Example: tourism industry

Stock Forms

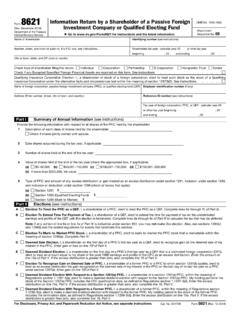

Found 2 free book(s)Form 8621 (Rev. December 2018) - IRS tax forms

www.irs.govapplicable stock. If the holding period of the stock began in the current tax year, see instructions . . . . 15a . b . Enter the total distributions (reduced by the portions of such distributions that were excess distributions but not included in income under section 1291(a)(1)(B)) made by the fund with respect to the applicable stock for

FORM 4 - SEC

www.sec.govOct 28, 2020 · for example, “Common Stock,” “Class A Common Stock,” “Class B Convertible Preferred Stock,” etc. (c) The amount of securities beneficially owned should state the face amount of debt securities (U.S. Dollars) or the number of equity securities, whichever is …