Transcription of What’s Inside - Florida Dept. of Revenue

1 Instructions for F-1120N. corporate income /Franchise Tax return R. 01/18. for taxable years beginning Rule on or after January 1, 2017. Florida Administrative Code Effective 01/18. The Florida corporate income Tax Code We encourage you to enroll for e-Services. When does not conform to first year federal you enroll in our e-Services program you will bonus depreciation for property placed receive a user ID and password. Advantages to in service on or after January 1, 2015, enrolling are: and before January 1, 2021. Additions your bank account and contact information to and subtractions from federal taxable are saved the ability to view your filing history income are required. See TIP #16C01-02.

2 The ability to reprint your returns and section (1)(e), Florida Statutes the ability to view bills posted to your account ( ), for more information. Also see the instructions for Schedule I Additions If you change your business name, location and/or Adjustments to Federal Taxable or mailing address, or close or sell your income , line 19 on page 8 and Schedule II business, immediately notify the Department. Subtractions from Federal Taxable income , The quickest way to notify us is online. Go to line 10 on page 9. , select "Information for Businesses and Employers," then select "Change address or account status.". Save Time and Paperwork with Electronic Filing. You can file and pay your Florida corporate income tax return ( Florida Form F-1120) electronically through the Internal Revenue Service's (IRS).

3 Modernized e-File (MeF) Federal/State Electronic Filing Program using electronic transmitters approved by the IRS and the Florida Department what 's Inside of Revenue . The Department also has an online application for corporate income tax payments u Who must p. 2. and filing Florida forms F-1120A ( Florida corporate u When to file and p. 2. Short Form income Tax return ), F-1120ES. (Declaration/Installment of Florida Estimated u Estimated p. 4. income /Franchise Tax), and F-7004 ( Florida Tentative income /Franchise Tax return and u Special p. 4. Application for Extension of Time to File return ). u Line-by-line instructions .. p. 5. You must file and pay electronically if you paid $20,000 or more in tax during the State of u Contact p.

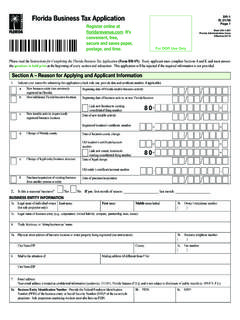

4 16. Florida 's prior fiscal year (July 1 June 30). General Information It is not included in a Florida or federal consolidated corporate income tax return . corporate income tax is imposed by section (s.) , Florida Statute ( ). It claims no tax credits other than tentative tax payments or estimated tax payments. Who Must File a Florida corporate It is not required to pay Federal Alternative Minimum Tax. income /Franchise Tax return ? Electronic Filing You are able to file and pay your Florida corporate income tax All corporations (including tax-exempt organizations) doing return ( Florida Form F-1120) electronically through the IRS. business, earning income , or existing in Florida . MeF Federal/State Electronic Filing Program.

5 You must file and pay electronically if you paid $20,000 or more in tax during Every bank and savings association doing business, the State of Florida 's prior fiscal year (July 1 June 30). The earning income , or existing in Florida . Department also has an online application for corporate income All associations or artificial entities doing business, tax payments and filing Florida forms F-1120A, F-1120ES, earning income , or existing in Florida . Declaration/Installment of Florida Estimated income /Franchise Tax, and F-7004, Florida Tentative income /Franchise Tax return Foreign (out-of-state) corporations that are partners or and Application for Extension of Time to File return . Go to the members in a Florida partnership or joint venture.

6 A Florida Department's website for more information. partnership is a partnership doing business, earning income , or existing in Florida . Using Software to Prepare Your return A limited liability company (LLC) classified as a If you use commercial software to prepare and file your paper corporation for Florida and federal income tax purposes return : is subject to the Florida income Tax Code and must file a The Department of Revenue must approve all vendor Florida corporate income tax return . software that develops paper tax forms. Ask the vendor for An LLC classified as a partnership for Florida and federal proof that you are using approved software. income tax purposes must file a Florida Partnership Make sure that the software is for the correct year.

7 You Information return ( Florida Form F-1065) if one or more of its cannot use 2015 software to produce 2016 tax forms. owners is a corporation. In addition, the corporate owner of an LLC classified as a partnership for Florida and federal income Visit the Department's website to obtain a list of approved tax purposes must file a Florida corporate income tax return . software vendors. A single member LLC disregarded for Florida and federal If you used software to produce your tax return last year, you income tax purposes is not required to file a separate Florida will not receive a corporate income tax return package this corporate income tax return . The income must be reported year.

8 On the owner's return if the single member LLC is owned, directly or indirectly, by a corporation. The corporation must file Florida Form F-1120, reporting its own income and the When to File and Pay income of the single member LLC, even if the only activity of the corporation is ownership of the single member LLC. When is Florida Form F-1120 Due? Homeowner and condominium associations that file Generally, Florida Form F-1120 is due the later of: federal Form 1120 ( Corporation income Tax return ) (1) For tax years ending June 30, the due date is on or before must file Florida Form F-1120 or F-1120A regardless of the first day of the fourth month following the close of the whether any tax may be due.

9 If you file federal Form 1120-H tax year. For all other tax year endings, the due date is on or ( income Tax return for Homeowners Associations), you before the first day of the fifth month following the close of are not required to file a Florida return . the tax year. For example, for a taxpayer with a tax year that Political organizations that file federal Form 1120-POL. ends December 31, 2016, the Florida Form F-1120 is due on or before May 1, 2017; or S corporations that pay federal income tax on Line 22c of federal Form 1120S. (2) The 15th day following the due date, without extension, for the filing of the related federal return for the taxable year. For Tax-exempt organizations that have unrelated trade or example, if the federal return is due on May 15, the related business taxable income for federal income tax purposes Florida Form F-1120 is due on June 1.

10 Are subject to Florida corporate income tax and must file either Florida Form F-1120 or F-1120A. You must file a return , even if no tax is due. Florida corporate Short Form F-1120A If the due date falls on a Saturday, Sunday, or federal or state holiday, the return is considered to be filed on time if Corporations or other entities subject to Florida corporate postmarked on the next business day. income tax must file Florida Form F-1120 unless qualified to file Florida corporate Short Form income Tax return , Florida Form For a calendar of filing due dates for Florida corporate income F-1120A. tax returns go to the Department's website at: Who is Eligible to File Florida Form F-1120A?