Cpa Firm

Found 6 free book(s)Instructions for Completing Verification of Experience by ...

www.op.nysed.gov1. he/she is working in private industry, government, or a not for profit and he/she does not have a US licensed CPA supervisor; or. 2. he/she is working as a sole proprietor of a CPA firm in a state other than New York. To self-verify experience on Form 4B the applicant must do all of the following:

Frequently Asked Questions - AICPA

us.aicpa.orgWould independence be impaired if a CPA firm retained an independent contractor (as defined by IRS regulations and other federal regulatory guidance such as case law and revenue rulings) on a part-time basis that is employed by or associated with an attest client in …

UNIFORM APPLICATION FOR SECURITIES INDUSTRY …

www.finra.orgnot, for example, permit a broker-dealer agent working with brokerage firm A to maintain a registration with brokerage firm B if firms A and B are not owned or controlled by a common parent. Before seeking a dual registration status, you should consult the applicable rules or

Charities Bureau Guidance Document Issue date: September ...

www.charitiesnys.comThe Role of the CPA Auditor or CPA Audit Firm . The purpose of an audit is to provide users of a financial statement with an opinion prepared by the auditor in accordance with the professional standards established by the American Institute of Certified Public Accountants (AICPA) as to whether the financial statements of the entity are ...

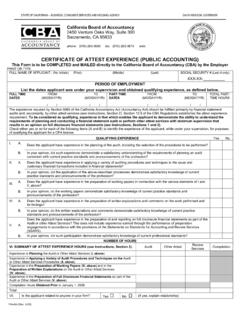

Certificate of Attest Experience – Public Accounting

www.dca.ca.govOTHER NOTES TO EMPLOYER COMPLETING Certificate of Attest Experience (Public Accounting). See Instructions Sections 1, 2, and 3. For the authorization to sign attest reports, applicants applying for licensure under either Pathway 1 or Pathway 2 must obtain a minimum of 500 hours of qualifying attest experience. Section 69 of the CBA Regulations provides that the …

Practice Continuation Agreements - AICPA

us.aicpa.orgCPA, relating to any other business of John Doe, CPA. In any case, the party receiving or retaining such records shall make them available to the other during the period of _____ (____) years fol-lowing the closing date hereof in the event said documents are necessary for any legitimate business