Claimed Amount

Found 7 free book(s)Schedule C: The Property Claimed as Exempt

www.uscourts.govspecific dollar amount as exempt. Alternatively, you may claim the full fair market value of the property being exempted up to the amount of any applicable statutory limit. Some exemptions—such as those for health aids, rights to receive certain benefits, and tax-exempt retirement funds—may be unlimited in dollar amount.

CHY4 ANNUAL CERTIFICATE SECTION 848A TAXES …

www.revenue.ieapproved body can obtain a refund of that amount. This can be claimed after the end of the tax year 2018. The amount repaid to an approved body cannot exceed the amount of tax paid by the donor for the year in question. If Joan’s income tax liability for 2018 is €350, and

Note: The draft you are looking for begins on the next ...

www.irs.govThis is the amount you overpaid . . 34 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here . . . 35a Direct deposit? See instructions. b Routing number c Type: Checking Savings d Account number 36 Amount of line 34 you want applied to your 2022 estimated tax. . 36 Amount You Owe 37 Amount you owe.

Depreciation - IRS tax forms

www.irs.gov• The amount of money borrowed to purchase the asset • The value of any items you traded for the new asset • The value of bartered services Your basis will increase by the amount of major improvements you make to the property and will decrease by the amount of depreciation deductions you take on your tax return.

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

edd.ca.govthe amount that will be withheld on your wages based on the marital status and number of withholding allowances you will claim for 2021. Multiply the estimated amount to be withheld by the number of pay periods left in the year. Add the total …

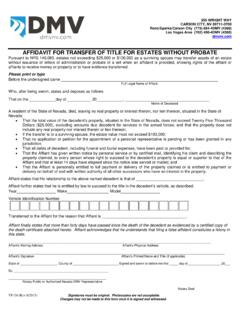

VP 024 - Affidavit for Transfer of Estates Without Probate

dmvnv.comproperty claimed, to every person whose right to succeed to the decedent’s property is equal or superior to that of the Affiant and that at least 14 days have elapsed since the notice was served or mailed; and • That the Affiant is personally entitled to full payment or delivery of the property claimed or is entitled to payment or

Dependents - IRS tax forms

apps.irs.govDependents 6-3 example Joan, who is a U.S. citizen, adopted an infant boy from Cambodia who lived with her for the entire tax year. Even though Joan’s child is not yet a U.S. citizen, he meets the citizen or resident test because he