Deceased Estate

Found 8 free book(s)Transfer Ownership – Deceased Owner

www.oregon.govEstate document requirements for the owner who passed away most recently, based on the situation of their estate - Estate Not Probated, Estate Being Probated, or Estate Probated but Now Closed. An odometer disclosure, if required; Original releases or bills of sale from any previous owners, except for any deceased owner;

PPF DECEASED CLAIM - OnlineSBI

retail.onlinesbi.comof administration or a succession certificate to the estate of the deceased _____ (Name of the subscriber) or a certificate from the Controller of Estate Duty to the effect that estate duty has been paid or will be paid or none is due, I/We and we _____ (Sureties) do hereby for ourselves and our heirs, legal representatives, executors and ...

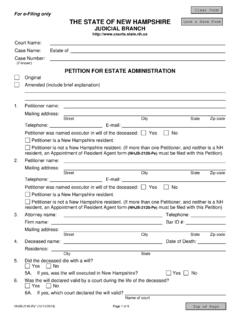

For e-Filing only THE STATE OF NEW HAMPSHIRE

www.courts.nh.gov10. The deceased was not a resident of New Hampshire and at the time of death, the deceased owned real estate in the State of New Hampshire and the deceased did not have an estate probated in another state. (If more space is needed, attach additional pages) Yes No If yes complete Section 10A 10A.

Affidavit of Inheritance of a Motor Vehicle

dor.georgia.govthat the deceased, _____, (Full Legal Name of the Deceased) who at the time of his or her death was the owner of the motor vehicle described below, left no will; no application for the administration of the estate of the deceased is to be had; the

Probate & Succession in Louisiana

www.goea.louisiana.govA succession is the process of settling a deceased person’s estate and distributing the property to those who inherit after the debts are paid. This process is called probate in other states. The term “succession” may also be used to refer to the estate a person leaves behind at death. 6.

Dennett, Craig and Pate - dcpate.com

www.dcpate.com15. File any outstanding claims for health insurance or Medicare 16. Obtain copies of deceased’s outstanding bills. 17. Locate and/or obtain other important paperwork of the necessary for the settlement of their estate:

AFFIDAVIT OF HEIRSHIP - Wisbar

www.wisbar.orgName of Deceased Brother or Sister Name of Deceased Brother’s or Sister’s Children Date of Death 7. If no surviving brothers or sisters, then list the names of maternal (mother) and paternal (father) grandparents and the descendants of any deceased grandparent and whether the person is living or deceased.

A Roadmap to Estate and Trust Income - IRS tax forms

www.irs.gov• Client picked up her uncle’s 1041 estate return for 2009. This was the first year of the estate and will still continue for 1 – 2 more years. She saw a NOL worksheet and a negative taxable income including excess deductions. Her question: – How did we decide what income went on the 1041 and she as a beneficiary, what part of the loss does