.4 Interest 1 2.5 Government charges 2 2.6 Payments in the wrong currency 2 ... – the obligations in this clause apply after as well as before any judgment of a court. 2.5 Government charges You must pay any government duties, taxes and charges on ...

Glossary of terms

home.barclaysFeb 23, 2022 · ‘Business scenario stresses’ Multi-asset scenario analysis of extreme, but plausible, events that may impact the market risk exposures of the Investment Bank. ‘Buy to let mortgage’ A mortgage whereby the intention of the customer is to let the property at origination.

THIS INFORMATION IS FOR MORTGAGE INTERMEDIARIES …

zephyrhomeloans.co.uk9. Property Details 12 a) EPC 12 b) Valuations 12 c) Retentions 12 ... The cash flow should therefore demonstrate the sustainability of the portfolio over the previous and future 12 month periods. Mortgage payments will be cross checked with the credit file/ Companies ... • Consideration must be as per the valuation amount

RICS guidance note, UK

www.rics.orgCommercial mortgage-backed security (CMBS) A type of finance transaction. See Appendix C5. Delict Used in Scots law instead of ‘tort’. Desk-top valuations Valuations conducted without a site visit. Disclosure Permitting advice to be seen by or disclosed to a third party (i.e. a person

MONTHLY MORTGAGE STATEMENT DISCLOSURES

onlineaccess.ncsecu.orgSERVICEMEMBERS CIVIL RELIEF ACT . If you have received notice that you are to report to federal or state active duty military service, are currently on active duty military service, were on active duty military service within the past 365 days, or are the spouse or financial dependent of a person called to active duty, you may be entitled to ...

Uniform Closing Dataset (UCD) Critical Edits ...

sf.freddiemac.comThis document relates to the Uniform Mortgage Data Program ®, an effort undertaken jointly by Freddie Mac and Fannie Mae at the direction of the Federal Housing Finance Agency . Uniform Closing Dataset (UCD) Critical Edits – Implementation Guide. Issued by Fannie Mae and Freddie Mac. Document Version 1.3 . February 15, 2022

GRADE 12 ACCOUNTING LEARNER NOTES - Mail & Guardian

serve.mg.co.zaIncome tax rate is 27% of net income 2. Authorised Share Capital: comprises 1 000 000 ordinary shares of R3 each. ... 2.6 Refer to the budgeted forecast figures in the information provided (Information (C)) ... Mortgage Loan (1 600 000 + 204 000 1 432 800 ...

For release at 2 p.m. EST January 26, 2022

www.federalreserve.govJan 26, 2022 · mortgage‑backed securities by at least $10 billion per month. The Federal Reserve’s ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses. (more)

Indicator/Action Last Economics Survey: Actual: Regions’ View

assets.realclear.comand our forecast allows for some catching up in the February data. That should be enough to break a streak of seven straight monthly declines in unadjusted single family starts, which is a reflection of intensifying supply chain constraints. Even with recent increases in mortgage interest rates, many builders report that demand remains

U.S. government obligations income information

personal.vanguard.comMortgage-Backed Securities Index Fund 0.07 Multi-Sector Income Bond Fund 2.13 PRIMECAP Core Fund 0.07 PRIMECAP Fund 0.04 Real Estate II Index Fund 0.01 Real Estate Index Fund 0.01 S&P 500 Growth Index Fund 0.01 S&P Mid-Cap 400 Growth Index Fund 0.01 S&P Mid-Cap 400 Value Index Fund 0.01 S&P Small-Cap 600 Index Fund 0.01 Selected Value Fund 0.06

Lifetime mortgages Lending criteria - Aviva

www.aviva.co.uk2 Ownership/occupancy – The youngest applicant must be a homeowner aged 55 or older. Considered for valuation Property must be the main home of the borrower(s). Applications from non-British citizens provided the property is their main residence and is based in England, Wales, Scotland or Northern Ireland. Married/civil partnership couples must apply jointly even if the …

Fact Sheet:SPDR® Bloomberg Global Aggregate Bond UCITS …

www.ssga.comCredit Quality Breakdown Weight (%) Aaa 39.85 Aa 14.19 A 31.47 Baa 14.50 Credit quality rating is based on an average of Moody's, S&P, and Fitch. Sector Breakdown Weight (%) Treasury 54.17 Mortgage Backed Securities 12.09 Corporate - Industrial 9.55 Corporate - Finance 6.87 Agency 6.28 Non Corporates 5.67 Corporate - Utility 1.43 CMBS 0.82 Cash ...

HR SERVICE CENTER for HR Related Questions

www.thehartford.comExample: You’re applying for a mortgage, buying a new car, renting an apartment, etc. 3 Employment Talx 7 a.m. –8 p.m. ET 800-367-2884 Verification Information Other Pay Questions 4 Pay Inquiries Alight Solutions 8:30 a.m. – 6:30 p.m. ET Live Chat - Workday WorkdayTime and Absence Personal / Job Related Information

USDA Product Profile: Correspondent

www.newrezcorrespondent.com1 West Virginia: Maximum 50% DTI. Streamlined Refinance ... amounts <= $417,000, if the loan being refinanced is a Special Mortgage, or a ... with the DU Findings and Fannie Mae require ments and that all loans submitted to LPA comply with the LPA Findings and Freddie Mac requirements. This document should not be relied upon or

Consumer Mortgage Lending Products - CommBank

www.commbank.com.auT1. Opening an account 63 T2. Operating joint accounts 63 T3. Trust accounts 63 T4. Tax on credit funds 64 T5. When we can close an account 64 T6. Cheques 64 T7. Combining an account 64 T8. Making deposits 64 T9. Electronic banking 65 T10. Making withdrawals and payments 65 T11. Agency opening hours 65 T12. Fees and charges payable 66 T13.

MoneySavingExpert.com SECTION TITLE Guide to

www.moneysavingexpert.comAnd the EU Mortgage Credit Directive nailed that in place. For more on this see page 24 of the guide.. Lenders will look at all your outgoings too, so if you think you may be near the brink, go through all your expenditure first, to see where you can save cash

Maryland Mortgage Program Product Matrix

mmp.maryland.govAdvantage 5000 - Conventional 640 FICO ≥680 = 50%; 640-679 = 45% No Yes, unless buying in targeted area or veteran using exemption for the first time $5,000 loan, 0% deferred, repayable Advantage 5000 Allows Partner Match640 Most DPA for loans under $166,000FHA 1st Time - 640 FICO ≥680 = 50%; 640-679 = 45% No 1st Time Advantage 5000 - VA ...

For release at 2 p.m. EDT March 16, 2022

www.federalreserve.govMar 16, 2022 · Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting. In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook.

Designated Home Mortgage Disclosure Act (HMDA) Key …

www.federalreserve.govcollect, record, and report certain HMDA data points specified in EGRRCPA, as further explained in the Bureau’s interpretive and procedural rule to clarify and implement the legislation (83 FR 45325 (September 7, 2018)). Various HMDA data points are associated with multiple HMDA data fields. Financial institutions subject to a

Submission Guide

s3-eu-west-1.amazonaws.comPortfolio Non portfolio Residential Help to Buy 1 2-3 FTB 1 2-3 FTB All tiers All tiers Standard Declaration (signed and dated) Direct debit mandate Existing property portfolio form Combined business plan, cash flow, and assets and liabilities form, along with latest month's bank statement evidencing rent and mortgage payments

Residential Foreclosure Part TEMPORARY RULES DURING …

www.nycourts.govresidential foreclosure legislation. 1. All residential foreclosure actions that are filed should include the following language in the Complaint: whether this action involves a residential, one-to-four family, owner-occupied property upon which the mortgage is considered sub-prime, high-cost or nontraditional; whether plaintiff has

State of Wisconsin Homeowner Assistance Fund (HAF) Needs ...

doa.wi.govpreventing homeowner mortgage delinquencies, defaults, foreclosures, loss of utilities or home energy services, and displacement. For more information related to the HAF and the US Treasury’s guidance to recipients, please visit:

Veterans’ Mortgage Life Insurance - Veterans Affairs

www.benefits.va.govVeterans must pay VMLI premiums by deduction from their monthly compensation. How Do You Apply for VMLI? You can apply for VMLI by completing VA …

VanDyk Mortgage Corporation CONUMER ONLINE BANKING ...

vandykmortgage.comdisclosures, agreements and instructions electronically, you can also request a paper copy of the related legal disclosures, agreements and instructions by contacting our Grand Rapids Corporate Office at 616-940-3000. We will not charge you any fees for providing a paper copy of the disclosures, agreements and instructions to you,

DOE Zero Energy Ready Home National Program …

www.energy.gov• 3Dwelling units in multifamily buildings with 3 stories or fewer above-grade4 ... Index of the Target Home is automatically calculated in accordance with the RESNET Mortgage Industry National ... zero@newportpartnersllc.com and will typically receive an initial response within 5 business days. If DOE

CIBC RetireeNews

www.cibc.comprograms on mortgages, loans and credit cards. We were also the first bank to announce reduced ... I know many of you find purpose in giving back to your communities, and I recognize that the pandemic has made this a challenge. I want to thank you for giving your time and dollars so ... toys for children in need in my community. G F Hilary ...

Your Home Page 1 of 22 10:39 - 18-Jan-2022

www.irs.gov527 Residential Rental Property 530 Tax Information for Homeowners. 504 505 527 530 . 537 Installment Sales 544 Sales and Other Dispositions of Assets 547 Casualties, Disasters, and Thefts 551 Basis of Assets 587 Business Use of Your Home 936 Home Mortgage Interest Deduction 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments

Mortgage Banking, Comptroller's Handbook

www.occ.treas.govMortgage banking is a cyclical business, and earnings can be volatile. Without proper management, a profitable mortgage banking operation can quickly generate substantial losses. Consistent profitability in mortgage banking requires a significant level of oversight by the board and senior management, and careful management of all mortgage banking

MORTGAGE PROGRAM POLICY AND PROCEDURES FOR …

www.nj.govsettlement costs, including title and transfer costs, title insurance, survey fees and other similar costs and ... of income as described chapter 3 of in this guide. Annual Household Income review is required under ... requirements of the Agency’s funding sources upon assumption of the Mortgage Loans; and/or provide for consumer and/or ...

Mortgage Loan Disclosure Statement / Good Faith Estimate ...

www.dre.ca.govM ORTGAGE L OAN D ISCLOSURE S TATEMENT / G OOD F AITH E STIMATE N ONTRADITIONAL M ORTGAGE P RODUCT (ONE TO FOUR RESIDENTIAL UNITS) RE 885 (Rev. 8/08) Borrower’s Name(s):_____ Real Property Collateral: The intended security for this proposed loan will be a Deed of Trust on (street address or legal ...

Mortgage Burning Celebration

salembc.orgApr 04, 2018 · olence Fund. The tournament will be Saturday, May 26, 2018. Shotgun Start will be at 9:00am at Elmwood Park Golf Course. Registration is $75.00 per golfer. Proceeds will provide assistance to people who do not have the immediate ability to take care of specific financial needs. Consider putting a team together, being a sponsor, or giving a ...

Similar queries

Description FLORIDA MORTGAGE LOAN ORIGINATOR, Mortgage Loan, Mortgage Credit Directive, Mortgage, Statement Request for Mortgage Discharge or Transfer, Scotiabank, Unit, Request, Transfer, 4235.1 REV-1, Bond, Information, Your mortgage, Your, Profile, Portfolio, Advantage, IRS tax forms, Mortgage credit certificate, Credit, Foreclosure, Notice of lien, Sole Trader, Residential, Foreclosures, Suntrust, Memorandum of Mortgage, Costs, After, Judgment, Multi, INFORMATION IS FOR MORTGAGE INTERMEDIARIES, Property, Sustainability, Valuation, RICS guidance note, UK, Commercial mortgage, Backed, MONTHLY MORTGAGE STATEMENT DISCLOSURES, SERVICEMEMBERS CIVIL RELIEF ACT, Freddie Mac, Guide, GRADE 12, Rate, Forecast, Lifetime mortgages Lending criteria, Applications, Related, Maximum, Amounts, Consumer Mortgage Lending Products, Agency, Agency mortgage, Home Mortgage Disclosure Act, HMDA, HMDA data, Veterans’ Mortgage Life Insurance, Veterans Affairs, Premiums, Monthly, VanDyk Mortgage, Disclosures, Multifamily, Business, Mortgages, Know, Need, Mortgage banking, Settlement costs, Consumer, M ORTGAGE L OAN, M ORTGAGE, Mortgage Burning Celebration, Olence