Fatca crs declaration

Found 6 free book(s)FATCA/CRS Declaration Form - DCB Bank

www.dcbbank.comSelf-Certification for Entities FATCA/CRS Declaration Form Part I A. Is the account holder a Government body/International Organization/listed company on recognized stock exchange

FATCA/CRS Self-Certification Declaration For a Legal Entity

www.stanlib.comFATCA Classification CRS Classification 2.10 Passive Non-Financial Foreign Entity (If you tick this box, please include individual self-certification forms for your Controlling Persons)

A guide to FACTA and the Common Reporting Standard

library.adviserzone.com04 A guide to FATCA and the Common Reporting Standard In summary We have included a matrix to help you check who may have to register and who may have obligations to comply with FATCA/CRS …

Entity Self-Certification Form for FATCA and CRS

www.alfi.luEntity Self-Certification Form for FATCA and CRS Instructions for completion We are obliged under local laws and regulations to collect and report to the Luxembourg tax …

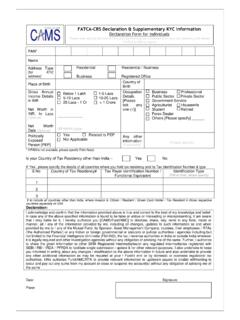

FATCA-CRS Declaration & Supplementary KYC Information ...

www.camsonline.comPlease seek appropriate advice from your professional tax professional on your tax residency and related PAN* Name Address Type [for KYC address]

Customer declaration of America (“U.S.”) or any state or ...

www.icicibank.comCustomer declaration (i) Under penalty of perjury, I certify that: 1. The applicant is (i) an applicant taxable as a US person under the laws of the United