Corporate income tax return

Found 27 free book(s)GUIDE TO CORPORATE INCOME TAX RETURN - ird.gov.lk

www.ird.gov.lk2 GUIDE TO CORPORATE INCOME TAX RETURN - YEAR OF ASSESSMENT - 2017/2018 Asmt_CIT_015_E Example for correct filling of data The outlines of Schedules are as follows.

Instructions DR 0112 Related Forms - colorado.gov

colorado.govCorporate income tax returns are due on the fifteenth day of the fourth month after the end of your tax year, or by April 17, 2018, for traditional calendar year filers.

Corporate Income Tax - Kansas Department of Revenue

www.ksrevenue.orgA Kansas Corporate income tax return must be filed by all corporations doing business in or deriving income from sources within Kansas who are required to file a federal income tax return, whether or not a tax …

2016 Oklahoma Corporation Income and Franchise Tax …

ftp.zillionforms.com2016 Oklahoma Corporation Income and Franchise Tax Forms and Instructions Draft 10/13/16 ... combined corporate income and franchise tax return. • There has been a name change, the income tax ... homa income tax return, such election shall be binding.

2017 PA Corporate Net Income Tax - CT-1 Instructions (REV ...

www.revenue.pa.goveral income tax return will automatically be granted an exten - sion to file RCT-101, PA Corporate Net Income Tax Report. Corporate taxpayers granted a federal extension must indi -

2017 Instructions for Form 1120 - Internal Revenue Service

www.irs.govInstructions for Form 1120 U.S. Corporation Income Tax Return Department of the Treasury ... tax structure with a flat 21% corporate tax rate and repealed the corporate alternative minimum tax (AMT), effective ... Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure ...

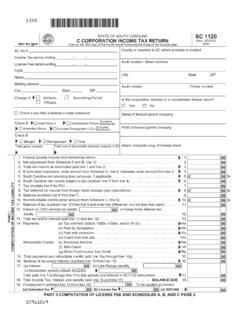

SC 1120 'C' CORPORATION INCOME TAX RETURN Return is …

dor.sc.gov1350 STATE OF SOUTH CAROLINA 'C' CORPORATION INCOME TAX RETURN (Rev. 10/5/17) Return is due on or before the 15th day of the 4th month following the close of the taxable year. 3091 SC 1120 ... REFUNDS OR ZERO TAX: SC DEPARTMENT OF REVENUE CORPORATE …

GENERAL INSTRUCTIONS - Louisiana Revenue

www.revenue.louisiana.govGenerally, separate corporate income and franchise tax returns must be filed by all corporate entities liable for a Louisiana tax ... following the close of an accounting period, an income tax return for the period closed and a franchise tax return for the succeeding period must be ... GENERAL INSTRUCTIONS. Page 14 • Department of Revenue ...

Corporate Income Tax - FloridaRevenue.com

floridarevenue.comGenerally, the Florida corporate income tax return is due: • On or before the first day of the fourth month following the close of the tax year, or • The 15th day following the due date, without extension, for the filing of the related

2017 Form 1120 - irs.gov

www.irs.govU.S. Corporation Income Tax Return For calendar year 2017 or tax year beginning, 2017, ... Corporate Report of Nondividend Distributions. See the instructions for Form 5452. If this is a consolidated return, answer here for the parent corporation and on Form 851 for each subsidiary. ... U.S. Corporation Income Tax Return …

2015 Form 20 Instructions, Oregon Corporation Excise Tax ...

www.oregon.govIn general, Oregon income tax law is based on federal income tax law. Oregon is tied to the federal definition of taxable income as of December 31, 2014; however, Oregon ... Oregon corporate excise tax return will change. The list will include Guatemala and the Republic of Trinidad and Tobago. Monaco is deleted from the list. The list will

What’s Inside - Florida Dept. of Revenue

floridarevenue.comCorporate Income/Franchise Tax Return for taxable years beginning on or after January 1, 2017 ... What’s Inside The Florida Corporate Income Tax Code does not conform to first year federal bonus depreciation for property placed in service on or after January 1, 2015,

Forms 512-FT, 512-FT-SUP Corporation Income and Franchise ...

www.ok.govFranchise Tax Forms and Instructions This packet contains: ... elect to file a combined corporate income and franchise tax return. To make this election file Form 200-F. Corporations not filing Form 200-F must file a stand-alone Oklahoma ... Corporation Income and Franchise Tax ...

Oregon 2016 Corporation Excise Tax Form OR-20 Instructions

www.oregon.govIn general, Oregon income tax law is based on federal income tax law. Oregon is tied to the federal definition of taxable income as of December 31, 2015; however, Ore - ... Oregon corporate excise tax return has changed. The list changed to include Guatemala and the Republic of Trini - dad and Tobago. Monaco is deleted from the list. The list

Minnesota Corporation Franchise Tax 2016

www.revenue.state.mn.usMinnesota Corporation Franchise Tax 2016 Includes instructions for Forms M4, M4I, M4A and M4T. ... • 13-08 — Income and Corporate Fran-chise Tax - Federal Entity “Check the Box” Classification - Revocation and ... Unrelated Business Income Tax Return. Exempt organizations include:

Corporation Income Tax - Idaho State Tax Commission

tax.idaho.govCorporation Income Tax Return Idaho Apportionment and Combined Reporting Adjustments Form 41S Form 44 ... of exercising its corporate franchise in Idaho. This includes a corporation in business solely to perform contracts with the U.S. Department of Energy at the Idaho National Laboratory.

Corporate Income Tax Booklet - North Dakota

www.nd.govAny news affecting corporate income tax will be summarized in the December 2016 practitioners’ income tax newsletter, which is available on our website. ... Credit for the income tax withheld can be claimed on the income tax return. A Form 1099-MISC is required to substantiate the income tax withheld.

CORPORATE INCOME AND FRANCHISE TAX INSTRUCTIONS …

www.dor.ms.govINCOME AND FRANCHISE TAX . INSTRUCTIONS. 2016. ... The Mississippi combination return of corporate incomeand franchise tax must be filed on or before the 15th day of the 4th ... Users cannot file Corporate Income and Franchise Tax Returns in TAP. However, tax preparers have the ability to file the tax …

Corporate Income Tax Booklet - nd.gov

www.nd.govaffecting corporate income tax will be summarized in the May 2017 or most recent practitioner’s income tax newsletter, which is available on our website. ... taxable income must file a corporation income tax return on or before the 15th day of the fifth month after the tax year ends. Short period return

Corporate Income Tax Return (Form 1120) Tx 8120 Project

www2.gsu.eduCorporate Income Tax Return (Form 1120) Tx 8120 Project For two years, you have worked for a CPA firm, Weil, Duit, Wright, & Company (EIN 33-1201885), located at 1840 Peachtree Street, Atlanta, GA 30314 (telephone 404-389-7724).

Instructions for Form N-30, Rev 2016 - hawaii.gov

files.hawaii.gov(REV. 2016) INSTRUCTIONS FOR FORM N-30 CORPORATION INCOME TAX RETURN (Section references are to the Internal Revenue Code (IRC), unless otherwise indicated) ... a payment is being made with this return, Form N-201V, Business Income Tax Payment Voucher, must be completed and attached to the return.

CORPORATE INCOME AND FRANCHISE TAX INSTRUCTIONS …

www.dor.ms.govThe Mississippi combination return of corporate income and franchise tax must be filed on or before the 15th day of the 4th month following the close of the accounting year.

2016 Form 100 California Corporation Franchise or Income ...

www.ftb.ca.gov3601163 Form 100 C1 2016 Side 1 TAXABLE YEAR 2016 California Corporation Franchise or Income Tax Return FORM 100 Schedule Q Questions (continued on Side 2) A FINAL RETURN…

What’s New for Louisiana 2017 Corporation Income Tax and ...

revenue.louisiana.govWhat’s New for Louisiana 2017 Corporation Income Tax and 2018 Corporation Franchise Tax? Calendar year – A new box was added to the face of the return for calen- dar year filers. Mark the box if the return is for a calendar year.

1120S U.S. Income Tax Return for an S Corporation Form

www.tax.govForm 1120S Department of the Treasury Internal Revenue Service U.S. Income Tax Return for an S Corporation Do not file this form unless the corporation has …

Simpler. Faster. Safer. - Office of Tax and Revenue

otr.cfo.dc.govauthorize another person to discuss the return with the Office of Tax and Revenue (OTR). • Modernized e-File (MeF) - Corporate taxpayers may now e-file the D-20 Corporation Franchise Tax Return through MeF.

INFORMATION BULLETIN # 15 - IN.gov

www.in.govincome tax return past the due date of the return and does not attach a valid extension of time to file or has not prepaid at least 90 percent of the tax reasonably expected to be due by the original due date.

Similar queries

Corporate income tax return, Corporate income tax, Kansas Department of Revenue, Income, Income tax return, 2016 Oklahoma Corporation Income and Franchise Tax, Corporate income, Tax Return, Income Tax, Corporate, Form 1120, Internal Revenue Service, Corporate tax, INCOME TAX RETURN Return, 1350, Return, GENERAL INSTRUCTIONS, Louisiana Revenue, What’s Inside, Franchise Tax Forms and Instructions, Oklahoma, Corporation Income and Franchise Tax, Minnesota Corporation Franchise Tax 2016, Corporation Income Tax, Idaho, Corporation Income Tax Return Idaho, Corporate Income Tax Booklet, North Dakota, CORPORATE INCOME AND FRANCHISE TAX INSTRUCTIONS, INCOME AND FRANCHISE TAX . INSTRUCTIONS. 2016, Mississippi, Corporate Income Tax Return Form, INSTRUCTIONS FOR FORM N-30, 2016 Form 100 California Corporation Franchise, Income Tax Return for an S Corporation, INFORMATION BULLETIN # 15