Example: stock market

Search results with tag "Form 14157"

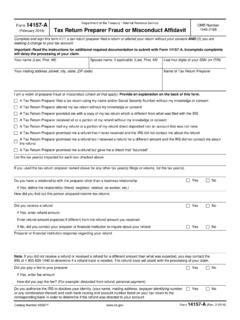

Form 14157-A Tax Return Preparer Fraud or Misconduct …

www.irs.govPlace the Form 14157-A on top of all other required documentation. If submitting this information in response to a notice or letter received from the IRS: Send the completed Form 14157-A, Form 14157, and other documents with a copy of the notice or letter to the address contained in that notice or letter.

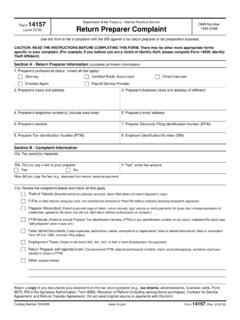

14157 (June 2018) Return Preparer Complaint - IRS tax forms

www.irs.govQuestions were added to help tax return preparers self-report issues with compromised PTINs, data breaches/security incidents, return count discrepancies or if someone used their identity to obtain a PTIN. Purpose of Form. Use Form 14157 to file a complaint against a tax return preparer or tax preparation business. Tax professionals can use ...