Circular Ct

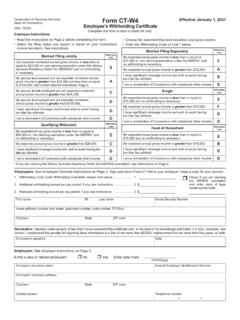

Found 5 free book(s)State of Connecticut Form CT-W4 Employee’s Withholding ...

portal.ct.govEmployer’s Tax Guide, Circular CT, for complete instructions. Report Certain Employees Claiming Exemption From Withholding to DRS Employers are required to file copies of Form CT-W4 with DRS for certain employees claiming “E” (no withholding is necessary). See IP 2021(1). Mail copies of Forms CT -W4 meeting the conditions listed

Department of Revenue Services State of ... - portal.ct.gov

portal.ct.govEmployer’s Tax Guide, Circular CT, for complete instructions. Report Certain Employees Claiming Exemption From Withholding to DRS Employers are required to file copies of Form CT‑W4 with DRS for certain employees claiming “E” (no withholding is necessary). See IP 2022(1). Mail copies of Forms CT‑W4 meeting the conditions listed

Form CT-W4 1, 2021 Employee’s Withholding Certificate

www.simsbury.k12.ct.usEmployer’s Tax Guide, Circular CT, for complete instructions. Report Certain Employees Claiming ExemptionFrom Withholding to DRS. Employers are required to file copies of Form CT-W4 with DRS for . certain employees claiming “E” (no withholding is necessary). See IP 2021(1). Mail copies of Forms CT-W4 meeting the conditions listed

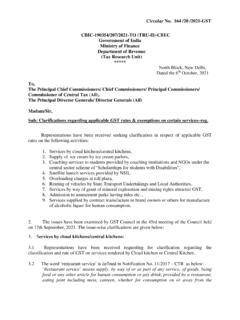

Circular No. 164 /20 /2021-GST CBIC-190354/207/2021-TO ...

cbic-gst.gov.inCircular No. 164 /20 /2021-GST Notification No. 11/2017-Central Tax (Rate). The rate prescribed against this entry prior to 01.01.2019 was “the same rate as applicable on supply of like goods involving transfer of title in goods”.

Circular No. 26/26/2017-GST F. No. 349/164/2017/-GST ...

cbic-gst.gov.inPage 3 of 11 be offset against output tax liability or added to the output tax liability of the subsequent months of the registered person. 3.2 Since, the GST Council has decided that the time period of filing of FORM GSTR-2 and FORM GSTR -3 for the month of July 2017 to March 2018 would be worked out by a Committee of officers, the system based reconciliation …