Business Tax Receipt

Found 7 free book(s)Local Business Tax Receipt - Broward County

www.broward.orgapplication for local business tax receipt (formally known as occupational license) a business tax receipt is not a guarantee that your business is operating in compliance with local laws. if your business is located within a municipality’s jurisdiction, check with that municipality for the zoning requirements. 1.

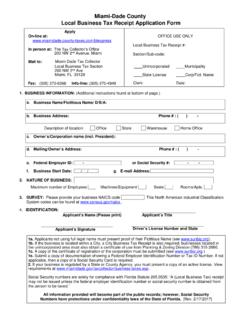

Local Business Tax Receipt Application - Miami-Dade County

www.miamidade.gov1b. If the business is located within a City, a City Business Tax Receipt is also required; businesses located in the unincorporated area must also obtain a certificate of use from Planning & Zoning Division (786) 315-2660. 1c. A copy of the certificate of registration of the corporation must be submitted (see www.sunbiz.org ) 1e.

BRUCE VICKERS, CFC OFFICIAL USE ONLY Osceola County Tax ...

osceolataxcollector.orgcounty business tax receipt (previously referred to as an occupational license) is issued pursuant to this application is for the privilege of doing business in Osceola County and does not waive Florida ’ s licensing, registration, and/or certification requirements, nor does it waive any other such requirements of any city, county,

TAX YEAR 2021 SMALL BUSINESS CHECKLIST - Tim Kelly

www.timkelly.comADDRESS OF BUSINESS (IF NOT HOME BASED) FEDERAL TAX ID NUMBER (IF ANY) TYPE OF BUSINESS . SECTION B GROSS INCOME OF THIS BUSINESS . P0F. 1. P. ... or business, travel, meals and entertainment, mileage, telephone, etc. Start up expenses ... You must retain a copy of a receipt for any lodging expense. 19.

BUSINESS PRIVILEGE AND/OR MERCANTILE TAX RETURN

www.hab-inc.comBUSINESS PRIVILEGE AND/OR MERCANTILE TAX RETURN Business Name: Make check payable to and remit to: Tax Year: Re: District: Account Number: Amount of Payment: $ _____ Make any corrections to Business Name & Address and check here. m e r c r e-w e b 0 4 2 7 2 0 NO CASH PAYMENTS WILL BE ACCEPTED. Your cancelled check is your receipt of payment.

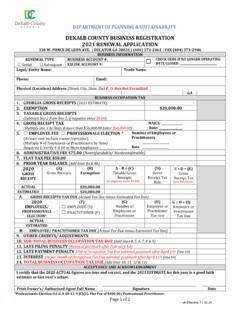

DEKALB COUNTY BUSINESS REGISTRATION 2021 RENEWAL …

www.dekalbcountyga.govDeKalb County Business Registration application. 3. In the past year, have you been convicted of or pleaded nolo contendere to a violation of any federal, state, or county law concerning crime of moral turpitude, misdemeanor, or violation of this Code directly relates to the business for which the certificate is sought?

BUSINESS TRANSFEROR’S NOTICE LABOR OPPORTUNITY TO ...

www.michigan.govBUSINESS TRANSFEROR’S NOTICE . TO TRANSFEREE OF UNEMPLOYMENT TAX LIABILITY AND RATE. Regardless of any agreement between the parties to the transfer, the Michigan Employment Security (MES) Act provides that when a business is sold (or otherwise transferred), the buyer (or other transferee) of the business may be liable to pay the