Collection Due Process

Found 9 free book(s)Form 12153 Request for a Collection Due Process or ...

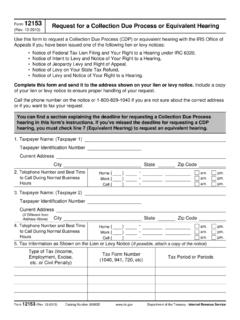

www.irs.govRequest for a Collection Due Process or Equivalent Hearing. Form . 12153 (Rev. 12-2013) Catalog Number 26685D www.irs.gov. Department of the Treasury - Internal Revenue Service. Use this form to request a Collection Due Process (CDP) or equivalent hearing with the IRS Office of Appeals if you have been issued one of the following lien or levy ...

Form 12153 Request for a Collection Due Process or ...

www.irs.govRequest for a Collection Due Process or Equivalent Hearing. Use this form to request a Collection Due Process (CDP) or equivalent hearing with the IRS Independent Office of Appeals if you have been issued one of the following lien or levy notices: • Notice of Federal Tax Lien Filing and Your Right to a Hearing under IRC 6320,

BEST PRACTICES FOR COLLECTION, PACKAGING, STORAGE ...

www.crime-scene-investigator.netCollection, Packaging, Storage, Preservation, and Retrieval of Biological Evidence Page 4 of 8 Effective Date: 10/30/2012 Document Evidence During the collection process, it is essential to record the location of evidence collected at a crime scene. These are effective methods to do this:

Strategies for optimizing your accounts receivable

www2.deloitte.com• Fail to follow up with customers in a timely manner when payments are past due ... collection rates on bad receivables and even collection efforts made. This will ... you need a process – clear and concise policies for issuing credit and recovering debt in a timely fashion.

Designing and Sizing Baghouse Dust Collection Systems

www.baghouse.comDust collection systems play a vital role in many commercial and industrial facilities. Whether part of a system process, used to capture harmful pollutants from furnaces/boilers, to convey dry bulk product or to maintain a clean and safe work ... challenges due to improper system design and engineering.

Customer Due Diligence - Overview

www.ffiec.govCustomer Due Diligence — Overview ... • Provide standards for conducting and documenting analysis associated with the due diligence process, including guidance for resolving issues when insufficient or ... collection of customer information regarding beneficial ownership is governed by …

Robotic Process Automation (RPA) - KPMG

home.kpmgData collection (crawling) Data query (structured data) Data entry Validation Logins to multiple systems, etc. Traits • Automates even routine tasks that were performed by human labor due to whatever constraints applied, using business rules engine, image recognition technology, workflow, and so on. • Human labor is needed to deal with ...

The Process of Gathering Data in Strategic Planning

psrdc.fmhi.usf.eduThe Process of Gathering Data in Strategic Planning Abstract A major part in strategic planning is the process of gathering data. It should be done prior to, during the creation of the strategic plan, continue on through the implementation, and in the monitoring process of the strategic plan. Data can be secondary or primary data and gathered

Pub 131:10/19 Your Rights and Obligations Under the Tax ...

www.tax.ny.govspecialty at any time during the audit process. We may use audit adjustments of one tax specialty as a basis to recalculate tax in another, depending on the facts and circumstances of the case. For sales and compensating use taxes, we may estimate any additional tax due only if, in response to our request for records,