Search results with tag "Tax return preparer"

Registered Tax Return Preparer Test Explained

www.irs.govA paid tax return preparer must take the Registered Tax Return Preparer competency test and meet the other requirements for becoming a Registered Tax Return Preparer unless the tax return preparer is a: o Certified Public Accountant, attorney, or an Enrolled Agent; o Supervised preparer, which is an individual who: Does not, and is not required ...

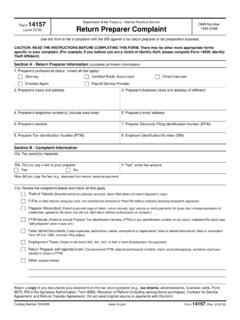

14157 (June 2018) Return Preparer Complaint

www.irs.govUse Form 14157 to file a complaint against a tax return preparer or tax preparation business. Tax professionals can use this form to report events that impact their PTIN or business. Individuals who are paid to prepare federal tax returns must follow ethical standards and guidelines as established in Treasury Department Circular 230.

Publication 135 Consumer Bill of Rights Regarding Tax ...

www.tax.ny.govRegarding Tax Preparers www.tax.ny.gov Pub 135 (11/21) Office of Professional Responsibility We're committed to holding tax return preparers to the highest standards of quality service. We work closely with professional societies, consumer advocacy groups, and law enforcement to ensure all tax preparers perform their duties in an ethical and

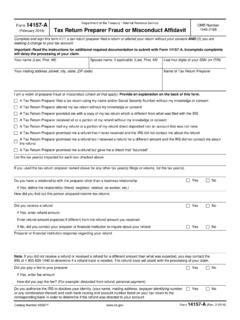

Form 14157-A Tax Return Preparer Fraud or Misconduct …

www.irs.govTax Return Preparer Fraud or Misconduct Affidavit - Complete form in its entirety and sign under penalties of perjury. If your filing status is Married Filing Joint, at least one signature is required. Form 14157, Complaint: Tax Return Preparer - Complete form in its entirety. Information provided on this form will be shared with

Annual Filing Season Program - IRS tax forms

www.irs.govDepending on certain factors, a tax return preparer will need either 15 or 18 hours of continuing education from an IRS-approved continuing education provider. The following categories need 15 hours annually: • Anyone who passed the Registered Tax Return Preparer test administered by the IRS between November 2011 and January 2013.

LB&I Transaction Unit - IRS tax forms

www.irs.govAll Issues, Step 1: Initial Factual Development (cont’d) Sale of a Partnership Interest. Fact Element. Resources Tax return preparers normally use one of two methods to record the change of ownership on the Form 1065, Schedule M -2. − In the first method, on lines 2 and 6 of Schedule M-2 the preparers record the change ...

Tax Return Preparer Ethical Issues

taxces.complan agents and other qualified tax return preparers. Within each category, the IRS further delineates the permitted scope of responsibilities. In this chapter we will look at the scope of tax return preparer responsibilities. In so doing, we will discuss the practices identified as best practices by the IRS that tax preparers should follow in

Similar queries

Registered Tax Return Preparer Test Explained, Tax return preparer, Registered Tax Return Preparer, Preparer, Return Preparer, Form 14157, Form, Ethical, Tax Preparers www.tax.ny.gov, Tax return preparers, Tax preparers, Form 14157-A Tax Return Preparer Fraud or Misconduct, Tax Return Preparer Fraud or Misconduct Affidavit, Annual Filing Season Program, IRS tax forms, Issues, Preparers, Chapter