Search results with tag "Fatca"

Supplementary Guide to help complete your W-8BEN-E - …

www.commsec.com.autype and FATCA status that are most appropriate to your circumstances. If you believe that your entity type and FATCA status are different to the ones listed above, please contact the International trading desk on 1300 361 170 to discuss your details. You can use the ‘Help Determine FATCA Status’ tool to help you select the correct FATCA ...

Guide de classification des entités dans le cadre de FATCA ...

www.credit-suisse.comFATCA au sein de votre entité et que vous connaissez déjà votre classification FATCA, veuillez remplir un formulaire W-8BEN-E ou W-8IMY, ou un «Formulaire d’autocertification FATCA», et le fournir à votre conseiller clientèle.

Self-Certification for Individual - FATCA/CRS Declaration Form

npscra.nsdl.co.inSelf-Certification for Individual - FATCA/CRS Declaration Form Name of Subscriber: Permanent Retirement Account Number (PRAN): Date of Birth: FATCA/CRS Declaration Form Part I- Please fill in the country for each of the following: 1 Country of: a) Birth b) Citizenship c) Residence for Tax Purposes 2 US Person (Yes / No)

IRS: Foreign Account Tax Compliance Act (FATCA)

www.irs.govof certain foreign entities with substantial U .S . owners . A Foreign Financial Institution may agree to report certain information about its account holders by registering to be FATCA compliant. The FATCA Registration System is a secure, web-based system that Financial Institutions (FIs) may use to register completely online as a Participating

Foreign Account Tax Compliance Act (FATCA): Entity ...

www.fatca.hsbc.comappropriate IRS (Internal Revenue Service) W-series form confirming the entity’s FATCA classification (also known as Chapter 4 status). It is the information on this form (and supporting documentation where appropriate) that we will rely upon to fulfil our legislative reporting requirements where necessary in respect of FATCA and US Persons.

Re-KYC Form (updation of KYC Information) Cum FATCA / …

kotak.comPage 2 of 3 FATCA / CRS DECLARATION FOR INDIVIDUAL ACCOUNTS (Including Sole Proprietor) Note: The information in this section is being collected because of enhancements to Kotak Mahindra Bank’s new account on-boarding procedures in order to comply with Foreign Account Tax Compliance Act (FATCA) requirements pursuant to

FORMULAIRE D’AUTO-CERTIFICATION DE RESIDENCE …

www.cgd.frMod 569 – AEOI FATCA – Auto-certification Personne physique - version Juin 2019 3 GLOSSAIRE Ces définitions sont asées sur les normes d’é hanges automatiques de renseignements, le Common Reporting Standard (CRS) ainsi que sur l’a ord FATCA on lu entre la Fran e et les Etats-Unis.

2018 Form 1099-MISC - IRS tax forms

www.irs.govFATCA filing requirement. If the FATCA filing requirement box is checked, the payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement. You also may have a filing requirement. See the Instructions for Form 8938. Amounts shown may be subject to self-employment (SE) tax. If your net income

Trading Account Number / Login ID

secure.icicidirect.comForm No. / Trading Account No. / User ID - _____ FATCA / CRS Declaration (Individuals) 1. Are you a US Person Yes No ... to whom FATCA/CRS norms are applicable, in whose schemes/ products I ... reviewing this declaration and existing KYC data and only if permitted by AMCs.

Form W-9 (Rev. October 2018) - HSBC

www.fatca.hsbc.comInternal Revenue Service . Request for Taxpayer ... The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because

Self-Certification / U.S. Tax Forms An Overview

av.sc.comtax/ for further information on CRS and FATCA. Self-Certification Forms Overview Self- Certification Form – Individual This form is a Self-Certification to be completed by an individual account holder to establish the account holder’s tax status and jurisdiction(s) of tax residence for CRS and/or FATCA purposes.

ATAL PENSION YOJANA (APY)

npscra.nsdl.co.in$ FATCA/CRS is applicable for US Persons/Tax Residents other than India. FATCA/CRS Declaration Form needs to be submitted if you are an US person or your Country of Birth / Country of Citizenship / Country of Residence for Tax Purpose is a country other than India.

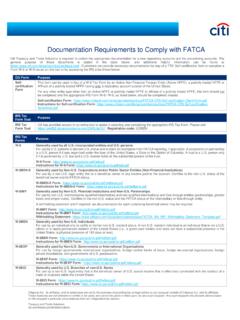

Documentation Requirements to Comply with FATCA

www.citibank.comDocumentation Requirements to Comply with FATCA . Citi Treasury and Trade Solutions is required to collect the appropriate documentation for a new depository accounts and for pre-existing accounts. The general purpose of these documents is stated in the table below, and additional helpful information can be found at

Required minimum distribution (RMD) form - MetLife

eforms.metlife.com4. I am not subject to FATCA reporting because I am a U.S. person and the account is located within the United States. (If you are not a U.S. Citizen or other U.S. person for tax purposes, please cross out the last two certifications and complete appropriate IRS documentation.)

Entity AEOI self-certification guidance notes

home.barclaysBeginning with the Foreign Account Tax Compliance Act (FATCA) in 2014 and additionally the Common Reporting Standard (CRS) in 2016, new international agreements involving a large number of countries have come into force to help tax authorities find and stop tax …

Entity AEOI self-certification form

home.barclaysEntity AEOI self-certification form The Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS) international agreements have come into force to help tax authorities find and stop tax evasion, especially relating to assets held in countries where the owner is not resident for tax purposes.

Entity Tax Residency Self-Certification Form (CRS-E(HK ...

www.crs.hsbc.comFATCA "), you may still need to provide additional information for the CRS as this is a separate regulation. Please tell us in what capacity you are signing in Part 5. For example you may be an authorised officer of the business or a ... Administrative Region that sets out information relating to the implementation of AEOI in Hong Kong:

Qualified transfer request - MetLife

eforms.metlife.comGuarantee requirements, and replacement requirements. • For all transfers and rollovers, mail this form and any paperwork required to ... I am not subject to FATCA reporting because I am a United States person and the account is located within the United States.

CRS Controlling Person

www.crs.hsbc.comwww.crs.hsbc.com . For joint or multiple controlling persons each individual will need to complete a copy of the form. Even if you have already provided information in relation to the United States Government’s Foreign Account Tax Compliance Act (FATCA), you may still need to provide additional infor mation for the CRS as this is a

CRS Individual Self-Certification Form (CRS-I)

www.hangseng.comSelf-Certification Form” (CRS-E). Similarly, if you are a controlling person of an entity, complete a “CRS Controlling Person ... Act (“FATCA”), you may still need to provide additional information for the CRS as this is a separate regulation. ... suitably updated self-certification and Declaration within 90 days of such change in ...

TYPE OF ENTITY RELEVANT SECTIONS - DBS

www.dbs.com.sgIf your FATCA classification is none of the above, kindly complete and submit the appropriate US IRS Form W-8. Passive Investment Entity • It derives more than 50% of its gross income (for the previous calendar year) from passive income such as …

Bank of Cyprus Privacy Statement

www.bankofcyprus.com.cyPEPs), FATCA / CRS info, authentication data [e.g. signature]. When we agree to provide products and services to you or another person (for example, a legal entity for which you are the authorized representative / agent or beneficial owner) then additional personal data may be collected and processed which may include:

Form W-8BEN Certificate of Foreign Status of Beneficial ...

www.rbcdirectinvesting.comInternal Revenue Service . Certificate of Foreign Status of Beneficial Owner for United ... If you are resident in a FATCA partner jurisdiction (i.e., a Model 1 IGA jurisdiction with reciprocity), certain tax account information may be provided to your jurisdiction of residence.

Insta S er Account No. - Axis Bank

www.axisbank.comFATCA-CRS Declaration ADDRESS *Desired Individual Name on the Card *Line1 *Line2 Landmark *City *Country *State *Pincode DEBIT CARD Entity Name to be printed on Card (First 14 characters of the name will be printed on the card) Y N If yes, Business Supreme Business Platinum Business Classic Y N KYC OF THE INDIVIDUAL Identity Proof Document Type

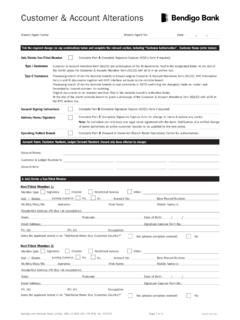

Customer & Account Alterations - Bendigo Bank

www.bendigobank.com.auAccount Name, Customer Numbers, Ledger/ Account Numbers (Record only those effected by change) Account Name: Account No’s: ... Foreign Accounts Tax Compliance Act (FATCA) - Completion of all questions is mandatory Are any applicants Citizens or …

FATCA AND CRS TAX RESIDENCY SELF-CERTIFICATION FORM

www.linkmarketservices.com.auPersonal Information Collection Notification Statement: Link Group advises that the Tax Laws Amendment (Implementation of the FATCA Agreement) Act 2014, which inserted Division 396–FATCA into Schedule 1 of the Taxation Administration Act 1953 and Tax Laws Amendment (Implementation of the Common Reporting Standard) Act 2016 (Cth) which gave domestic …

FATCA/CRS FAQs:- - ICICI Bank

www.icicibank.comThe Government of India has also joined the Multilateral Competent Authority Agreement (MCAA) on June 3, 2015 and financial institutions in india to comply with CRS. 3. Why do we need to ask the FATCA/CRS declaration from the customer? Government of India (GOI) has signed a Model 1 Inter-Governmental Agreement (IGA) with US on July 9, 2015.

FATCA & CRS terms & glossary page FATCA Form

digitalservices.meezanbank.comdefined terms in the Glossary of Terms provided below. Please use a separate form for each individual of a Joint Account. In case of Minor Account, guardian should complete this form on behalf of account holder i.e. minor. This form will remain valid unless there is a change in circumstances relating to

FATCA/CRS Declaration Form for Individual

www.icicibank.comFATCA/CRS Declaration Form for Individual To: ICICI Bank Limited India Part I- Please fill in the country for each of the following (Mandatory for all customers): *US person means - a citizen or resident of the US or a green card holder or an estate of a decedent who was a citizen or resident of US Part II. Refer the form filling guidelines II A.

FATCA and CRS Entity Classification Guides

business.aib.iefacilitate the implementation of FATCA. Participating Financial Institution Institution is a Financial Institution which has entered into an FFI agreement with the Internal Revenue Service (IRS) under section 1471(b) of the Internal Revenue Code and § 1.1471-4 of the Treasury treated as a participating FFI. Exempt Beneficial Owner

FATCA/CRS Declaration Form Appl. No - ICICI Bank

www.icicibank.comFATCA/CRS Declaration Form To: ICICI Bank Limited India Customer ID: Name: Primary Holder Joint Holder 1 Joint Holder 2 1. Country of : a) Birth b) Citizenship c) Residence for Tax Purposes Part I- Please fill in the country for each of the following (Applicable for all customers): 2.US Person (Refer definition at bottom) b.

FATCA W8-IMY Withholding Statement Template - Citi

www.citibank.comChapter 4 (FATCA) Withholding Statement ‐ Part A For use by Non‐qualified Intermediaries and Non‐withholding Foreign Flow‐through Entities This withholding statement is an integral part of the Form W‐8IMY and the information is provided under the …

FATCA SELF-DECLARATION FORM - INDIVIDUALS - …

www.emiratesnbd.comI understand that Emirates NBD may be required to make disclosures in relation to the information contained herein to appropriate government authorities and/or other regulatory authorities locally/internationally, and vide this document. I irrevocably permit Emirates NBD to make such disclosures to any such authorities without ...

THEORIES AND PARADIGMS IN SOCIOLOGY - …

facta.junis.ni.ac.rsThe scientific journal FACTA UNIVERSITATIS Series: Philosophy and Sociology Vol.1, No 5, 1998 pp. 455 - 464 Editor of series: Gligorije Zaječaranović Address: Univerzitetski trg 2, 18000 Niš, YU, Tel: (018) 547-095, Fax: (018)-547-950 THEORIES AND PARADIGMS IN SOCIOLOGY UDC:316.2:316.286 Petar Hafner Faculty of Economics, Niš Abstract. This ...

How To Read An Equifax Credit Report

www.700credit.comThe FACTA obligates a CRA to indicate when a consumer has placed an initial or extended fraud alert or active duty military alert on his or her file. INITIAL FRAUD VICTIM (Alert stays on file for 90 days) EXTENDED FRAUD VICTIM (Alert stays on file for 7 years) ACTIVE DUTY MILITARY (Alert stays on file for 12 months)

FOLDED STRUCTURES IN MODERN ARCHITECTURE

www.doiserbia.nb.rsFACTA UNIVERSITATIS Series: Architecture and Civil Engineering Vol. 10, No 1, 2012, pp. 1 - 16 DOI: 10.2298/FUACE1201001S FOLDED STRUCTURES IN MODERN ARCHITECTURE UDC 72:624=111 Nenad Šekularac, Jelena Ivanovi ć Šekularac, Jasna Čikić Tovarović University of Belgrade, Faculty of Architecture, Serbia

Compliance Plan - Paramount Health Care

www.paramounthealthcare.comTax Exempt Standards – requires all transactions with ‘disqualified persons’ be at Fair Market Value Fraud – intentional misrepresentations of material facts leading to harm The Fair and Accurate Credit Transaction Act of 2003 (FACTA) – standards for the prevention of identity theft Compliance Plan Content

GLOBALIZATION: THEORETICAL PERSPECTIVES, IMPACTS …

facta.junis.ni.ac.rsFACTA UNIVERSITATIS Series: Economics and Organization Vol. 5, No 3, 2008, pp. 263 - 272 GLOBALIZATION: THEORETICAL PERSPECTIVES, IMPACTS AND INSTITUTIONAL RESPONSE OF THE ECONOMY UDC 005.44 Zoran Stefanović Faculty of Economics, University of Niš, Trg kralja Aleksandra Ujedinitelja 11, Serbia

Trichomoniasis: the Facta - Centers for Disease Control ...

www.cdc.govtrichomoniasis THE FACTS • Trichomoniasis (TRICK o man NI a sis) is a sexually transmitted disease (STD). • Both men and women can get trichomoniasis.

SAFE Mortgage Loan Originator Test National Content Outline

mortgage.nationwidelicensingsystem.org2. Fair Credit Reporting Act (FCRA)/Fair and Accurate Credit Transactions Act (FACTA) 15 USC § 1681 et seq. a. Definition of a “fraud alert” b. Information included in a “consumer report” c. Permissible times when a credit report may be accessed d. Requirement to develop policies and procedures regarding identity theft e.

Account Holder Name Change Request - Chase.com

www.chase.comExemption from FACTA Reporting Code (if any) Social Security or Tax ID Number (required) According to the IRS Form W-9 instructions, if you are only submitting this form for an account you hold in the United States, you may leave the Exemption from FACTA Reporting code field blank. 1. Tell Us About Your Account 2.

Similar queries

FATCA, Self, FATCA/CRS Declaration Form, Foreign Account Tax Compliance Act, Foreign, Account, Internal Revenue Service, CRS Declaration, Individual, AUTO-CERTIFICATION DE RESIDENCE, IRS tax forms, Form, Declaration, Citi, Required minimum distribution (RMD) form, Certification, Entity Tax Residency Self-Certification Form CRS, Implementation, Requirements, Axis Bank, Customer & Account Alterations, CERTIFICATION FORM, ICICI Bank, Of India, India, FATCA/CRS declaration, FATCA & CRS terms & glossary page FATCA Form, Terms, Glossary of Terms, Internal Revenue, FATCA SELF-DECLARATION FORM - INDIVIDUALS, Emirates NBD, SOCIOLOGY, FACTA, Credit Report, Transactions, Fair, Facts, The Fair and Accurate Credit, GLOBALIZATION, Trichomoniasis: the Facta, Trichomoniasis THE, Trichomoniasis, Fair Credit, Fair and Accurate Credit Transactions Act, Credit, Account Holder Name Change Request