Search results with tag "Income tax return"

Form Maryland Return of Income Tax Withholding 2022 ...

www.marylandtaxes.govappropriate income tax return must be filed for the year in which the transfer of the real property occurred. The due date for each income tax return type can be found in the instructions to the specific income tax return. What to file The nonresident individual or nonresident entity must file the appropriate Maryland income tax return for the ...

PHILIPPINE TAX CALENDAR - AHC Certified Public Accountants

ahcaccounting.comIncome Tax Returns Form No. 1701 - Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts Form No. 1702Q - Quarterly Income Tax Return for Corporations, Partnerships and Other Non-Individual Taxpayers Form No. 1702-EX - Annual Income Tax Return for Use ONLY by Corporation, Partnership

Philippine Tax Calendar 2020 - AHC Certified Public ...

ahcaccounting.comIncome Tax Returns Form No. 1701 - Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts Form No. 1702Q - Quarterly Income Tax Return for Corporations, Partnerships and Other Non-Individual Taxpayers Form No. 1702-EX - Annual Income Tax Return for Use ONLY by Corporation, Partnership

Corporate Income Tax Booklet - nd.gov

www.nd.govaffecting corporate income tax will be summarized in the May 2017 or most recent practitioner’s income tax newsletter, which is available on our website. ... taxable income must file a corporation income tax return on or before the 15th day of the fifth month after the tax year ends. Short period return

WHAT’S NEW FOR LOUISIANA 2021 INDIVIDUAL INCOME TAX?

revenue.louisiana.govbenefit provided directly or indirectly by the state or federal government as a COVID-19 relief benefit if the income was included in the taxpayer’s Federal Adjusted Gross Income. Benefits may include payments from the ... income tax return, you must file a Louisiana income tax return reporting all income earned in 2021.

Who Must File You must file a New Jersey income tax return if–

www.nj.govretirement income exclusions, to reflect the period covered by each return. If your income for the entire year from all sources was $7,500 or less ($3,750 if filing status is married, filing separate return), no tax is due. You must attach a copy of your Federal income tax return or a statement to that effect if you did not file a Federal return.

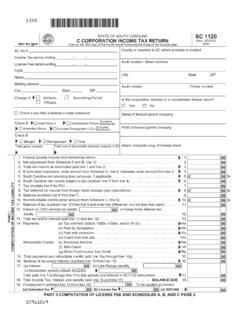

SC 1120 'C' CORPORATION INCOME TAX RETURN Return is …

dor.sc.gov1350 STATE OF SOUTH CAROLINA 'C' CORPORATION INCOME TAX RETURN (Rev. 10/5/17) Return is due on or before the 15th day of the 4th month following the close of the taxable year. 3091 SC 1120 ... REFUNDS OR ZERO TAX: SC DEPARTMENT OF REVENUE CORPORATE …

Employee’s Withholding Exemption Certificate

tax.ohio.govcompensation, you may need to make estimated income tax payments using form IT 1040ES or estimated school district income tax payments using the SD 100ES. Individuals who commonly owe more in Ohio income taxes than what is withheld from their compensation include: z Spouses who file a joint Ohio income tax return and both report income, and

Publication 58:(1/15):Information for Income Tax Return ...

www.tax.ny.govdefinition of a tax return preparer was added to section 32 to specify who would be required to register with the Tax Department and who would be excluded from the registration requirements. A tax return preparer who meets the definition of a commercial tax return preparer will also be required to pay an annual registration fee of $100. 6

Corporate Income Tax - Kansas Department of Revenue

www.ksrevenue.orgA Kansas Corporate income tax return must be filed by all corporations doing business in or deriving income from sources within Kansas who are required to file a federal income tax return, whether or not a tax …

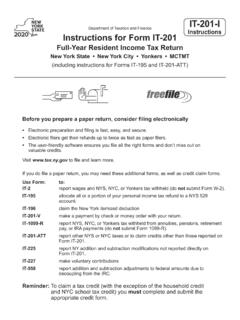

Full-Year Resident Income Tax Return

www.tax.ny.govTax Law §§ 174-c and 1701 have been extended through March 31, 2025. Tax Law § 174-c allows the Commissioner of Taxation and Finance (Commissioner) to serve income executions (wage garnishments) on individual tax debtors and, if necessary, on employers of tax debtors, for collection of fixed and final tax debts without filing a public warrant.

ITR-1 INDIAN INCOME TAX RETURN [For individuals being a ...

www.incometaxindia.gov.inITR-1 SAHAJ 2 INDIAN INCOME TAX RETURN [For individuals being a resident (other than not ordinarily resident) having total income upto Rs.50 lakh, having Income from Salaries, one house property, other sources (Interest etc.), and agricultural income upto Rs.5 thousand] ... 139(1)-On or before due date, 139(4) ...

भाग खण्ड ITR-1 INDIAN INCOME TAX RETURN …

www.incometaxindia.gov.inITR-1 SAHAJ INDIAN INCOME TAX RETURN [For individuals being a resident (other than not ordinarily resident) having total income upto Rs.50 lakh, having Income from Salaries, one house property, other sources (Interest etc.), and agricultural income upto Rs.5 thousand]

8716 Election To Have a Tax Year Other Than a

www.irs.govincludes the 1st day of the tax year the election will be effective, or . 2. The due date (not including extensions) of the income tax return for the tax year resulting from the section 444 election. Items . 1 . and . 2 . relate to the tax year, or the return for the tax year, for which the ending date is entered on line 5 above.

Volunteer Income Tax Assistance (VITA) / Tax Counseling ...

www.irs.govVolunteers are trained to assist in the filing of Form 1040, U.S. Individual Income Tax Return, and Form 1040-SR, U.S. Income Tax Return for Seniors, and certain schedules and forms. The Scope of Service chart in Publication 4012 covers limitations or expansion of scope of service for each certification level. This list is not all-inclusive.

2020 DELAWARE Resident Individual Income Tax Return

revenuefiles.delaware.govSteps for Preparing Your Return . Step 1. Complete your federal income tax return and any other state return(s). They will be used in preparing your Delaware return. Step 2 Fill in the top boxes on the front of the form (name, address, filing status). See page 5 of this booklet.

MO-1040 2019 Individual Income Tax Return - Long Form

dor.mo.govTotal tax from federal return. Do not enter federal income tax withheld. 12. Federal tax percentage – Enter the percentage based on your 9. 00. 10. 00. 11. 00. 12. 14. 00. 14. Missouri standard deduction or itemized deductions. • Single or Married Filing Separate - $12,200 • Head of Household - $18,350 *19322020001* 19322020001. Income.

2017 PA Corporate Net Income Tax - CT-1 Instructions (REV ...

www.revenue.pa.goveral income tax return will automatically be granted an exten - sion to file RCT-101, PA Corporate Net Income Tax Report. Corporate taxpayers granted a federal extension must indi -

INDIAN INCOME TAX RETURN Assessment Year FORM ITR-1 …

www.incometax.gov.inGross Total Income (B1+B2+B3) (If loss, put the figure in negative) Note: To avail the benefit of carry forward and set of loss, please use ITR -2 B4 PART C – DEDUCTIONS AND TAXABLE TOTAL INCOME (Refer instructions for Deduction limit as per Income-tax Act. Please note

How to Complete the Income Tax Return for Trusts

downloads.sarsefiling.co.zaThis guide is designed to help you complete the income tax return for trusts (IT12TR) accurately and properly. For further assistance visit the local SARS office or contact the SARS Call Centre at 0800 00 SARS (7277). The return must be completed and submitted by 19 December 2008 if you submit manually. If, however, you submit your return

2019 Virginia Resident Form 760 Individual Income Tax …

www.tax.virginia.govIndividual Income Tax Return File by May 1, 2020 — PLEASE USE BLACK INK 'R \RX QHHG WR ÀOH" 6HH /LQH DQG ,QVWUXFWLRQV 1. ... 2019 Form 760; Virginia Resident Individual Income Tax Return Created Date: 1/15/2020 3:14:00 PM ...

INDIAN INCOME TAX RETURN Assessment Year FORM …

incometaxindia.gov.inB5 Gross Total Income (B1+B2+B3+B4) To avail the benefit of carry forward and set of loss, please use ITR -3/5. B5 PART C–DEDUCTIONS AND TAXABLE TOTAL INCOME (Refer to instructions for Deductions limits as per Income-tax Act and

2021 Form 512-S Oklahoma Small Business Corporation …

oklahoma.govincome tax return, showing their respective amount of income and tax withheld. Copies of Form 500-Bs, along with the cover Form 501, must be electronically filed with the OTC by the same date. Each nonresident shareholder must provide a copy of the Form 500-B with their Oklahoma income tax return as verification for this withholding.

2020 PA-40 NRC - Nonresident Consolidated Income Tax ...

www.revenue.pa.govNonresident Consolidated Income Tax Return, a return filed on behalf of a group of qualifying electing nonresident indi-vidual owners that meet the individual filing requirements of Pennsylvania personal income tax law. Signed Statements for additional information. The department’s acceptance of a PA-40 NRC is conditional INDIVIDUAL

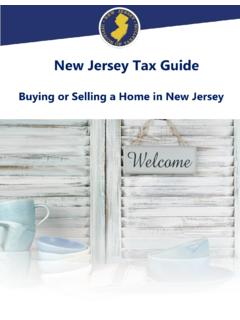

New Jersey Tax Guide - State

www.state.nj.usIncome Tax, including tax on any capital gain from the sale of property, when it comes time to file the NJ-1040 Resident Income Tax Return. New Jersey residents who sell their New Jersey home and move outside of this state are considered nonresidents for the purpose of the sale. New Jersey may require an estimated

2020 IA 1065 Partnership Return of Income - Iowa

tax.iowa.govindividual income tax return (or by a C corporation if it is a partner). If a Fuel Tax Credit is claimed, complete the IA 4136 and include it with the IA 1065. Each partner’s share is recorded in Part III of the partner’s IA Schedule K-1. Other Tax Credits . ...

filling out the paper form followingby a prescriptive ...

www.ritaohio.comincome tax return is automatically extended as well. However, you must provide a copy of the federal extension with your tax year 2020 Form 37 on or before October 1, 20521. If you have not requested or received a federal extension you may receive an extension for the filing of your municipal income tax return by completing Form 32 EST-EXT ...

Part-Year Residents and Nonresidents - State

www.state.nj.usNew Jersey Income Tax that was either withheld or remitted through estimated payments. When she files her New Jersey return, Marianne must enclose a copy of her federal income tax return. If she did not file a federal return, she must enclose an informal statement – written, signed, and dated by

Convenience of the Employer Rule

www.cga.ct.govThe convenience rule also has implications for the income tax credit states allow resident taxpayers ... (Connecticut Resident Income Tax Return Instructions, 2019 Form CT-1040, p. 5). ... State Tax Notes, November 2, 2020 (available through the Legislative Library)).

WHAT’S NEW FOR LOUISIANA 2021 INDIVIDUAL INCOME TAX?

revenue.louisiana.govIndividual Income Tax Return, has been discontinued. All ... For the 2021 tax year, credits from 2016 through 2020 can be applied on Line 3. Any remaining child care credit from 2015 ... estates, trusts, or partnerships is taxable to Louisiana. See Revenue Information Bulletin 10-005 for more information.

Form 8586 Low-Income Housing Credit - IRS tax forms

www.irs.gov(Rev. 12-2016) Form 8586 (Rev. 12-2016) Page . 2 General Instructions ... Estates or trusts. Allocate the low-income housing credit on line 12 between the estate or trust and the beneficiaries in the ... instructions for their individual income tax return. The estimated

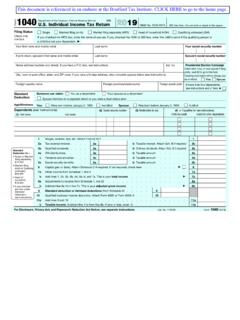

1040 U.S. Individual Income Tax Return 2019

www.bradfordtaxinstitute.comForm. 1040 . Department of the Treasury—Internal Revenue Service (99) U.S. Individual Income Tax Return . 2019. OMB No. 1545-0074. IRS Use Only—Do not write or staple in this space.

NJ 1040 - New Jersey Resident Income Tax Return

www.nj.govIncome Tax Return. Nae(s as shon on or N-Your Soia Seurit Nuber 15. Wages, salaries, tips, and other employee compensation (State wages from

2016 Form 100 California Corporation Franchise or Income ...

www.ftb.ca.gov3601163 Form 100 C1 2016 Side 1 TAXABLE YEAR 2016 California Corporation Franchise or Income Tax Return FORM 100 Schedule Q Questions (continued on Side 2) A FINAL RETURN…

2021 Child Tax Credit (CTC) Sign-up Guide for Non-filers

www.whitehouse.govDid not file a tax return for 2020 ... Were otherwise not required to file a federal income tax return for 2020 ... Check out this checklist. Each child must meet all of these

IT-ELEC-03-G01 - How to complete the company Income Tax ...

www.sars.gov.zathe completion, submission and management of the Company Income Tax Return (ITR14) via eFiling. This document must be read in conjuction with the following External Guide - How to …

2021 Form OR-40, Oregon Individual Income Tax Return for ...

www.oregon.govSigning this return does not grant your preparer the right to represent you or make decisions on your behalf. For more information, see the instructions for the Tax Information Authorization and Power of Attorney for Representation form on our website. Important: Include a copy of your federal Form 1040, 1040-SR, 1040-X, or 1040-NR.

What is Estimated Tax Check or Money Order State of New ...

www.state.nj.usbirth of the first person listed on your New Jersey Income Tax return to make a payment. Estates and trusts need their federal employer identification number and either the date of the dece-dent’s death or the date the trust was created. E-check payments of estimated tax can be scheduled in advance. Credit Card (Processing Fees Apply).

State Guidance Related to COVID-19: Telecommuting Issues ...

www.hodgsonruss.comArkansas Checkpoint surveyed all 50 states, and the No guidance . Arkansas Department of Finance and Administration replied that "Arkansas has ... Resident Income Tax Return (Form 540NR) return to report the California sourced portion of your compensation. One way to calculate the portion of

2019 Form 100S California S Corporation Franchise or ...

www.ftb.ca.govCalifornia S Corporation Franchise or Income Tax Return FORM 100S For calendar year 2019 or fiscal year beginning and ending . (m m / d d / y y y y) (m m / d d / y y y y) RP Corporation name California corporation number FEIN Additional information. See instructions. California Secretary of State file number Street address (suite/room no.) PMB no.

Income Tax Return for Individuals

www.sars.gov.zaIndicate the number of tax free investment(s) Number of tax free investment(s) Y N Is this declaration made by a Tax Practitioner? N Income Tax Return for Individuals (Income Tax Act. No. 58 of 1962, as amended) Taxpayer Ref No.* Year of Assessment* E X A M P L E SARS_2021_LookFeel_ITR12_v2021.00.10 Example

Similar queries

Return, Income Tax, Income Tax Return, 1701, Annual Income Tax Return, Philippine Tax Calendar 2020, Corporate Income Tax, Income, Benefit, INCOME TAX RETURN Return, 1350, Corporate, Tax return, Kansas Department of Revenue, Corporate income tax return, 1 SAHAJ, Filing, 2020 DELAWARE Resident Individual Income Tax Return, Missouri, Virginia Resident Form 760 Individual Income Tax, Virginia Resident, Oklahoma, Oklahoma income tax return, 2020, Pennsylvania, New Jersey Tax, State, New Jersey, 2020 IA 1065 Partnership Return of Income, Corporation, New Jersey Income Tax, New Jersey return, 2016, Estates, Trusts, IRS tax forms, 2016 Form 100 California Corporation Franchise, Checklist, Form, Estates and trusts, Arkansas, California, California corporation