Due Diligence Report

Found 9 free book(s)Exercising Due Diligence guidance for officers

www.comcare.gov.auDue diligence in relation to ensuring health and safety is defined for the first time in the WHS Act. In demonstrating due diligence, section 27 of the WHS Act requires officers to show that they have taken reasonable ... > a reporting culture—in which people are …

Form W-10 Dependent Care Provider’s Identification and ...

www.irs.gov• You report an incorrect name, address, or TIN of the provider on your Form 2441; and • You can’t establish, to the IRS upon its request, that you used due diligence in trying to get the required information. Due diligence. You can show due diligence by getting and keeping in your records any one of the following.

CORPORATE RESPONSIBILITY REPORT 2020 - Arla

www.arla.comThe report serves as our annual communication on progress against the UN Global Compact and the statutory statement ... due diligence process, which we apply before entering a new partnership or joint venture, covers economic, social, and environmental concerns.

M&A BUYER DUE DILIGENCE CHECKLIST - Smartsheet Inc.

www.smartsheet.comM&A BUYER DUE DILIGENCE CHECKLIST ... Quality of earnings report Unedited financial statements with comparable statements for the last year EBITDA and adjustments Financial statements from the last 3-5 years Margin statements List …

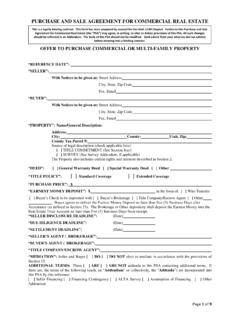

PURCHASE AND SALE AGREEMENT FOR COMMERCIAL REAL …

images1.loopnet.comThe Due Diligence Deadline is subject to extension as set forth in any Addendum attached hereto. If, prior to Closing, the Title Company issues a supplemental or amended title report showing additional title exceptions (the “ ...

Financial Due Diligence Overview

cdn.ymaws.comFeb 23, 2016 · PwC approach to Due Diligence 20 Our approach to due diligence is collaborative to keep clients informed of real-time issues, issue-focused to remain efficient, and flexible to adapt to the transaction-specific circumstances at hand. While every transaction is unique, a typical due diligence engagement involves:

Introduction of Due Diligence Requirements for Corporate ...

www.mas.gov.sg3.2 Under the proposal, CF advisers will be required to act with due care, skill and diligence when performing due diligence2, establish a governance framework over the performance of due diligence by their representatives and staff, and keep records of the 1 As referred to under the SGX-ST Main oard Listing Manual. All references to “issue ...

Paid Preparer Due Diligence - IRS tax forms

www.irs.govBy law, if you are paid to prepare a tax return or claim for refund claiming one or more of the following tax benefits, you must meet four due diligence requirements. The tax benefits are the earned income tax credit (EITC), the child tax credit (CTC), the additional child tax credit (ACTC), the credit for other dependents (ODC), the American opportunity tax credit (AOTC),

Schedule C and Record Reconstruction Training

www.eitc.irs.govEITC due diligence, IRC §6695(g), requires paid tax return preparers to make additional inquiries of taxpayers who appear to be making inconsistent, incorrect or incomplete claims related to their self-employment when the tax return