Preparer Irs Answer

Found 4 free book(s)VITA/TCE QUALITY REVIEW REFRESHER - IRS tax forms

www.irs.govThe volunteer tax preparer helps the quality reviewer by: • Providing a completed Form 13614-C, which means all taxpayer information is filled-in; all questions are answered; all “unsure” answers are clarified and changed to either “yes” or “no”; and preparer fields are completed.

Preparer IRS Answer Question

www.eitc.irs.govPreparer Question IRS Answer . If you are not comfortable with the answers or credibility of the client, then due diligence dictates you . do not . prepare the return. You may also want to present your client with the Publication 4717, Help Your Tax Preparer get You the

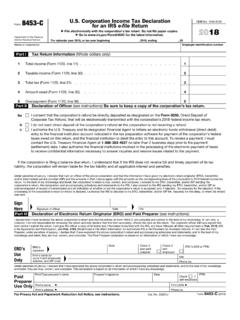

8453-C U.S. Corporation Income Tax Declaration - IRS tax …

www.irs.govIf the corporation’s return is filed through an ERO, the IRS requires the ERO’s signature. A paid preparer, if any, must sign Form 8453-C in the space for Paid Preparer Use Only. But if the paid preparer is also the ERO, do not complete the paid preparer section. Instead, check the box labeled “Check if also paid preparer.” Use of PTIN

IRS Difficulty of Care Income Exclusion Information

www.publicpartnerships.com•IRS Notice 2014-7, at this time, applies only to Federal Income Withholding Tax. •Some Attendants are already FICA/FUTA exempt and this does not prevent them from also qualifying for the DOC income exclusion. •The IRS DOC income exclusion is unrelated to the Live-In Domestic Employee Exemption from the overtime provisions of