Administration Of Estates Small Estates

Found 5 free book(s)Affidavit in Lieu of Probate 421 CONNECT IC UT PROBATE …

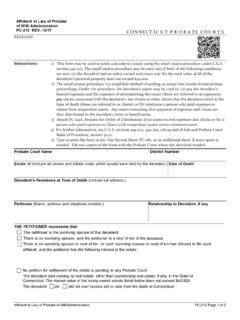

www.ctprobate.govof Will/ Administration PC-212 REV. 4/21 RECEIVED: Instructions: 1) This form may be used to settle a decedent’s estate using the small estates procedure under C.G.S. section 45a-273. The small estates procedure may be used only if both of the following conditions are

Probate: Pennsylvania

www.metzlewis.comSettlement of small estate on petition. This is an abbreviated proceeding that may be used for certain estates with a gross value not exceeding $50,000 (20 Pa. C.S. § 3102). This proceeding can be used whether or not the decedent died with a will. Ancillary probate or administration. This is a proceeding used to

Estates and Trusts

www.state.nj.usEstates and Trusts Understanding Income Tax ... Electing Small Business Trusts ... and expenses of administration. Generally, the residue of the estate is the property that remains after specific gifts and expenses are distributed. Estate and Trust Income Reporting Requirements .

(OR) , MARYLAND BEFORE THE REGISTER OF WILLS FOR

registers.maryland.govPETITION FOR ADMINISTRATION Estate value in excess of $50,000. (If spouse is sole heir or legatee, $100,000.) Values for DOD before October 1, 2012 are $30,000 and $50,000 if spouse is the sole legatee or heir. Complete and attach Schedule A. SMALL ESTATE PETITION FOR ADMINISTRATION Estate value of $50,000 or less.

2021 Form 1041-ES - IRS tax forms

www.irs.govstock held by an electing small business trust. For details, see . Electing Small Business Trusts. in the 2020 Instructions for Form 1041. Note: For 2021, the highest income tax rate for trusts is 37%. Include household employment taxes on line 12 if: • The estate or trust will have federal income tax withheld from any income, or