California Corporation Franchise Or Income

Found 5 free book(s)This form can be submitted electronically ... - California

bpd.cdn.sos.ca.gov• California nonprofit corporations are not automatically exempt from paying California franchise tax or income tax each year. Most corporations must pay a minimum tax of $800 to the California Franchise Tax Board (FTB) each year. (California Revenue and …

2021 Instructions for Form FTB 3893

www.ftb.ca.gov100S, California S Corporation Franchise or Income Tax Return, Form 565, Partnership Return of Income, or Form 568, Limited Liability Company Return of Income. To ensure timely and proper application of the payment to the PTE account, enter the California corporation number, the federal employer identification

Limited Liability Companies - California

bpd.cdn.sos.ca.govCalifornia during the taxable year and the taxable year was 15 days or less. (California Revenue and Taxation Code section 17946.) An LLC that is taxed as a corporation is obligated to pay to the FTB an annual minimum tax of $800, and generally determines its California income under the Corporation Tax Law commencing with California

State Guidance Related to COVID-19: Telecommuting Issues ...

www.hodgsonruss.comfor purposes of P.L. 86-272 protection.” had previous source income from California. Will CA Franchise Tax Board, COVID-19 Frequently Asked Questions for Tax Relief and Assistance Answer: Yes. As a nonresident who relocates to California for any portion of the year, you will have California source income during the period of time

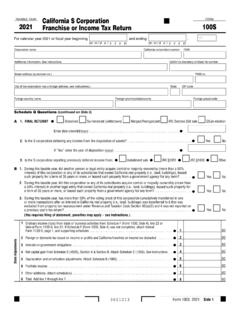

2021 Form 100S California S Corporation Franchise or ...

www.ftb.ca.gov3611213 Form 100S 2021 Side 1 B 1. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation or any of its subsidiaries that owned California real property (i.e., land, buildings), leased