Search results with tag "14157"

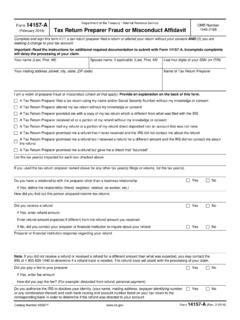

Form 14157-A Tax Return Preparer Fraud or Misconduct …

www.irs.govGenerally, tax returns and return information are confidential, as required by IRC Section 6103. The time require to complete this form will vary depending on individual circumstances. The estimated average time is 5 minutes. The primary purpose of this form is to report potential violations of the Internal Revenue laws by tax return preparers.

MATERIAL INDUSTRIAL, S.L. - Casals

casalsmd.comNo. Connect Ref. System ID Weight (kg) QIP (pcs) CT. FS. FS. Part No. GY. PHX. AT. VBC. CF-G. DNL. GRT. Other Manufacturer's Cross References 50 14157-16 131028-CO

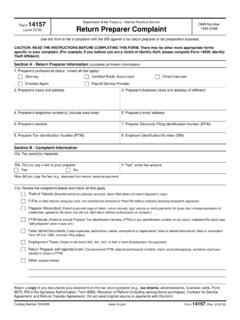

14157 (June 2018) Return Preparer Complaint - IRS tax forms

www.irs.govQuestions were added to help tax return preparers self-report issues with compromised PTINs, data breaches/security incidents, return count discrepancies or if someone used their identity to obtain a PTIN. Purpose of Form. Use Form 14157 to file a complaint against a tax return preparer or tax preparation business. Tax professionals can use ...