Before Completing The Forms Instructions

Found 8 free book(s)RETIREE NOTICE OF ELECTION (NOE) R SOUTH ... - South …

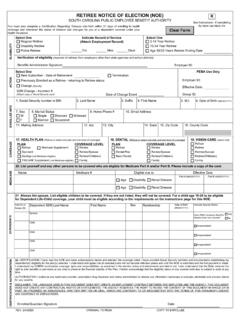

www.peba.sc.govINSTRUCTIONS FOR COMPLETING THE RETIREE NOTICE OF ELECTION (NOE) You must also complete a Certification Regarding Tobacco Use form within 31 days of enrolling in health coverage and whenever the status of ... If you initially became eligible for insurance before May 2, 2008, and you have fewer than 10 years service credit, or if

Instructions for Completing the Statement of Information ...

bpd.cdn.sos.ca.govRead instructions. before completing this form. This form may be used only if a complete Statement of Information has been filed previously and there has been no change. Filing Fee – $20.00 Copy Fee – $1.00 per copy; Certification Fee - $5.00 plus copy fee. Above Space For Office Use Only . 1. Limited Liability Company Name (Enter the . exact

INSTRUCTIONS & WORKSHEET FOR COMPLETING …

mva.maryland.gov1392, Supplemental Form W-4 Instructions for Nonresident Aliens, before completing this Form. Check your withholding. After your Form W-4 takes effect, use Pub. 919 to see how the amount you are having withheld compares to your projected total tax for 2011. See Pub. 919, especially if your earnings exceed $130,000 (Single) or $180,000 (Married).

Instructions for Form IT-196 New York Resident ...

www.tax.ny.govOct 01, 2021 · Instructions for Form IT-196 New York Resident, Nonresident, and Part-Year Resident Itemized Deductions ... amounts from your Schedule A when completing Form IT-196. If ... you took out on or before October 13, 1987, totaled over $1 million at any time during 2021. The limit is $500,000 if married

Instructions for Form W-8BEN (Rev. October ... - IRS tax forms

www.irs.govinstructions for the withholding agent, see the Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. Who Must Provide Form W-8BEN. You must give Form W-8BEN to the withholding agent or payer if you are a nonresident alien who is the beneficial owner of an amount subject to withholding, or if you are an

INSTRUCTIONS FOR COMPLETING AN ERM-14 FORM I. …

www.dcrb.comINSTRUCTIONS FOR COMPLETING AN ERM-14 FORM I. PURPOSE AND EFFECTIVE DATE OF CHANGE A. COMBINATION OF SEPARATE ENTITIES 1. Two or more entities sharing common ownership (more than 50% common ownership in each entity). 2. Entities may be combined for experience rating if two or more entities wish to be written on one policy.

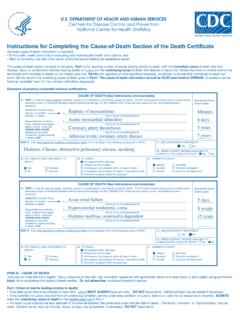

Instructions for Completing the Cause-of-Death Section of ...

www.cdc.govblack ink in completing the cause-of-death section. Do not abbreviate conditions entered in section. Part I (Chain of events leading directly to death) • Only one cause should be entered on each line. Line a MUST ALWAYS have an entry. DO NOT leave blank. Additional lines may be added if necessary.

Instructions for the Requester of Form W-9 ... - IRS tax forms

www.irs.govForms W-9 from U.S. exempt recipients to overcome a presumption of foreign status. For federal tax purposes, a U.S. person includes but is not limited to: • An individual who is a U.S. citizen or U.S. resident alien; • A partnership, corporation, company, or association created or organized in the United States or under the laws of the United