Search results with tag "Internal revenue code"

DEPARTMENT OF THE TREASURY Internal Revenue …

www.treasury.govDEPARTMENT OF THE TREASURY Internal Revenue Service ... Internal Revenue Service (IRS), ... Internal Revenue Code (Code). Section 864(e) ...

Summary of Internal Revenue Code, Section 170(h)

ahhowland.comSummary of Internal Revenue Code, Section 170(h) PERTINENT PARTS OF INTERNAL REVENUE CODE RELATIVE TO CONSERVATION EASEMENTS U.S.C., 170(b)(1)(E), ...

N-LINE AX UTHORITIES FFICIAL AX UTHORITIES OP AX ERMS ...

nersp.osg.ufl.eduINTRODUCTION TO TAX SCHOOL STRUCTURE OF THE CODE. INTERNAL REVENUE CODE STRUCTURE. The following structure applies throughout the Internal Revenue Code. You . must understand the Code’s structure if you are to understand its numerous cross-references. Many rules, definitions, and exceptions apply to part of only

Section 1042: A tax deferred sale to an ESOP

www.dickinson-wright.comUnder §1042 of the Internal Revenue Code (“IRC”) eligible shareholders can ... Similar to the real estate provision IRC § 1031 and life insurance IRC § 1035. Example of tax benefits . ... Laws governing ESOP transactions and the rules under section 1042 of the Internal Revenue Code of 1986, as amended (“Code”), are complex and ...

Mandatory Internal Revenue Code 7216 Disclosure and …

c10626023.preview.getnetset.comMandatory Internal Revenue Code 7216 Disclosure and Consent Federal law requires you to obtain Client consent to disclose tax return information to third parties for purposes of assembling information, calculations, diagnostics, and processing of various IRS tax

The Internal Revenue Code - nsba.biz

www.nsba.bizThe Internal Revenue Code: Unequal Treatment Between Large and Small Firms A Study By: ... B. Section 79 -- Group Life Insurance Purchased for Employees 20

TAXPAYER RELIEF ACT OF 1997 - Congress

www.congress.govof section 15 of the Internal Revenue Code of 1986. (d) WAIVER OFESTIMATEDTAXPENALTIES.—No addition to tax shall be made under section 6654 or 6655 of the Internal Revenue Code of 1986 for any period before January 1, 1998, ... Sec. 1031. Extension and modification of taxes funding Airport and Airway Trust

26 CFR 301.6621-1: Interest rate. - Internal Revenue Service

www.irs.govPart 1 Section 6621.--Determination of Rate of Interest . 26 CFR 301.6621-1: Interest rate. Rev. Rul. 2017-6 Section 6621 of the Internal Revenue Code establishes the interest rates on

Tax Treaty Table 1 2019 - Internal Revenue Service

www.irs.govTable 1. Tax Rates on Income Other Than Personal Service Income Under Chapter 3, Internal Revenue Code, and Income Tax Treaties (Rev. Feb 2019) This table lists the income tax rates on interest, dividends, royalties, and other income that is not effectiv ely connected with the conduct of a U.S. trade or business.

Form 5305-EA Coverdell Education Savings …

www.irs.govForm 5305-EA (Rev. October 2016) Department of the Treasury Internal Revenue Service . Coverdell Education Savings Custodial Account (Under section 530 of the Internal Revenue Code)

2017 Form 4835 - Internal Revenue Service

www.irs.gov2 General Instructions Section references are to the Internal Revenue Code unless otherwise noted. Future developments. For the latest information about

2021 Limitations Adjusted as Provided in Section 415(d ...

www.irs.govSection 415 of the Internal Revenue Code (the Code) provides for dollar limitations on benefits and contributions under qualified retirement plans. Section 415(d) requires that the Secretary of the Treasury annually adjust these limits for cost-of-living increases. Other limitations applicable to deferred compensation plans are also affected by ...

2018 Limitations Adjusted As Provided in Section …

www.irs.gov2018 Limitations Adjusted As Provided in Section 415(d), etc. Notice 2017-64 . Section 415 of the Internal Revenue Code (the Code) provides for dollar limitations on

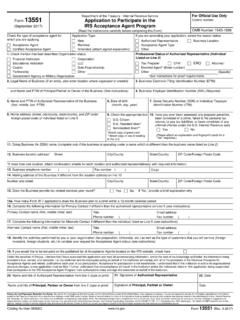

For Official Use Only Form 13551 Application to ...

www.irs.govNew Renewal. Amended (attach. signed explanation) ... Acceptance Agents and related publications each year of our participation. Acceptance for participation is not transferable. I understand that if this institution is sold or its organizational ... section 265(b)(5) of the Internal Revenue Code (Code) or §1.165-12(c)(1)(iv) of the regulations, a

What You Should Know About The Controlled …

www.murphyinsurance.com... coverage testing under Internal Revenue Code ... (All section references are to the Code unless ... What You Should Know About The Controlled Group, Affiliated ...

26 CFR 601.204: Changes in accounting periods and …

www.irs.gov-7- SECTION 1. PURPOSE This revenue procedure updates and revises the general procedures under § 446(e) of the Internal Revenue Code and § 1.446-1(e) of the Income Tax …

ALVAREZ & MARSAL TAXAND LIMITATIONS ON CORPORATE …

www.alvarezandmarsal.comInternal Revenue Code of 1986 (as amended, the “Code”) under the Tax Reform Act of 1986, PL 99-514. The new rules were generally effective with respect to ownership changes after December 31, 1986. PL 99-514, § 621(f)(1)(A)(i). Since 1986, the Congress has tinkered with the language of section 382 on several occasions (as recently

213 d Eligible Medical Expenses - BeniComp Select

www.benicompselect.comIRS Code Section 213(d) Eligible Medical Expenses An eligible expense is defined as those expenses paid for care as described in Section 213 (d) of the Internal Revenue Code.

Instructions for Form N-30, Rev 2016

files.hawaii.gov2016 STATE OF HAWAII—DEPARTMENT OF TAXATION (REV. 2016) INSTRUCTIONS FOR FORM N-30 CORPORATION INCOME TAX RETURN (Section references are to the Internal Revenue Code (IRC), unless otherwise indicated)

The Minister’s Housing Allowance - ECFA

www.ecfa.orgThe Minister’s Housing Allowance I ntroduction A substantial tax benefit is provided to qualifying ministers based on Section 107 of the Internal Revenue Code (IRC).

QUALIFYING FOR PUBLIC CHARITY STATUS: and the Section …

www.kalami.netQUALIFYING FOR PUBLIC CHARITY STATUS: The Section 170(b)(1)(A)(vi) and 509(a)(1) Test and the Section 509(a)(2) Test Tax-exempt status under Section 501(c)(3) of the Internal Revenue Code …

IRS Issues Final Section 415 Rules for Defined …

retire.prudential.comIRS Issues Final Section 415 Rules for Defined Benefit Plans ... BACKGROUND AND SUMMARY Section 415 of the Internal Revenue Code ... The section 415 ...

Trade or Business Expenses Under IRC § 162 and …

www.taxpayeradvocate.irs.govInternal Revenue Code ... Section 274(d) provides that ... 350 Most Litigated Issues — Trade or Business Expenses Under IRC § 162 and Related Sections

IRC Section 412(i) Plan Frequently Asked Questions

www.idakc.comWhat is an Internal Revenue Code (IRC) Section 412(i) plan? An IRC Section 412(i) plan is a qualified defined benefit pension plan, funded exclusively with annuity contracts or

§ 401 Qualified pension, profit-sharing, and stock …

www.irafinancialgroup.comInternal Revenue Code § 401 Qualified pension, profit-sharing, and stock bonus ... section 414(q)(4) ) paid to the participant by the employer for any year—

#1 - Taxpayer Advocate Service

www.taxpayeradvocate.irs.govInternal Revenue Code (IRC) §§ 6662(b)(1) and (2) authorize the IRS to impose a penalty if a taxpayer’s negligence or disregard of rules or regulations caused an ...

Instructions for Completing IRS Section 83(b) Form

www.fidelity.comInstructions for Completing IRS Section 83(b) Form ... I hereby make an election pursuant to Section 83(b) of the Internal Revenue Code of 1986, as amended, ...

Request for Product Sample Donation - Chattem

www.chattem.comRequest for Product Sample Donation Product sample donations are limited to non-profit organizations that qualify under Internal Revenue Code

PENSION PROTECTION ACT OF 2006 - Congress

www.congress.govSubtitle B—Amendments to Internal Revenue Code of 1986 Sec. 211. Funding rules for multiemployer defined benefit plans. Sec. 212. Additional funding rules for multiemployer plans in endangered or critical status. 29 USC 1001 note. Pension Protection Act …

2021 Gross Income Tax Depreciation Adjustment Worksheet ...

www.state.nj.us(the New Jersey maximum of $25,000 plus the federally allowed increased amount up to a maximum of $35,000). The Liberty Zone Depreciation Al-lowance is allowed if the asset meets Internal Revenue Code requirements. Calculation is …

Transfer Your Account to Schwab - Schwab Brokerage

www.schwab.comIRA account, Section 1035 of the Internal Revenue Code may allow you to make a tax-free exchange of one annuity contract for another annuity contract. Contact your tax or estate planning professional Do not complete this section if you are making a 1035 annuity exchange. For all 1035 annuity exchanges, call 1-888-311-4887. ADA

COMPENSATION COMMITT EE HANDBOOK …

www.meridiancp.com©Meridian Compensation Partners, LLC AAINT/ IPAD APP/ 409A-TAX DEFERRALS NOVEMBER 2011 PAGE 1. The Basics What is the rule? Section 409A of the Internal Revenue Code establishes a complex regime for taxation and regulation of

Internal Revenue Code (IRC or “Code”) - AICPA

www.aicpa.orgInternal Revenue Code (IRC or “Code”) section 451,1 regarding the ... 1 All references herein to “section” or “§” are to the Internal Revenue Code of ...

Internal Revenue Code section 1042 - Long Point …

www.longpointcapital.comESOP brief 2 What is an Internal Revenue Code section 1042 ESOP Rollover? Internal Revenue Code of 1986, as amended (Code), section 1042, allows

Internal Revenue Service Regulations: IRC Section …

www.accruit.comINTERNAL REVENUE SERVICE REGULATIONS: IRC §1031 1.1031(a)-1 PROPERTY HELD FOR PRODUCTIVE USE ... section 1031 of the Internal Revenue Code. The regulations affect

Internal Revenue Code § 223 - American Health Value

www.americanhealthvalue.comInternal Revenue Code § 223 ... section 1871 of the Social Security Act, except as otherwise provided by the Secretary). (D) Special rules for network plans

INTERNAL REVENUE CODE SECTION 280E: CREATING AN …

thecannabisindustry.orgSection 280E of the Internal Revenue Code forbids businesses from deducting otherwise ordinary business expenses from gross income associated with the “trafficking” of Schedule I or II substances, as defined by the Controlled Substances Act. The IRS has subsequently applied Section 280E to state-legal cannabis

Internal Revenue Code 415fibff LIITS - Colorado PERA

www.copera.orgInternal Revenue Code Section 415(b) imposes a . dollar limit on the benefit amount Colorado PERA can pay from tax-deferred trust funds. Since PERA members may retire at a relatively early

Internal Revenue Code Section 42 Low-Income …

www.treasurer.ca.govInternal Revenue Code § 42 Low-income housing credit. (a) In general. For purposes of section 38 , the amount of the low-income housing credit

Similar queries

DEPARTMENT OF THE TREASURY Internal Revenue, DEPARTMENT OF THE TREASURY Internal Revenue Service, Internal Revenue, Internal Revenue Code, Code, Section, Internal Revenue Code, Section, 1031, TAXPAYER RELIEF ACT OF 1997, Internal Revenue Service, Coverdell Education Savings, Coverdell Education Savings Custodial Account, Form 4835, Section 415, Notice 2017-64, Publications, Should Know About The Controlled, Should Know About The Controlled Group, Affiliated, Revenue, 213 d Eligible Medical Expenses, Code Section 213(d) Eligible Medical Expenses, INSTRUCTIONS FOR FORM N-30, The Minister’s Housing Allowance, QUALIFYING FOR PUBLIC CHARITY STATUS, Section 170, Issues Final Section 415 Rules for Defined, Issues Final Section 415 Rules for Defined Benefit, Trade or Business Expenses Under IRC, Internal Revenue Code ... Section, I) Plan Frequently Asked Questions, Instructions for Completing IRS Section, Request for Product Sample Donation, PENSION PROTECTION ACT OF 2006, Pension Protection Act, Transfer Your Account to Schwab, Schwab Brokerage, COMPENSATION COMMITT EE HANDBOOK, AICPA, Internal Revenue Code section 1042, Internal Revenue Service Regulations: IRC Section, INTERNAL REVENUE SERVICE REGULATIONS: IRC, Internal Revenue Code § 223, INTERNAL REVENUE CODE SECTION 280E, Section 280E, Colorado PERA, Internal Revenue Code Section