9 Taxpayer

Found 7 free book(s)W-9 Request for Taxpayer - Wisconsin Department of ...

doa.wi.govAn individual or entity (Form W-9 requester) who is required to file an information return with the IRS must obtain your correct taxpayer identification number (TIN) which may be your social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer

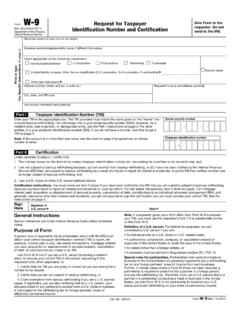

Form W-9 (Rev. October 2018) - IRS tax forms

www.irs.govAn individual or entity (Form W-9 requester) who is required to file an information return with the IRS must obtain your correct taxpayer identification number (TIN) which may be your social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number

Form 4506-C (9-2020) - Bank of America

homeloanhelp.bankofamerica.comSignature of taxpayer(s). I declare that I am either the taxpayer whose name is shown on line 1a or 2a, or a person authorized to obtain the tax information requested. If the request applies to a joint return, at least one spouse must sign. If signed by a corporate officer, 1 percent or more shareholder, partner,

Form W-9 Request for Taxpayer C Corporation S Corporation ...

upload.wikimedia.orgW-9 (Rev. December 2011) Department of the Treasury Internal Revenue Service . Request for Taxpayer Identification Number and Certification. Give Form to the requester. Do not send to the IRS. Print or type . See. Specific Instructions . on page 2. Name (as shown on your income tax return) Business name/disregarded entity name, if different ...

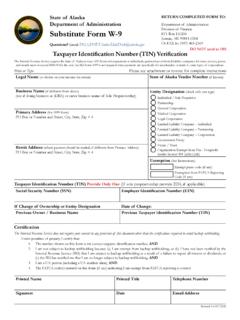

Division of Finance Substitute Form W-9 - Alaska

doa.alaska.govInstructions for Completing Taxpayer Identification Number (TIN) Verification (Substitute W-9) -- Page 2 Exemptions If you are exempt from backup withholding and/or Foreign Account Tax Compliance Act (FATCA) reporting, enter in the Exemptions box any code(s) that may apply to you. See Exempt payee code and Exemption from FATCA reporting code below.

Taxpayer Charter - Income Tax Department

www.incometaxindia.gov.in7. respect privacy of taxpayer The Department will follow due process of law and be no more intrusive than necessary in any inquiry, examination, or enforcement action. 8. maintain confidentiality The Department shall not disclose any information provided by taxpayer to the department unless authorized by law. 9. hold its authorities accountable

Do not send cash. - Indiana

www.in.gov9. Payment Previously Made (EFT) − Enter the total amount paid by EFT for all months within the quarter. If you are mailing this recap before you have initiated the final EFT payment for the quarter, you should claim the EFT payment you will be initiating on this line. Do not enter the final EFT payment for the quarter on Line 10. 10.