Search results with tag "Expenditure"

THE INCOME-TAX ACT, 1961 ARRANGEMENT OF SECTIONS

www.indiacode.nic.in35. Expenditure on scientific research. 35A. Expenditure on acquisition of patent rights or copyrights. 35AB. Expenditure on know-how. 35ABA. Expenditure for obtaining right to use spectrum for telecommunication services. 35ABB. Expenditure for obtaining licence to operate telecommunication services. 35AC. Expenditure on eligible projects or ...

Social Expenditure (SOCX) Update 2020 Social spending ...

www.oecd.orgFigure 2. Pensions and health expenditure are the main items of public social spending Public social expenditure by broad social policy area, in percentage of GDP, in 2017/19 (or latest year available) Note: Countries are ranked by decreasing order of public social expenditure as a percentage of GDP. Spending on Active Labour Market

Annexure A: Irregular Expenditure Framework

www.treasury.gov.zabe recorded in the irregular expenditure Lead Schedule, as contained in Appendix B to this Framework. Confirmation of Non-compliance 17. Where it has been confirmed that the identified non-compliance does not constitute irregular expenditure, as defined in section 1 of the PFMA, the accounting officer or accounting authority must –

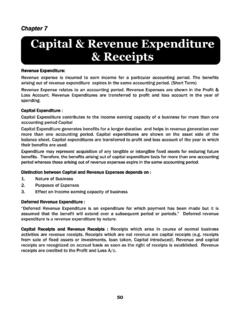

Chapter 7 Capital & Revenue Expenditure & Receipts

commonproficiencytest66.yolasite.comAn expenditure is a classified as capital expenditure when (a) The amount is large (b) It is shown in the balance sheet (c) It is to benefit a number of future years (d) …

Internal Revenue Service Department of the Treasury

www.irs.govexpenditure, the taxpayer has full present knowledge of each element of the expenditure, such as the amount, time, place, and business purpose. An expense account statement which is a transcription of an account book, diary, log, or similar record prepared or maintained at or near the time of the expenditure, is considered a

GUIDELINES FOR IMPLEMENTATION - National Treasury

www.treasury.gov.za2.9.1Medium Term Expenditure Framework (MTEF) 16 2.9.2Estimates of National Expenditure (ENE) 16 2.9.3 Estimates of Provincial Revenue and Expenditure (EPRE) 16 2.9.4 Classification of public entities 16 FORMATS FOR STRATEGIC AND ANNUAL PERFORMANCE PLANS 18 Strategic Plan format 19

FISCAL RESPONSIBILITY ACT, 2007

lawsofnigeria.placng.org14. Time limit for presentation of medium- term Expenditure Framework to Federal Executive Council. 15. Publication of medium- Term Expenditure Frame work in the Gazette. 16. Adjustment to the medium -Term Expenditure Framework. 17. Assistance to state and Local Government. PART III-THE ANNUAL BUDGET 18. Annual budget to be derived from Medium ...

Supply Chain Management: Enhancing compliance and ...

mfma.treasury.gov.zaSCM: Enhancing Compliance and Accountability July 2013 Page 4 of 8 “Termination for Default” in the General Conditions of Contract. The expenditure at this stage will not be classified as irregular expenditure. In the event that the same expenditure is detected in …

HMRC Company Losses Toolkit - GOV.UK

assets.publishing.service.gov.ukresult in non-allowable expenditure being incorrectly claimed or calculated. Conversely ... with generally accepted accounting practice form the starting point for the computation of ... For example adjustments are normally required for expenditure that is capital or not incurred wholly and exclusively for business purposes.

Chapter 5Chapter 5 - NCERT

www.ncert.nic.inRevenue Expenditure is expenditure incurred for purposes other than the creation of physical or financial assets of the central government. It relates to those expenses incurred for the normal functioning of the government departments and various services, interest payments on debt incurred by the government, and grants given to state governments

The Pure Theory of Public Expenditure Paul A. Samuelson ...

www.u.arizona.eduPUBLIC EXPENDITURE there is still this fundamental technical differ- ence going to the heart of the whole problem of social economy: by departing from his indoc- trinated rules, any one person can hope to snatch some selfish benefit in a way not …

ESTIMATES OF THE PROGRAM EXPENDITURE AND …

www.gov.nl.caBudgetary expenditures are classified into main objects by type of goods or services. The standard main objects used are as follows: 08.Loans, Advances and Investments 09.Allowances and Assistance 10.Grants and Subsidies. 11.Debt Expenses. 1. Salaries 2. Operating Accounts. Employee Benefits Transportation and Communications Supplies ...

Is migration good for the economy? - OECD

www.oecd.orgallocation of collectively accrued revenue and expenditure items Note: The “baseline” calculations include estimates for indirect taxes as well as expenditure on education, health and active labour market policy. Source: Liebig and Mo (2013).

OFFICE MEMORANDUM - DoPT

www.dopt.gov.inNo.11-1/2016/E.1I 8(7th CPC)/PUII(C) GOVERNMENT OF INDIA MINISTRY OF FINANCE Department of Expenditure (7th CPC matters) North Block, New Delhi Dated: 22.09.2017 OFFICE MEMORANDUM Subject: Ceilings in respect of Office Expenditure on hospitality- …

INLAND REVENUE BOARD OF MALAYSIA TAX TREATMENT OF …

lampiran2.hasil.gov.myrespect of the same expenditure can be claimed under subsection 33(1), subsection 34(7) or section 34B of the ITA. (e) A pioneer company is not entitled to claim a double deduction under section 34A of the ITA on the revenue expenditure incurred for a qualifying R&D activity. It can only claim the amount of direct revenue

GRADE 12 ECONOMICS LEARNER NOTES - Mail & Guardian

serve.mg.co.za1.5 The government's medium-term expenditure framework (MTEF) provides an . outline of income and expenditure for the next …years. A four . B three . C two (2) 1.6 If the rand/US dollar exchange rate changes from R6,80 to R7,00 to the dollar, then … A imports will increase.

1. INTRODUCTION 1

www.treasury.gov.za1.2. The guidelines provide an outline of the fiscal strategy for the 2022 medium-term expenditure framework as well as guidance on the data required to inform budget deliberations. The outcome of the deliberations will be recommended first to the Medium-Term Expenditure Committee and then the Minister’s Committee on the

Allowable vs Unallowable Expenditures on Federal Grants

www.mtholyoke.eduawarding agency or pass‐through entity. (2) Capital expenditures for special purpose equipment are allowable as direct costs, provided that items with a unit cost of $5,000 or more have the prior written approval of the Federal awarding agency or pass‐through entity. Equipment Purchases

CPF M 102

files.ocpf.usfinance activity, including contributions, loans, receipts, expenditures, disbursements, in-kind contributions and liabilities for this reporting period and represents the campaign finance activity of all persons acting under the authority or on behalf of this candidate in accordance with the requirements of M.G.L. c. 55.

TITAN COMPANY LIMITED th Annual Report 2020-21

www.titancompany.inPrivate Final Consumption Expenditure (PFCE), a vital indicator to gauge household spending in the country and the largest component of GDP, fell by 54% in the first quarter of FY21, compared to a 56% growth in the same period in the previous fiscal. Pay cuts and layoffs across the country and a drop in consumer confidence,

Chapter 4. Revenue - Census.gov

www2.census.gov• Proceeds from the sale of investments and the repayment of loans, except for contingent loans as mentioned above. Any recorded profit or loss from the sale of investments, however, is reported as revenue or expenditure, respectively. • Transfers from agencies or funds of the same government (see Section 3.9).

Lotto 6/47 Rules - Lotto Results | Irish National Lottery

www.lottery.ieThe Minister for Public Expenditure and Reform has granted a licence to Premier Lotteries Ireland Designated Activity Company authorising it to conduct the National Lottery on the Minister's behalf, in accordance with the National Lottery Act 2013. At Dublin, this 12th day of January, 2022 PURSUANT to the National Lottery Act 2013.

SOCIAL ACCOUNTABILITY MECHANISM - India

darpg.gov.in• Participatory Expenditure Tracking System (Uganda, Delhi, Rajasthan); ... accountability efforts in Chapter 5, and propose some policy recommendations to overcome these challenges in Chapter 6. Chapter 7 which is the summary of whole framework and

Nepal's Constitution of 2015

www.constituteproject.orgEstimate of Revenue and Expenditure of Village Council and Municipality . . 108 PART 20: Interrelationship between the Federation, Provinces and Local levels . 108

FINANCING OF NATIONAL GOVERNMENT EXPENDITURES

www.dbm.gov.phliability of the NG. Revenues consist of tax and non-tax collections. 3. What is a tax? What agencies are authorized to collect taxes? A tax is a compulsory contribution mandated by law and exacted by the government for a public purpose. The major tax collecting agencies of the national government are the Bureau of Internal Revenue and the ...

Cycle to Work Scheme

assets.gov.iethe Cycle to Work Scheme, effective from 1st August 2020. The scheme applies to teachers, special needs assistants, clerical officers, caretakers and child care ... expenditure under the cycle to work scheme and also provides that employees and directors can avail of the scheme more regularly. The Legislation also permits the

CONTENTS

www.treasury.gov.zaThe Medium -Term Expenditure Framework (MTEF) Technical Guidelines provide public institutions with guidance on how to prepare their medium-term budget estimates for the ... reviews will be conducted in this current budget cycle in line with the active scenario approach. 2.2. The envisaged spending reviews provide a detailed understanding of ...

FY 2022-23 FY 2024-25 E-12 Education

mn.govGeneral Expenditures $186,969 $396,533 Public Pre-K for Eligible 4-Year Old Children The Governor recommends full-day, state-funded prekindergarten for the most underserved four-year old children, using a mixed-delivery model comprised of school-based, Head Start, and community-based licensed center and family child care programs.

Economic Survey 2021-22

www.indiabudget.gov.inNew Delhi-110001 E-mail: cordecdn-dea@nic.in January, 2022. ... 351 Trends in Social Sector Expenditure 353 Education 361 Skill Development 365 Trends of Employment 376 Health 382 Drinking Water and Sanitation 386 Rural Development ... Ministry of Finance Government of …

www.niti.gov.in

www.niti.gov.inHEALTH INSURANCE / ASSURANCE IN INDIA: NEED AND LANDSCAPE Expansion of health insurance / assurance coverage is a necessary step, and a pathway in India’s effort to achieve Universal Health Coverage (UHC). Low Government expenditure on health has constrained the capacity and quality of healthcare services in the public sector.

MEDICAL ATTENDANCE AND TREATMENT RULES

www.vizagsteel.comexpenditure incurred on this account will have to be approved by the competent authority before it is admitted. 6.1.3 Rates of consultation fee for visits of Specialist in Hospital/Nursing homes during hospitalisation shall be at par with the rates applicable to home visits of Specialists. Reimbursement of such visiting

05-910 2022 Texas Franchise Tax Report Information and ...

comptroller.texas.govExpenditures by an entity exempt from franchise tax under Tax Code Section 171.063 (Nonprofit corporation exempt ... Certain receipts and transactions related to financing or ... tax report unless it is a member of a combined group. If the entity is a member of a combined group, the reporting entity ...

Budget Estimates 2022-2023

www.indiabudget.gov.inDepartment of Expenditure 476.88 0.01 476.89 122-123. Notes on Demand for Grants, 2022-2023 (iii) SBE Summary of Contents (In ` crores) Budget Estimates 2022-2023 Ministry/Demand Revenue Capital Total Page No 32. Department of Financial Services 1102.70 4211.03 5313.73 124 …

Typical Costs of Cycling Interventions - GOV.UK

assets.publishing.service.gov.ukTypical Costs of Cycling Interventions: Interim analysis of Cycle City Ambition schemes 3 | Page Purpose of this document This document provides a summary of typical costs of cycling interventions and the factors that affect them, drawn from expenditure during delivery of Phase 1 of the Cycle City Ambition (CCA) programme. Methodology

COMET - Quick User Guide - Virginia

www.elections.virginia.govVirginia Department of Elections Campaign Finance Services – COMET Quick User Guide 8 Edit or Delete Data 1. Click on the appropriate tab to add receipts, expenditures, or loans/debts. On the right of the entry is an “X” and a pencil.

Relief on Disposals of Certain Land or Buildings - Revenue

www.revenue.ieenhancement expenditure incurred during the seven-year period of ownership. The property is sold on 2 March 2019 for €1 million. The gain of €200,000 on the disposal of the property is fully relieved as the property is held for a full 7 years. If the property were sold on 2 March 2018 for €900,000, the gain of €100,000 is not

Homelessness in California - California State Auditor

www.auditor.ca.govexpenditure data from state agencies. • Its planned statewide data system will lack information about some service providers. • It is not required to develop guidance or disseminate best practices to CoCs and does not have a mechanism to enforce them. » The five CoCs we reviewed do not consistently employ best practices to

ACCOUNTABILITY IN THE NHS - King's Fund

www.kingsfund.org.ukaccountability, with the latter involving the possibility of sanctions if the account- ... remains one of the largest domains of public expenditure, and that there are increasing pressures on budgets in the current tighter fiscal climate, there will

Unsworn Declaration in Lieu of Sworn Statement for ...

www.dos.pa.govExpenditure Reports (form DSEB-505) need not be notarized. Instead, the filer may file with each report or statement the corresponding version of this form signed by the required individual(s). ... Cycle 9 30 Day Post-Special Election Part I - If this form is submitted with a Committee report, the treasurer must sign here. If ...

Mobilizing LGU Support for Basic Education: Focus on the ...

pidswebs.pids.gov.phTable 8. SEF Income, Expenditure and Balance, 2001-2008 (in million pesos) 22 Table 9. SEF Balances-To-Income Ratio across Level of LGUs, 2008 23 Table 10. SEF Balance-To-Income Ratio of Sample LSBs (%), 2008 23 Table 11. SEF Cash Balance at the end of year as % of SEF Income, 2008 24 Table 12.

A Guide to Campaign Disclosure - Illinois State Board of ...

www.elections.il.govexpenditures exceeding $5,000 in a 12-month period supporting or opposing a public official or candidate is covered by the Act. NOTICE OF OBLIGATION At the time of filing, a candidate who files nomination papers in person will receive a notice of obligation to file campaign disclosure reports under the Campaign Finance Act.

Similar queries

Expenditure, Future, Department, Guidelines, Treasury, Expenditure Framework, Medium, Term expenditure framework, Term Expenditure Frame work, Accountability, Company Losses Toolkit, Computation, Capital, Government, PUBLIC EXPENDITURE, ESTIMATES OF THE PROGRAM EXPENDITURE AND, Standard, Accounts, OECD, Active labour market policy, INDIA MINISTRY OF FINANCE Department of Expenditure, New Delhi, ECONOMICS, Term Expenditure, Allowable vs Unallowable Expenditures on Federal Grants, Pass, CPF M 102, Finance, Receipts, Expenditures, Campaign Finance, Final, Of GDP, Revenue, Contingent, Lotto 6/47 Rules, National, Constitution, Revenue and Expenditure, FINANCING OF NATIONAL GOVERNMENT EXPENDITURES, Cycle to work scheme, Cycle, Ministry of Finance, Health, In India, MEDICAL ATTENDANCE AND TREATMENT, Account, Reimbursement, Report, Department of Expenditure, Typical costs of cycling interventions, Homelessness in California, Campaign disclosure