Search results with tag "Preparer tax"

New York State Modernized e-File (MeF) Guide For Return ...

www.tax.ny.govTax return preparer penalties NYS Tax Law, Article 22, § 697(e) and Article 37, § 1825, prescribe penalties for violation of confidentiality of taxpayer information requirements. NYS Tax Law §§ 32 and 685 prescribe penalties for paid preparers who fail to meet their responsibilities. Tax preparers are subject to these penalties if they fail ...

2021 Clergy Tax Return Preparation Guide - CPG

www.cpg.orgA Supplement to the 2021 Clergy Tax Return Preparation Guide for 2020 Returns For the 2020 tax year, the ... and tax preparers in better understanding ... a section on tax highlights addresses recent tax changes. Second, a question-and-answer format addresses key tax issues, and information provided in the guides and how it specifically applies ...

Publication 135 Consumer Bill of Rights Regarding Tax ...

www.tax.ny.govRegarding Tax Preparers www.tax.ny.gov Pub 135 (11/21) Office of Professional Responsibility We're committed to holding tax return preparers to the highest standards of quality service. We work closely with professional societies, consumer advocacy groups, and law enforcement to ensure all tax preparers perform their duties in an ethical and

Office of Tax and Revenue D-20ES 2021 D-20ES Franchise Tax ...

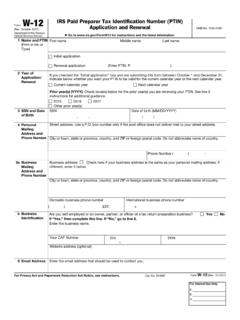

otr.cfo.dc.gov•The Preparer Tax Identification Number (PTIN) is an identification number issued by the IRS that all paid tax preparers must use on tax returns or claims for refund. You must wait until you receive a TIN before you file a DC return. Your return may be rejected if your TIN is missing, incorrect or invalid. Help us identify your forms and ...

Page 22 - The New York City enhanced real property tax ...

www.tax.ny.govNew York City tax preparers .....34 . New York State School Tax Relief (STAR) Program .....34 . Suspension of STAR eligibility for taxpayers with past due state tax liabilities .....34 . Publication 36 (3/15) Introduction . This publication provides general tax information that may be of special ...

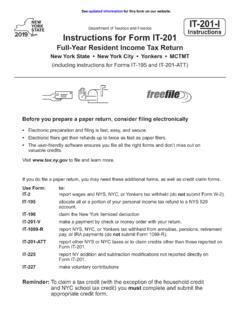

Full-Year Resident Income Tax Return

www.tax.ny.govapply to all tax preparers, for returns filed or required to be filed for tax years beginning in tax year 2019. • Treatment of certain gambling winnings Beginning in tax year 2019, New York State withholding is required for any gambling winnings from a wagering transaction within New York State if the proceeds from the

Amended and Prior Year Returns - IRS tax forms

apps.irs.govHow do I complete the amended return using tax software? Volunteer tax preparers can amend returns regardless of where the original return was prepared, using tax software. Remember to follow the interview process and use the research tools to prepare an accurate return. Tax Software Hint: For software entries, go to Volunteer Resource Guide ...

Office of Tax and Revenue D-40ES 2021 D-40ES Individual ...

otr.cfo.dc.govtax using a computer-prepared or computer-generated substitute ... tification Number (ITIN) or Preparer Tax Identification Number (PTIN). ... Enter 1 if married/registered domestic partner filing jointly or filing separately on same return and your spouse/registered domestic partner is …

Third-Party Verification Letters: Questions and Answers

www.aicpa.orgadditional challenges. See questions .02 and .07 .10, which address many of the tax issues involved. ... Section 301.7216-3 actually makes it a crime for a tax preparer to disclose client tax return information to a third party without ... an ethical violation. Providing assurance on solvency is not a decision about risk—it’s an ethics ...

W-12 IRS Paid Preparer Tax Identification Number (PTIN)

www.irs.govForm W-12 (Rev. October 2017) Department of the Treasury Internal Revenue Service . IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal

Tax Preparer Instructions for Setting Up and Using the ...

www.lctcb.org2 What’s New for Tax Year 2011 The following lists some of the new functionality in the Tax Preparer module of the 2011 individual online eFiling. Automatic Recall of Taxpayer Information from Year to Year - eFiling now remembers your taxpayer’s address and income history from year to year.

Preparer IRS Answer Question - IRS tax forms

www.eitc.irs.govpaid tax preparer's due diligence requirements and the . Preparer Question IRS Answer . consequences of not filing an accurate return. We have a checklist to make sure our clients are eligible for the EITC. We determined they were not eligible and did not claim the EITC on the return. But, the . IRS

Similar queries

Return, Tax return, Preparers, Tax preparers, Tax issues, Tax Preparers www.tax.ny.gov, Tax return preparers, Preparer Tax, Amended, IRS tax forms, Amended return, Prepared, Registered, Third-Party Verification Letters: Questions and Answers, Tax preparer, Ethical, Tax Preparer Instructions for Setting, Preparer IRS Answer, Preparer, IRS Answer