Control Commission Privilege Tax

Found 6 free book(s)CONSTITUTION OF THE STATE OF WASHINGTON

leg.wa.gov4 Sectarian control or influence prohibited. 5 Loss of permanent fund to become state debt. Sections 1 Who liable to military duty. 2 Organization — Discipline — Officers — Power to call out. 3 Soldiers' home. 4 Public arms. 5 Privilege from arrest. 6 Exemption from military duty. Sections 1 Existing counties recognized.

GENERAL INSTRUCTIONS FOR FILING THE GENERAL …

dotax.ehawaii.govGeneral Excise Tax The GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person en-gaging in the business activity. Activities subject to the tax include wholesaling, retailing, farming, services, construction contracting, rental of per-

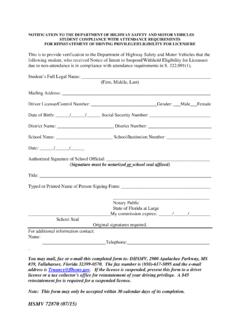

NOTIFICATION TO THE DEPARTMENT OF HIGHWAY SAFETY …

www.flhsmv.govlicense or a tax collector’s office for reinstatement of your driving privilege. A $45 reinstatement fee is required for a suspended license. Note: This form may only be accepted within 30 calendar days of its completion. HSMV 72870 (07/15)

Los Angeles County

file.lacounty.govOct 28, 2021 · Los Angeles County - Public Records Request Contacts Last modified: October 28, 2021 Compiled by: Countywide Communications - pio@ceo.lacounty.gov Page 1 of 4

Colorado Last Will and Testament Form - Will Forms

willforms.orgF. To make such elections under the tax laws as my Personal Representative shall deem appropriate, including elections with respect to qualified terminable interest property, exemptions and the use of deductions as income tax or estate tax deductions, and to determine whether to make any adjustments between income and principal on

Form W-9 (Rev. October 2018) - IRS tax forms

www.irs.gov3. The article number (or location) in the tax treaty that contains the saving clause and its exceptions. 4. The type and amount of income that qualifies for the exemption from tax. 5. Sufficient facts to justify the exemption from tax under the terms of the treaty article. Example. Article 20 of the U.S.-China income tax treaty allows an