Search results with tag "Treasury"

Monthly Treasury Statement

www.fiscal.treasury.govThe Monthly Treasury Statement of Receipts and Outlays of the United States Government (MTS) is prepared by the Bureau of the Fiscal Service, Department of the Treasury and, after approval by the Fiscal Assistant Secretary of the Treasury, is normally released on the 8th workday of the month following the reporting month.

Coronavirus State & Local Fiscal ... - home.treasury.gov

home.treasury.govU.S. DEPARTMENT OF THE TREASURY Coronavirus State & Local Fiscal Recovery Funds: Overview of the Final Rule U.S. Department of the Treasury The Overview of the Final Rule provides a summary of major provisions of the final rule for informational purposes and is intended as a brief, simplified user guide to the final rule provisions.

Guidelines for Quarterly Reporting for ... - National Treasury

www.treasury.gov.zaTreasury Regulations 29.1.3(b) and 29.1.6(a)-(j) require schedule 2 or 3B public entities to report on their borrowing programme on a quarterly basis. The National Treasury also specifically requires public entities to report on guarantees issued …

DEPARTMENT OF THE TREASURY Internal Revenue Service

www.treasury.govDEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Part 1 [REG-142695-05] RIN 1545-BF00 Employee Benefits - Cafeteria Plans AGENCY: Internal Revenue Service (IRS), Treasury. ACTION: Withdrawal of prior notices of proposed rulemaking, notice of proposed rulemaking and notice of public hearing.

DEPARTMENT OF THE TREASURY Internal Revenue Service

public-inspection.federalregister.govDEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Part 1 [REG-118250-20] RIN 1545-BP94 Guidance on Passive Foreign Investment Companies and Controlled Foreign Corporations Held by Domestic Partnerships and S Corporations and Related Person Insurance Income AGENCY: Internal Revenue Service (IRS), Treasury.

Tier 3: 100%

hcarewards.lifeatworkportal.comInflation Protected Treas-ury Index Fund Barclays Capital Inflation-Linked U.S. Treasury Index 1.75% 3.51% 5.19% 7.45% 4.34% 3.12% Long-Term Treasury Index Fund Barclays Capital Long-term Treasury Index 0.46% -7.40% -10.13% 9.17% 3.33% 4.40% High Yield Corporate Bond Fund Bank of America Merrill Lynch High Yield Master Index

Determination Pursuant to Section l(a)(i) of Executive ...

home.treasury.govFeb 22, 2022 · Secretary of the Treasury, to operate or have operated in such sectors of the Russian Federation economy as may be determined, pursuant to section l(a)(i) of E.O. 14024, by the Secretary of the Treasury, in consultation with the Secretary of State. To further address the unusual and extraordinary threat to the national security, foreign policy,

Executive Order 13849 - United States Department of State

www.state.govof relevant departments and agencies, in consultation with the Secretary of State and the Secretary of the Treasury, as appropriate, shall ensure that the following actions are taken where necessary to implement the sanctions selected and maintained by the President, the Secretary of State, or the Secretary of the Treasury:

Updated Reporting Requirements for SLFRF Program Funds …

www.amplifund.com• An explanation of how revenue replacement funds ... Treasury plans to use this information to gain a better understanding of the intended impact, identify opportunities for technical assistance, and . Updated Reporting Requirements for SLFRF Program Funds understand the recipient’s progress in program implementation. The Treasury

DEPARTMENT OF THE TREASURY INTERNAL REVENUE …

www.irs.govdepartment of the treasury internal revenue service washington, d.c. 20224 june 28 1999 cc:ebeo:br4 wta-n-106593-99 number: 199934018 release date: 8/27/1999 uilc: 32.02-00 internal revenue service national office chief counsel advice memorandum for:

Internal Revenue Service Department of the Treasury

www.novoco.comFeb 14, 2022 · Internal Revenue Service Department of the Treasury Washington, DC 20224 Number: 202206016 Release Date: 2/11/2022 ... manner as may be prescribed by the Commissioner of Internal Revenue in the Internal Revenue Service forms or instructions, or in publications or guidance published in the Internal Revenue Bulletin.

U.S. Treasury Check Security Features

www.fiscal.treasury.govU.S. Treasury Check Security Features Ultraviolet Overprinting Pattern A protective ultraviolet pattern, invisible to the naked eye, consisting of four lines of “ FMS” or

DEPARTMENT OF THE TREASURY INTERNAL REVENUE …

www.irs.govdepartment of the treasury internal revenue service washington, d.c. 20224 may 1, 2000 number: 200025055 release date: 6/23/2000 cc:intl:idc: wta-n-108604-00 uilc: 32.01-00 7701.09-00 internal revenue service national office technical assistance memorandum memorandum for acting director, international district

Department of the Treasury Department of Labor Pension ...

www.dol.govDepartment of the Treasury Department of Labor Pension Benefit Guaranty Corporation Internal Revenue Service Employee Benefits Security Administration 21 Instructions for Form 5500 Annual Return/Report of Employee Benefit Plan Code section references are to the Internal Revenue Code unless otherwise noted. ERISA refers to the Employee ...

DEPARTMENT OF TREASURY Internal Revenue Service (IRS)

www.irs.govMay 05, 2003 · DEPARTMENT OF TREASURY Internal Revenue Service (IRS) 26 CFR Part 1 [TD 9056] RIN 1545-BA82 ... Division Counsel/Associate Chief Counsel (Tax Exempt and Government Entities). However, other personnel from the …

19 Internal Revenue Service Department of the Treasury

www.irs.govDepartment of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Purpose of Form Use Form 8962 to figure the amount of your premium tax credit (PTC) and reconcile it with advance payment of …

DEPARTMENT OF THE TREASURY TECHNICAL …

www.irs.govdepartment of the treasury technical explanation of the convention between the government of the united states of america and the government of japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and on capital gains, signed at washington on november 6, 2003 this is a technical ...

ANNEXURE B DEPARTMENT OF EMPLOYMENT AND LABOUR …

www.careersportal.co.zaNational Treasury Regulations, Supply Chain Management Systems and Processes, Broad Bases Black Economic Empowerment (BBBEE), Preferential Procurement Policy Framework Act (PPPFA), Skills: Negotiation, People Management, Problem Solving, Communication, Computer Literacy, Presentation,

INTEREST RATES FOR MONEY JUDGMENTS ... - …

www.courts.michigan.govat auctions of 5-year United States treasury notes during the 6 months immediately preceding July 1 and January 1, as certified by the state treasurer, and compounded annually, according to this section. Interest under this subsection is calculated on the entire amount of the money judgment, including attorney fees and other costs.

XML Schema 2 - United States Secretary of the Treasury

bsaefiling.fincen.treas.gov1.1 10/13/2017 Updates include: Section 3.3 Element Requirements ... (SSN/ITIN) and 9 (Foreign TIN) as acceptable values for the Consolidated Report ... The FinCEN XML Schema 2.0 User Guide outlines the business and validation rules to support the electronic batch

Z894 G.P.-S 81/329645 Pensions Administration ACB BANK ...

gepf.gov.zaZ894 ACB BANK PARTICULARS Please have this form completed by your bank as confirmation of your bank particulars. National Treasury Pensions Administration SEE INSTRUCTIONS OVERLEAF A) BENEFICIARY PARTICULARS Date C) PREVIOUS BANKING DETAILS OF ACCOUNT HOLDER (Complete only if banking details have changed)

21 Internal Revenue Service Department of the Treasury

www.irs.govstructural function and thus do not qualify for the credit. To qualify for the credit, the property must be certified for performance by the nonprofit Solar Rating Certification Corporation or a comparable entity endorsed by the government of the state in which the property is installed. The home doesn't have to be your main home.

Irregular expenditure caused by 9 - AGSA

www.agsa.co.zaSuch expenditure does not necessarily mean that money had been wasted or that fraud had been committed. It is an indicator of non-compliance in the process that needs to be ... Auditees in KwaZulu-Natal, the Free State, ... increased without approval by the provincial treasury. on the national and provincial audit outcomes for 2016-17 98 ...

3520, Michigan Sales and Use Tax Contractor Eligibility ...

www.michigan.govMichigan Department of Treasury 3520 (Rev. 05-15) Michigan Sales and Use Tax Contractor Eligibility Statement A real property contractor may use this form to obtain a statement from the property owner that materials to be affixed to and made a structural part of

10 STABLECOIN MYTHS: Internet Wildcat Banking or Always …

fs.hubspotusercontent00.netTreasury as a Money Services Business (MSB). ... prudential management and compliance can be classified as digital legal tender. MYTH THREE ... a few postal codes), to now having the opportunity to read, write and now own the very internet services we depend on.

1 of 11

www.kznworks.gov.zaPLEASE NOTE THAT THIS QUOTATION IS SUBJECT TO TREASURY REGULATIONS 16A ISSUED IN TERMS OF THE PUBLIC FINANCE MANAGEMENT ACT, 1999, THE KWAZULU-NATAL SUPPLY CHAIN MANAGEMENT POLICY FRAMEWORK AND THE GENERAL CONDITIONS OF CONTRACT. 1. Unless inconsistent with or expressly indicated otherwise by …

W-9 Request for Taxpayer - Internal Revenue Service

www.irs.govDepartment of the Treasury Internal Revenue Service . Request for Taxpayer Identification Number and Certification. ... Section references are to the Internal Revenue Code unless otherwise noted. ... the rules under section 1446 require a partnership to presume that a …

GRAP 1 - National Treasury

oag.treasury.gov.zaGRAP 3 –Accounting Policies, Changes in Accounting Estimates and Errors Effective 1 April 2020 ACCOUNTING POLICIES DEFINITION Accounting policies are specific principles, bases, conventions, rules and practices applied by an entity in …

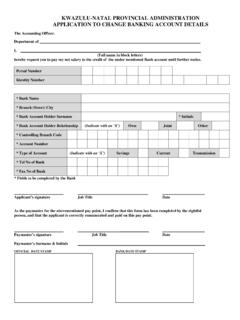

Application to Change Banking Account Details - KZN Treasury

www.kzntreasury.gov.zaKWAZULU-NATAL PROVINCIAL ADMINISTRATION APPLICATION TO CHANGE BANKING ACCOUNT DETAILS The Accounting Officer, ... * Controlling Branch Code * Account Number * Type of Account (Indicate with an ‘X’) Savings Current Transmission * Tel No of Bank ...

Covid-19 Vaccine Rollout Strategy 03 January 2020 - Bhekisisa

bhekisisa.orgDr Mark Blecher Member National Treasury ProfSalim AbdoolKarim Observer Chairperson: MAC on Covid-19 BishopMalusi Mpumlwana Observer Chairperson: Multi-Sectoral MAC on Social Behaivour. Vaccines Acquisition Task Team Primary objective of the task team is to co-ordinate the private sector ... • Emergency procurement procedures for vaccine, ...

FACT SHEET Investor Protections in Communication Protocol ...

www.sec.govfunction similarly to marketplaces operated by registered exchanges and ATS s and have become ... that, during at least four of the preceding six calendar months, had: (1) for U.S. Treasury Securities, three percent or more of the average weekly dollar volume traded in …

The Honorable Janet Yellen The Honorable Charles P. Rettig ...

www.feinstein.senate.govJan 26, 2022 · U.S. Department of the Treasury Internal Revenue Service 1500 Pennsylvania Avenue, NW 1111 Constitution Avenue, NW Washington, D.C. 20220 Washington, D.C. 20224 Dear Secretary Yellen and Commissioner Rettig: In light of the December 2021 Government Accountability Office (GAO)

Office of Foreign Assets Control 31 ... - home.treasury.gov

home.treasury.govFeb 08, 2022 · Because the Regulations involve a foreign affairs function, the provisions of E.O. 12866 of September 30, 1993, “Regulatory Planning and Review” (58 FR 51735, October 4, 1993), and the Administrative Procedure Act (5 U.S.C. 553) requiring notice of proposed rulemaking, opportunity for public participation, and delay in effective date

Australia to 2050 - Treasury

treasury.gov.authe 2010 intergenerational report 1 0 5 10 15 20 25 1970 1990 2010 2030 2050 0 5 10 15 20 25 65-84 85 and over Per cent Per cent Australia faces significant intergenerational challenges. Population ageing will mean that there will be fewer workers to support retirees and young dependants. This will place pressure on the economic growth that ...

FINANCING A SUSTAINABLE ECONOMY - National Treasury

www.treasury.gov.za4.1.2 Regulation 28 of the Pension Funds Act (2011)..... 21 4.1.3 Voluntary action by ... • Liability and disclosure risks – resulting from loss and damages, rising insurance costs, director’s liability and disclosure failures. ... Sustainable finance is essential for balanced and inclusive growth,3 based on the identification and . 20 ...

GUIDELINES FOR IMPLEMENTATION - National Treasury

www.treasury.gov.za2.9.1Medium Term Expenditure Framework (MTEF) 16 2.9.2Estimates of National Expenditure (ENE) 16 2.9.3 Estimates of Provincial Revenue and Expenditure (EPRE) 16 2.9.4 Classification of public entities 16 FORMATS FOR STRATEGIC AND ANNUAL PERFORMANCE PLANS 18 Strategic Plan format 19

159 - dpsa.gov.za

www.dpsa.gov.zaThe Provincial Department of Education: Kwazulu-Natal is an equal opportunity affirmative action employer ... of PFMA, PSA, Treasury Regulations, SASA, EEA, LRA and other prescripts of . 160 Education Law is a necessity. Computer literacy (MS Word, EXCEL, Access and ... Provide anti-fraud and ethics management. Provide computer auditing ...

Department of the Treasury Acquisition Procedures

home.treasury.govPart 1013—Simplified Acquisition Procedures . Subpart 1013.1—Procedures Subpart 1013.2—Actions At or Below the Micro-Purchase Threshold Subpart 1013.3—Simplified Acquisition Methods Subpart 1013.5—Simplified Procedures for Certain Commercial Items . Part 1014—Sealed Bidding . Subpart 1014.1—Use of Sealed Bidding Subpart 1014.2

Form 4988, Poverty Exemption Affidavit - Michigan

www.michigan.govMichigan Department of Treasury 4988 (05-12) Poverty Exemption Affidavit This form is issued under authority of Public Act 206 of 1893; MCL 211.7u. INSTRUCTIONS: When completed, this document must accompany a taxpayer’s Application for Poverty Exemption filed with the supervisor or the board of review of the local unit where the property is ...

TREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION

www.treasury.govJan 26, 2022 · Review of the Internal Revenue Service’s Purchase Card Violations Report and the Status of Recommendations. ... U.S. DEPARTMENT OF THE TREASURY WASHINGTON, D.C. 20220 TREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION: January 26, 2022 ... As a bureau of the Department of the Treasury, the Internal Revenue Service is …

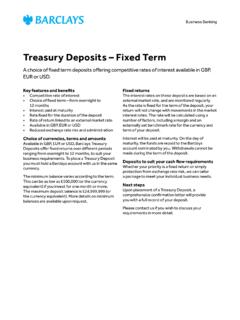

Treasury Deposits – Fixed Term - Barclays

www.barclays.co.ukBank UK PLC). They apply to all Fixed Term Treasury Deposit Accounts you hold with us. In the event of any inconsistency between these additional conditions and the general conditions of the Business Customer Agreement, these terms will apply in relation to the Fixed Term Treasury Deposit Account. 1. Availability

Similar queries

Treasury, The Treasury, Of the Treasury, Department of the Treasury Internal Revenue Service, Internal Revenue Service, Treas-ury, National, United States Department of State, Departments, Explanation, Technical, DEPARTMENT OF THE TREASURY INTERNAL REVENUE, Department of the treasury internal revenue service washington, Internal Revenue Service Department of the Treasury, Internal Revenue Service Department of the Treasury Washington, Internal Revenue, Treasury Check, Department of the Treasury Department, Section references, DEPARTMENT OF TREASURY, Revenue, Division, Department of the Treasury Internal Revenue Service Section references, Department, TREASURY TECHNICAL, Treasury technical explanation of the convention, United states, National Treasury, Supply Chain Management, Management, XML Schema, United States Secretary of the Treasury, Updates, ITIN, Guide, Z894, Function, Fraud, Natal, Provincial treasury, Provincial, Michigan, Prudential management, Codes, KWAZULU, Request for Taxpayer, Section, Practices, NATAL PROVINCIAL, Code, Acquisition, Procedures, Washington, Australia to 2050, Report, SUSTAINABLE, Regulation, Disclosure, Sustainable finance, GUIDELINES, Expenditure Framework, Expenditure, Department of the Treasury Acquisition Procedures, Simplified Acquisition, Simplified, Poverty Exemption Affidavit, DEPARTMENT OF THE TREASURY WASHINGTON, Department of the Treasury, Between, Agreement